When looking at the status and prospects of the numerous fixed-wing Combat and Light-Attack programmes of European manufacturers, one has to consider the uncertainty surrounding the funds available in the coming years for the defence sector given the impact of the various multi-billion post-COVID-19 economy stimulus packages. For most western governments, acquiring new or modernised combat aircraft will now assume a much lower priority. Western reluctance to spend more is in stark contrast to the recent 6.6% increase in defence funding in China, where COVID-19 originated.

While China may appear far away, other threats are in fact much closer. Until a few months ago, with Russia having emerged as a major threat to geopolitical stability, most NATO countries were on the right path to spend more on the Alliance’s defence. This included seeking replacements for ageing fighter aircraft, reflecting the need to replace MiG-29s, earlier F-16s and F/A-18s or TORNADOs which have been in service for nearly 30 years. Manufacturers have been reacting to the air forces’ demands for modern, multi-role combat platforms that can operate in complex aircraft packages, where ISR data is loaded onto computing clouds.

Before the resurgence of Russian power and assertiveness, most European air forces experienced drastic budget cuts. If there were any investments at all in this sector, most air arms concentrated their efforts on small deployments for close air support and urban operations, such as fighting the protracted wars in Iraq or Afghanistan. Subsequently, when conducting air operations over Libya, several shortcomings were noted, such as the fact that tactical recce no longer existed, except with the Swedish Flygvpanet, or that there were insufficient air-to-air refuelling capabilities.

At the same time, when it comes to competition on the global markets, the conditions for European manufacturers have once again darkened. This is contrasted by an increasing US dominance in the market, materialising by the ever growing Lockheed Martin F-35 aircraft and by the most recent versions of earlier designs such as the F-16 Block-70, the SUPER HORNET ADVANCED-III or the EA-18G GROWLER. Some time ago, European managers of defence agencies and companies had expected that the F-35 project might fail – which once nearly happened, while it is still plagued by drawn-out budget deficits. Last year, however, Steve Over, Lockheed Martin’s F-35 international business director stated, “We have won every competition that we entered.” That statement is justified. Most customers cite interoperability with the US as the main reason for choosing the F-35. Today, F-35 operators include Belgium (34), Denmark (27), Italy (90), the Netherlands (46), Norway (52), Poland (32) and the UK (138). Before being excluded from the F-35 programme in July 2019 after acquiring the Russian S-400 TRIUMF system, Turkey had a requirement for 120 F-35 aircraft, and may now choose to procure Russian fighter jets. Steve Over, however, is confident: “By 2030 we expect more than 500 F-35s to be operating in Europe, including 48 USAF examples based at RAF Lakenheath by 2030”. And Lockheed Martin’s John Neilson told the author at the last ILA Air Show, “We still see more markets in Europe emerging in addition to Switzerland or Finland. In the longer term that could include Greece, Spain or Romania”.

The Eurocanards

Three European solutions are competing against this considerable US footprint, namely the Eurofighter TYPHOON, Dassault RAFALE and Saab GRIPEN JAS 39E/F (and to some extent still JAS 39C/D). While they are each excellent in their own right, there are still limiting factors resulting from their parallel development since they are, or were, competing against each other, often only for moderate contract numbers. This drawback has meanwhile been addressed by politics and industry and is one of the drivers for the 6th generation FCAS project. While the FCAS is not the focus here, two such projects have since taken off and are in the long-term pipeline with a time horizon of 2040 – one undertaken by the UK, Italy and Sweden and one by France, Germany and Spain. Several aerospace industry captains are calling for, or predicting, that sometime in the mid-term future, these will (have to) merge due to budgetary constraints.

The EUROFIGHTER

No matter how one refers to it, the EF-2000, EFA or TYPHOON, the 4-nation-built EUROFIGHTER is not only the most powerful of the three Eurocanards, but also the most widespread and successful western fighter aircraft programme of the fourth generation. When it comes to its operational use, whether in a distant conflict or airspace protection, its equipment limitations or spare-part problems, the EUROFIGHTER is sometimes configured in a significantly different way within the consortium, as well as to export-user countries.

A little more than 17 years after the first flights of the initial (two seat) T1 production aircraft, the last two series-platforms from the 1990s’ basic framework agreement were rolled out at the end of 2019 – one each for the Spanish and Italian Air Forces. The British RAF and the German Luftwaffe took their last T3s into service in September and December 2019. 160 units went to the RAF, 143 to the Luftwaffe, 96 to the Aeronautica Militare Italiano (AMI) and 73 to the Spanish Ejército del Aire. In addition to these 472, there were six newly built out of 15 cannibalised T1s for first export customer, Austria in 2007, in addition to 72 for Saudi Arabia, 12 for Oman, 28 for Kuwait and 24 for Qatar. The aircraft from these two latest orders will be delivered between 2020 and 2023/24. Production continues in Warton, Manching, Caselle and Getafe and final assembly takes place in Caselle (Kuwait) and Warton (Qatar). In total, there are 623 aircraft – a number that no modern fighter aircraft (4th and 5th generation together) has achieved, even if the original framework contract was for 707 units. Regarding the US rivals, the F-35 currently stands at 500 deliveries (354 F-35A, 108 F-35B and 38 F-35C), but will outmatch the EUROFIGHTER some time soon.

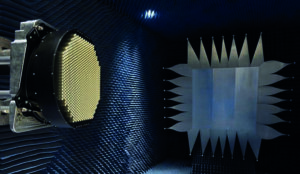

While Airbus Defence and Space has placed the TYPHOON in competitions in Switzerland, Finland, India and Colombia, as of last year, it was never anticipated that Germany alone would offer the type’s largest growth potential. There seems to be a consensus in Berlin that a replacement for the 85 ageing TORNADOs should be on the aprons by 2030. Time will tell whether it will be a split-buy between 60 to 90 additional TYPHOONs and/or – as recently officially announced – 30 Boeing SUPER-HORNETS for the shared nuclear capability and 15 EA-18G GROWLERS. While the latter represents an operational combat platform, and with the ALQ-218 receivers and new ALQ-249 jammers, it would take over SEAD/DEAD escort/standoff-jamming (electronic attack) role from the TORNADO-ECR – a role that Airbus recently claimed to be able to fulfil when they presented an artist’s impression of a two-seat T4. Since then, we are also familiar with the type’s LTE or Long-Term-Evolution. This includes Project Quadriga which covers 38 newly built T4 (26 single, seven twin-seaters, plus five options) to replace the Luftwaffe’s early T1s – and as a synergy effect possibly also the Swiss legacy HORNETS. In the end, there should be about 110 true multi-role German EF-2000s of only T2 and T3 types. All these aircraft would receive provision for conformal fuel tanks, improved aerodynamics and HUD and the AESA radar. Regarding this new main sensor, the four partner nations paid over €1Bn to develop it but no orders have been placed yet.

Flight-testing of the new moveable E-scan radar which allows a 50% wider field than conventional fixed plate antenna systems is currently proceeding on LEONARDO’s ISPA 6 (Instrumented Series Production Aircraft) for Kuwait and Qatar, based on their purchase orders.

Originally, the TYPHOON was developed as an air-superiority fighter to counter the MiG-29 and Su-27, with little emphasis placed on weapons integration for the air-to-ground role.

For this reason, the above-mentioned EW version was not a trivial development as it required substantial modification, including modifications to switch inboard wet pylons to mounts for external fuel tanks for the standoff jamming-pods. For that reason, in November 2019, the consortium presented both a dedicated EW/attack version and a simpler SEAD variant requiring fewer modifications. To add to the challenge, the type would require certification for the B61 tactical nuclear weapons that are stored in Büchel, as was the case with the TORNADO. That task could take some time to complete and would require the European defence industry to forward potentially sensitive coding information to US agencies and companies. Should the EUROFIGHTER consortium refuse to share relevant data on the aircraft’s weapon control system, the type may see itself restricted in B61 mod 12 use, comparable to how legacy platforms deploy the weapon, with locked tailkits in a non-guided mode, which is mandated by the non-digital nature of the current F-16 and TORNADO fleets.

RAFALE

This other excellent European fighter has never been faced with similar discussions and restrictions as it has been nuclear wired for the French Force de Frappe from its inception. The RAFALE was created when France abandoned the early EFA project which ultimately led to the TYPHOON. Not surprisingly, their replacement for the venerable MIRAGE turned out to be very similar.While many other European countries have opted, or are opting for a US solution for their future fighter needs, France remains loyal to its domestic aerospace industry, just like Sweden. The French military has a standing requirement for 286 Dassault RAFALEs, consisting of 118 single-seat C-models and 110 dual-seat B-models for the French Air Force, plus 58 single-seat carrier-borne M-variants for the French Navy.

When it comes to exports, RAFALE made a late but very French take-off when it only accrued orders from abroad two decades after being introduced. Deliveries of these exports have consequently caused interruption or have resulted in shifted production for the French forces.

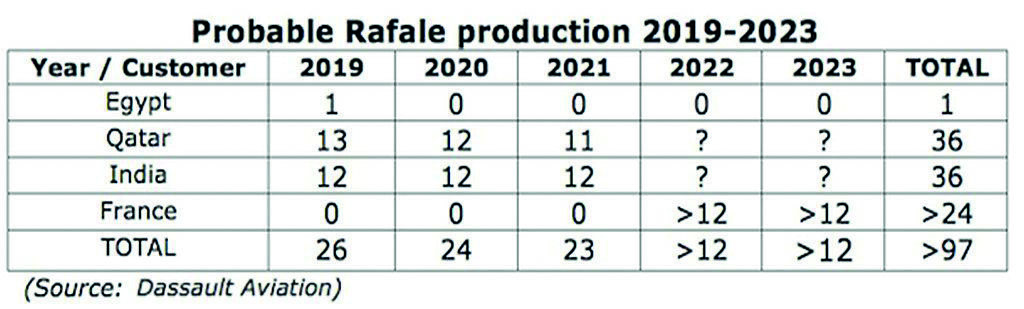

According to Dassault’s FY 2019 figures, Qatar has exercised an option for 12 additional RAFALE fighters, adding to a previous commitment for an earlier 24 aircraft (18 + 6).

Egypt has meanwhile received the first 24 of a total 36-strong fleet, while deliveries to Ambala of the first four or five out of 36 (30 + 6) jets for India are imminent, unhampered by COVID-19. In FY 2018, the company delivered 12 fighters (9 export and 3 for France), a figure that more than doubled to 26 in 2019. In December 2019, the backlog for the RAFALE stood at 75 aircraft (47 exports and 28 for France, that will be handed over from 2022 due to the export commitments). A year earlier, the backlog was 101 jets (73 exports and 24 for France). All these aircraft are being assembled at a relatively small facility which has an output rate of 11 aircraft per year.

But there might be more orders coming in soon. Next to the Swiss market, and with 36 jets under production for India, Dassault is in a strong position to implement the largest fighter order in the industry, namely an Indian contract for 114 multi-role jets. While this has been going on and off with contradictory statements for two years, the Indian Navy – unhappy with the power/payload-weight ratio of the Naval TEJAS – issued an RFP of its own in May 2017, for 57 carrier-capable fighter aircraft. This could only mean F-18F or RAFALE (and MiG-29K), but while not much has since been heard about this project, the author spoke to the Indian DRDO and the Indian Navy is still eager to replace its unreliable MiG-29Ks. To replace these MiG-29s, Dassault was also very active in Malaysia in 2017, but this has failed, just as it did in the UAE, where in late 2019, a €1Bn modernisation contract for the MIRAGE-2000/9s was signed instead.

In terms of the type’s subsystems development work, Dassault is now working to develop the F4 standard of the RAFALE under a €1.9Bn contract awarded in January 2019. Once development is complete, its retrofit to the 152 jets already delivered to the French Air Force and Navy will generate additional revenue. F4 means implementing innovative connectivity solutions to optimise the effectiveness in networked combat (new satellite and intra-patrol links, communication server, software-defined radio) and new functions to be developed to improve the aircraft’s capabilities (upgrades to the radar and front sector optronics sensors, helmet-mounted display capabilities). Also covered are new weapons to be integrated (MICA NG air-to-air missile and 1,000 kg AASM Air-to-Ground Modular Weapon). Validation of the F4 standard is scheduled for 2024, with some functions becoming available as of 2022. Qatar’s aircraft differ in detail from those delivered to France and Egypt, as they incorporate a Lockheed Martin SNIPER laser designator pod, instead of the French Thales DAMOCLES or the new Thales TALIOS pod now under development. QEAF RAFALEs also have provision for an Elbit Systems TARGO-II helmet-mounted target designation system.

GRIPEN

The original Saab GRIPEN was once purpose-built for Sweden’s national defence and datalinks, but its quick reaction alert (QRA) missions, and later added defensive/offensive counter-air or offensive recce roles during NATO’s “Operation Unified Protector” over Libya in 2011 for example, have succeeded in convincing other air chiefs.

Currently, the GRIPEN programme has been split into two parts. The main effort in Linköping (Sweden) and Dos Santos (Brazil) has been transferred to the latest – and fifth – version of the JAS-39, the GRIPEN-E. The Swedish Air Force (SwAF) has signed a deal for 60 single-seat GRIPEN-Es (+ maybe 10 more), but no two-seater GRIPEN-F. The latter are so far an issue only for the E-model’s first export customer (Brazil), with eight to be designed and largely built there together with the majority of the total of 36 airframes. Due to the introduction of new Russian weapon systems in Sweden’s vicinity, it is essential for the SwAF to bring the GRIPEN-E into service in order to remain a relevant player in the Baltic region, capable of defending the nation as well as supporting its partners. In April 2020, the test programme surpassed 300 flight hours and meanwhile, it includes six aircraft and will be expanding to two sites in 2020 involving SAAB test pilots, the Swedish defence materiel administration (FMV) and SwAF. SAAB is preparing to deliver three initial-production aircraft in 2020. Current plans are to have an Initial Operational Capability (IOC) in 2023 and a Full Operational Capability (FOC) in 2026/7.

During the roll-out in May 2016, the new model was described to the author as a giant smartphone with two separate software systems designed not to allow future capability apps to interfere with the flight-control software and other basic systems. SAAB enhanced the GRIPEN-Es fused sensor-suite and decision-support capabilities. So far, the AESA-radar, passive infrared search and track (IRST) sensor, tailored datalink and multi-function electronic warfare (EW) system “are performing better than expected”, according to a SAAB spokesman. Testing has also included an electronic jammer pod to complement the EW system, flights with the long-range MBDA METEOR BVR AtA missile and firing of the short-range infrared-guided IRIS-T.

In 2019, SAAB suffered a setback in Switzerland when a public referendum rejected the GRIPEN-E which had been selected in 2014 and which had to be withdrawn due to Swiss requirements to reflect an operational or fielded status, which could not be demonstrated during the flight-test programme. And then there is Finland, where SAAB is sweetening the selection of the E-model for 60+ aircraft by offering to add its unique GlobalEye multirole AEW&C platform.

Regarding the minor part of GRIPEN activities, these are related to the earlier GRIPEN-C/D. The 2019 “Swedish Defence White Paper” called for the earlier GRIPEN C/Ds to remain operational during the 2020s with 60 of them past 2030, with the D-models the last to be retired. The SwAF has introduced its latest edition, MS20, adding many capabilities, especially when it comes to air defence. The SwAF was the first air force operating the METEOR missile, once regarded as a game changer due to its long endurance and agility.

The latest add-on to the ʻC/Dʼ was announced in April 2020 – an AESA antenna for its PS-05/A fighter radar offered as an upgrade option for current C/D-operators (and other legacy types). This might well attract users such as the Czech Republic (their GRIPEN leasing runs until 2027), Hungary, Thailand and South Africa. With regard to Saab’s other lengthy export campaigns in Europe, it experienced considerable frustration because, although already selected, after changes of governments, Slovakia, Bulgaria and Croatia reversed their earlier decisions and opted instead for F-16 solutions. Meanwhile, Croatia has again changed its mind and has invited renewed bids for 12 jets.

Light Attack Aircraft

Light Attack Aircraft

Since 2001, in operational scenarios, especially in those with a low-medium threat level, modern and expensive 20 to 30 tonne-class fighters are often used with high operating costs. Generally, these are Close Air Support (CAS) missions in urban areas and battlefield air interdiction, as well as Homeland Security and air policing, tactical recce and support for combat SAR operations, where the use of low-cost aircraft equipped with on-board radar, a state-of-the-art target-designator pod, advanced self-protection systems, datalink and air-to-air refuelling capability would be enough.

Not surprisingly, this segment is increasingly prominent internationally but not truly reflected by efforts of the main European manufacturers – with three notable exceptions. Italian giant Leonardo presented the M346FA in Dubai 2017 as the latest iteration of their successful M346 MASTER advanced trainer (AJT) – or an evolution of the dual role fighter-trainer version, designed to meet air forces’ growing and diversified operational requirements. The -FA is advertised as an extremely effective and low-cost seven-hardpoint tactical solution for the modern battlefield, as it offers the most effectiveness with all the AJT-features, including their advanced and virtual training capabilities. GRIFO X-band radar equipped and advertised as a modern, affordable Red Air (aggressor), it was demonstrated to several Gulf and Central Asian states. Reportedly, Azerbaijan selected it, but as of yet, no contract has been announced. In 2019, Leonardo CEO Alessandro Profumo announced the sale of six -FAs but did not mention the customer.

COVID-19 restrictions have slowed efforts to sign a G2G deal with Austria to replace their obsolete Saab-105s. While favoured by Austrian AF officers, it seems that there is little political will in Vienna to go ahead with the deal.

Another manufacturer with a long tradition is Aero Vodochody in the Czech Republic. In the footsteps of the thousands of L-29 DELFIN and L-39 ALBATROS jet trainers built at Odolena Voda to the north of Prague, in October 2018, AERO rolled out the prototype of the latest version of the L-39NG (Next Generation). It conducted its maiden flight on 22 December 2018 and is also marketed for light-attack. The type will complete its flight test programme in mid-2021 and receive Light Attack type certification in Q3 2021. It was a considerable boost, when Senegal‘s President Macky Sall in April 2018 announced a contract for four of these aircraft. Other prospects are Red Air companies in the US and Portugal or the above-mentioned Austrian Saab-105 replacement. Another more distant project presented in 2018 by Aero and IAI (Lahav Division) is introducing the multirole light-fighter F/A-259, then oriented towards the USAF OA-X requirements

The Turboprop Segment

When it comes to turboprops, Serbia’s Pančevo UTVA factory surprisingly presented a light-attack version of the Serbian LASTA trainer dubbed KOBAC. Marketed since 2019 by the state-run Yugoimport agency, KOBAC is a two-seat training/light-combat or COIN (counter-insurgency) aircraft, but now with a turbo-prop engine instead of a piston engine. It comes with five hardpoints under the wings and one under the belly, providing a total ordnance weight of 500 kg. This could be pods with 7.62mm and 12.7mm MGs and 20mm MCs, multiple rocket launchers, bombs and guided missiles. Equipment includes an advanced nav/attack-system, optoelectronics with a day camera and thermal imager, and a laser range finder. Not much has been heard of KOBAC, but Yugoimport states the aircraft is oriented towards customers such as Iraq, Algeria, Angola, Kenya and Uganda.

There will be only one

In summary, it seems that European fighter programmes will struggle to survive as they are no longer financially viable in the post COVID-19 era. Looking to the future, most countries’ industries are being offered a chance to support one of the two mentioned European 6th-Gen. fighter options. And both will also have to compete with a US FA-XX solution and whatever players such as China might bring to the table. Therefore, we leave the last words to Dirk Hoke, CEO of Airbus Defence and Space: “We need to get our act together for a common European approach, not a national approach. I believe both FCAS sides in Europe need to make compromises. We will all benefit if we find a collective solution on how we approach defence. If we prolong with two competing major defence projects, competing for our nations’ involvement and supply chains, we will go under in fighting each other for small sales again. It is unacceptable that such a prohibitive situation should occur again”.

Georg Mader is a defence correspondent and freelance aerospace journalist based in Vienna, Austria, and a regular contributor to ESD.