The widespread adoption of the specialised offshore patrol vessel (OPV) has been one of the key maritime developments of the post-Cold War era. Europe has been very much in the forefront of this trend.

In addition to completing numerous vessels for national requirements, European yards have also been taking the lead exporting ships and design technology overseas, gaining contracts across the world. More recently, increasing global tensions have seen the emergence of a new requirement that consolidates constabulary and warfighting requirements. Again, European industry has been prominent in responding to this need.

Market Background

The growing global presence of purpose-built OPVs in recent decades can be attributed to two main factors. One has been the near universal implementation of the United Nations Convention on the Law of the Sea (UNCLOS) III regime and, particularly, the need to police national Exclusive Economic Zones (EEZs) expanding 200 miles or more beyond a country’s coastline. The other has been the end of the Cold War and the resulting imperative of establishing more cost-effective force structures. The acquisition of purpose-built ships optimised for low-cost deployment on constabulary duties in place of frontline warships was clearly attractive in this scenario. Whilst particularly influencing many European NATO countries, the shift has had global ramifications. For example, the supply of surplus, second-hand warships previously used by many developing navies to police their maritime interests steadily dried up once the major fleets completed their restructuring. The early success gained by the new generation of OPVs in performing economic yet efficient policing missions has been another important influence.

Although estimates of market size vary according to source, most commentators agree that OPVs have formed the fastest growing part of the broader naval vessels market over a sustained period of time. Numbers in service are now approaching 1,000 units, with several hundred additional vessels valued at over US$50Bn on order or planned.

Demand has typically been split between that for (i) ‘high end’ vessels equipped for a warfighting role and that for (ii) less complex ships intended for lower intensity policing. The former type would often have been termed light frigates or corvettes in a previous era. A cynic might suggest that the use of patrol vessel terminology for these ships frequently reflects a desire to achieve political acceptance for an expensive naval acquisition.

OPVs optimised for constabulary tasking have been by far the more numerous of the two types. A noteworthy feature of this market segment has been the particular prominence of European countries in developing these new designs. In addition to the pressures driving new force structures mentioned above, this reflects both the importance of their EEZs and the continued technical strength of the continent’s shipbuilding sector. As well as fulfilling national requirements, European shipbuilders have gained particularly strong positions in export markets through a combination of outright sales and technological transfers. An examination of the current status of European-based OPV programmes therefore provides a good indication of developments in the wider market.

European-led OPV Programmes

Current European-led OPV programmes are both numerous and diverse. Inevitably, many are being undertaken by countries with extensive territorial waters, including those facing the vast expanse of the North Atlantic and those that have retained overseas possessions as a legacy from colonial times. However, this has not been an exclusive precondition for participation in OPV production and countries with more limited EEZs have also been active. Another notable aspect of the market is the involvement of many smaller concerns alongside the more well-known naval shipbuilding giants. This is partly a reflection of the niche skills some specialist yards can bring to ships that are largely based on commercial design standards.

France

France has the world’s largest EEZ by virtue of its numerous overseas territories and long Atlantic coastline. It is therefore, perhaps, surprising that it has lagged behind many of its peers in the creation of a purpose-built OPV fleet. Other investment priorities led to the repeated postponement of a large BATSIMAR (bâtiments de surveillance et d’intervention maritime) project, which envisaged the acquisition of as many as 18 OPVs to replace a diverse flotilla of varying origins.

BATSIMAR has now been replaced by a two stage approach that prioritises the renewal of patrol vessels in France’s overseas territories.

In late 2019, a contract for six overseas patrol vessels – patouilleurs outre-mer (POM) – was placed with specialist Boulogne-based shipbuilder Socarenam. Developed from three slightly smaller ships of the LA CONFIANCE class designed by the same company for operation in Guyana and the Antilles, the c. 80-metres-long vessels will combine a steel hull with an aluminium structure. Although lightly armed, the design incorporates a flight deck and hangar for a large rotary drone to meet a requirement that is becoming increasingly common in the latest generation of OPVs. Deliveries are scheduled to take place between 2022 and 2025. Attention will then shift to construction of a series of more capable, oceanic Patouilleurs de Haute Mer that will likely be based in Metropolitan France. Ten of these are eventually planned, bringing the total number of OPVs in France’s inventory to 19.

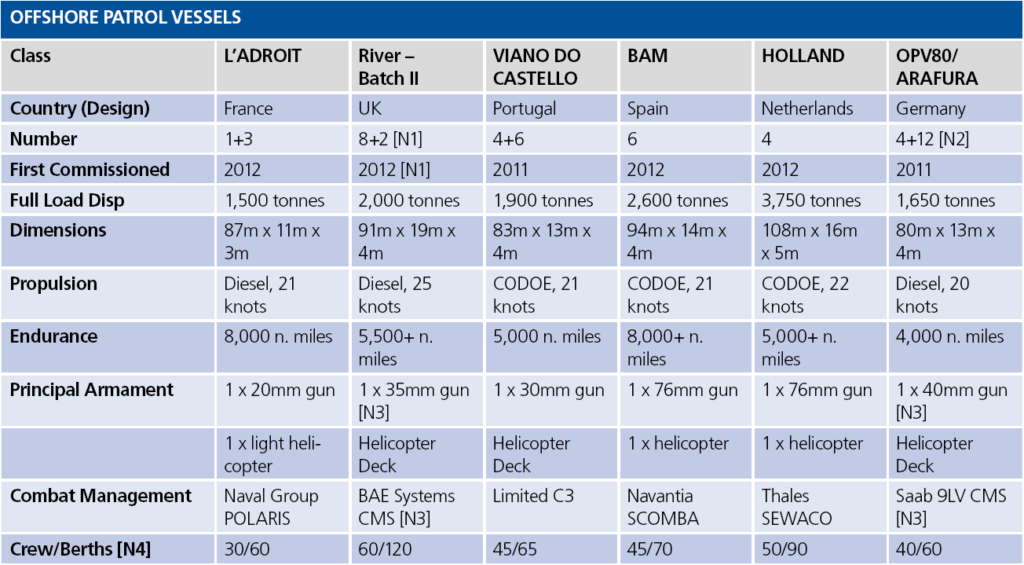

Whilst no details of the oceanic ships have yet been released, one contender is likely to be a derivative of the GOWIND type patrol vessel L’ADROIT. This design is now marketed by Kership, a joint venture formed between Naval Group and former fishing vessel specialist Piriou. L’ADROIT herself spent several years on loan to the French Navy but has recently been transferred to Argentina as part of a deal that will see three additional vessels of the type completed by the Kership alliance. An 87-metres-long, 1,500 tonne design, L’ADROIT incorporates a 360° panoramic bridge and integrated sensor mast, the latter linked to a POLARIS combat management system that is optimised for the constabulary role. She forms part of a portfolio of Kership OPV designs that is also being actively marketed for export. In November 2019, Piriou announced the signature of a contract with Senegal for three 62 metres patrol vessels based on the Kership 58 OPV concept.

Another French company active in the OPV export markets is OCEA, which specialises in aluminium construction. The bulk of its sales have comprised smaller, fast coastal patrol craft but it has also had recent success in gaining contracts for larger vessels. December 2019 saw the delivery of its largest patrol vessel to date, the OPV 270 type GABRIELA SILANG, which was handed over to the Philippine Coast Guard. The use of aluminium offers the potential of significant savings in operating costs compared with steel vessels of a similar size and may become increasingly popular if the latest OCEA vessels prove successful.

United Kingdom

Another country with significant domestic and overseas EEZs, the UK is close to completing the recapitalisation of its OPV flotilla with the imminent conclusion of deliveries of five Batch II RIVER class ships. The ships share some similarities with an earlier group of Batch I and Batch I modified RIVER class OPVs commissioned into the Royal Navy between 2003 and 2007. However, they are more directly based on the three Brazilian AMAZONAS class ships that were initially destined for Trinidad and Tobago. The c. 2,000 tonne BAE Systems’ design utilises a 91 metre hull with a form derived from light frigate practice and is capable of the relatively high speed of 25 knots. Other design elements that push the class towards the more sophisticated end of the OPV spectrum include use of a scaled-down variant of the combat management system fitted to frontline Royal Navy warships. A large flight deck is capable of landing a heavy weight helicopter. The ability to ship and handle various containerised equipment fits provides additional flexibility. It seems the Royal Navy’s present intention is to deploy the Batch II ‘Rivers’ to perform constabulary missions in the United Kingdom’s overseas territories. Some of the earlier smaller and less sophisticated Batch I ships will be retained to police domestic waters.

In addition to the three Brazilian ships, BAE Systems have sold the Batch II RIVER design to Thailand, who have completed two KRABI class variants under licence. Both are equipped with an OTO 76mm gun and Thales Nederland TACTICOS combat management system, demonstrating the type’s inherent flexibility to accept various equipment outfits.

The United Kingdom’s Babcock International has also been active in OPV export, delivering four SAMUEL BECKETT class vessels to the Irish Naval Service between 2014 and 2018. Based on a design provided by Fincantieri’s Vard Marine subsidiary, the 90 metre OPVs are large, c. 2,250 tonne ships optimised for the harsh conditions of the North Atlantic. Combined diesel or electric (CODOE) propulsion includes a power take-in arrangement from the electrical system to maximise low speed endurance. Main armament is an OTO 76mm gun but there is neither a combat management system nor helicopter facilities. The recent closure of the Appledore yard used to build these ships may herald Babcock’s exit from the OPV market.

Portugal

The Portuguese Navy polices a North Atlantic EEZ remarkably similar to that patrolled by the Irish Naval service. Perhaps unsurprisingly, its current OPVs of the 1,900 tonne VIANA DO CASTELO class have much in common with the SAMUEL BECKETT type in spite of different design origins. This includes the combination of a large, weatherly hull with an efficient CODOE propulsion. However, the Portuguese Navy’s broader range of capabilities are reflected in the provision of a flight deck for helicopter operations. The first pair of what was then intended to be an extended class was ordered from the Viana do Castelo yard in 2002 under the NPO2000 programme. However, a combination of economic and industrial problems meant it was 2011 before the first ship was delivered.

A restructuring of the building yard as West Sea Viana has put the project back on track and a further pair ordered in 2015 were commissioned in 2018 and 2019. This has paved the way for plans for six more under Portugal’s latest Military Programming Law.

Spain

Spain’s Navantia is another major force in European OPV construction, completing ships both for the Spanish Navy and for export. National requirements have been met by the Buque de Acción Marítima (BAM) programme. This was originally launched early in the new Millennium to replace a range of vessels. Accordingly, the intention was to produce a modular design capable of adaptation to perform a variety of distinct roles. Up to 14 ships were initially envisaged. However, Spain’s past economic problems have limited production to two batches totalling six units, all completed in OPV configuration. As for the later British RIVER class vessels, these 2,600 tonne ships are relatively sophisticated units equipped with powerful combat management systems and sensors. Whilst primarily intended for constabulary duties, these capabilities place them quite close to ships intended to undertake limited warfighting missions.

This blurring of constabulary and warfighting orientation is also evident in recent Navantia export programmes. These include two quartets of BVZ littoral and POVZEE oceanic patrol vessels delivered to the Venezuelan Navy from 2010 onwards. The latter design, in particular, incorporates military capabilities such as a combat management suite and close-in weapons system. It forms the basis for five, yet more-heavily armed AVANTE 2200 vessels being built for Saudi Arabia under a €1.8Bn contract concluded in July 2018. These ships will be designated as corvettes in Saudi service.

The Netherlands

The Netherlands

The Royal Netherlands Navy’s HOLLAND class OPVs demonstrate a somewhat different design philosophy. Currently the largest European OPVs with a displacement of 3,750 tonnes, they are designed for trans-Atlantic deployment to the Dutch overseas territories in the Caribbean. Four were completed by Damen’s yards in the Netherlands and Romania from 2012 onwards. They combine the sea-keeping and endurance found in other oceanic OPVs. The senor suite installed in an integrated Thales I-Mast provides unparalleled surveillance facilities. However, a limited armament outfit is focused on their constabulary mission. They could therefore only play a supporting role in higher intensity operations.

Although the Netherlands has now filled its national OPV requirement, Damen offer a wide range of patrol vessels for export. These range from the mainly coastal-orientated vessels of the Stan Patrol series to larger offshore types. Recent sales include two OPV 2400 derivatives being built in Romania as corvettes for the Pakistan Navy. Licensed construction has included more lightly-armed OPV 2400 variants for the Vietnam Coast Guard and three OPV 1800 types for the Malaysian Maritime Enforcement Agency.

Germany

Germany’s restricted territorial waters mean there is only limited national demand for OPVs. However, two of its shipbuilders have a major presence in export markets. Most significantly, Lürssen has followed domestic construction of four 1,600 tonne DARUSSALAM class OPVs for the Royal Brunei Navy with a 2017 contract for twelve Royal Australian Navy vessels based on the same basic OPV80 design. Fabrication of the lead vessel – ARAFURA – commenced at the Osborne yard in Adelaide in November 2018. However, all but the first pair will be built in Western Australia by a joint venture between Lürssen and local company Civmec.

In similar fashion to many of the OPVs operated by first-rank navies, the Australian vessels will be lightly armed. However, they incorporate a sophisticated command and control system as well as helicopter landing facilities.

Fellow Bremen-based shipbuilder Fassmer has also gained success exporting its own OPV80 design for licensed construction in South America. Chile’s ASMAR completed four OPV80 variants between 2008 and 2017 whilst Colombia’s COTECMAR has now also delivered three of the type. Fassmer has also built three similar OPV86 type POTSDAM class vessels for the German police. In an increasingly common trend, all these ships are built to a modular design and can be configured with different equipment fits.

Other OPV Programmes

Although this summary demonstrates the prominent place European companies have gained in OPV production and design, it is important to note that there are many other participants in this large and diverse market. In Asia, both China and Japan operate sizeable fleets of indigenous coast guard vessels. Indonesia has also recently developed OPVs for local production. A noteworthy feature of Chinese and Japanese – as well as Korean – programmes – has been construction of a series of increasingly large constabulary ships capable of lengthy oceanic deployment. The China Coast Guard’s CCG 2901 and 3901, delivered in 2015 and 2016, are currently the largest OPVs in the world.

In North America, the large US Coast Guard is close to completing induction of the sophisticated LEGEND class national security cutters produced by Huntington Ingalls Industries as the ‘high end’ of its constabulary fleet. However, it has otherwise largely relied on adapting overseas design concepts to meet its requirements. For example, its latest 4,500 tonne HERITAGE class offshore patrol cutters are based on a Vard Marine 7 110 vessel, with detailed design work performed by Babcock International. Vard, alongside British design house BMT, was also involved in developing Canada’s HARRY DE WOLFF class Arctic OPVs.

In general terms, few countries have matched the success of the various European manufacturers in exporting OPV designs. One significant exception has been India, which has developed significant experience in producing patrol vessels to meet its own maritime security vessels. A number of these designs have been exported to Indian Ocean fleets.

These include two large 2,300 tonne SARYU class OPVs constructed by Goa Shipyard Ltd for the Sri Lanka Navy and the GRSE-built BARRACUDA, which was delivered to the National Coast Guard of Mauritius. It seems probable, however, that competition from the main Asian builders will grow given their increasing presence in other fields of naval construction.

Future Market Trends

In addition to the likelihood of growing competition, a number of other trends are evident with respect to OPV production. One of the more significant trends is the growing importance of unmanned and autonomous vehicles in the constabulary role. In addition to help drive the quest for minimal crewing that has always been a feature of OPV operation, such assets improve a patrol vessel’s ability to perform persistent surveillance at longer ranges. At present, the focus is on the operation of unmanned aerial vehicles but their surface and sub-surface counterparts are also likely to assume greater prominence. The need to find space to embark these assets is likely, in turn, to increase the emphasis on modularity that is already a feature of many recent OPV designs.

Another important trend is the blurring of constabulary and warfighting capabilities that can already be seen in some of the programmes reviewed above. The steady spread of OPV procurement into less stable regions has produced a conflict in the minds of navies attracted by the economics of patrol vessel operation but which require some of the warfighting potential of a traditional frigate. Modular design concepts may also help resolve this dilemma.

One illustration of this approach is provided by Russia’s Project 22160 large patrol ships. Displacing around 1,500 tonnes, the basic design is modestly armed and minimally crewed. However, the ability to ship significant containerised weapons loads such as ‘Kalibr’ cruise missiles and their specialist operators offers the potential for rapid conversion into a warfighting unit. The Italian Navy’s larger, 6,000 tonne PPA multi-purpose offshore patrol vessels of the PAOLO THAON DI REVEL class are similar, albeit more complex, in concept. Available in different modularised equipment fits, outfitting can range from a ‘light’ constabulary configuration to a ‘full’ warfighting vessel. The PPA itself is probably too elaborate for many navies but it seems likely the idea will have wider application.

Conrad Waters is a naval and Defence analyst based in the UK. He is a regular contributor to Mittler Report publications and Editor of Seaforth World Naval Review.