According to new data from the Stockholm International Peace Research Institute (SIPRI), the largest exporters of arms during the past five years were the US, Russia, France, Germany and China. International transfers of major arms during the five-year period 2015–19 increased by 5.5% compared with 2010–14 transfers. This report focuses on the most recent five-year period, 2015–19, and increase or decrease comparisons are measured against the previous, 2010–14, period measured and presented by SIPRI.

Importing by Number

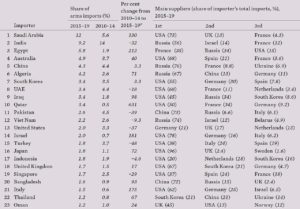

SIPRI’s new data shows that individually Saudi Arabia, India, Egypt, Australia and China are the top five arms importers, accounting for 36% of total arms imports. However, regionally Asia and Oceania account for 41 % of arms imports in 2015–19, followed by the Middle East at 35%, Europe at 11%, Africa at 7.2 % and the Americas 5.7 % for the same period.

USA is Number 1

Exports of major arms from the USA grew by 23%, raising its share of total global arms exports to 36% of the arms exported worldwide. These major arms transferred from the USA went to a total of 96 countries, a far higher number than any other supplier. US arms exports were 76% higher in total than those of Russia – the second-largest arms exporter in the world. In 2010–14 US exports of major arms were 17% higher than those of Russia, whereas in 2015–19 they are 76% higher.

The Middle East accounted for 51% of total US arms exports which is a 79% increase to the region. Saudi Arabia was the largest recipient of US arms, accounting for 25% of all US arms exports.

The value of the US exports is due in-part to the increased demand for its advanced F-35 stealth jet, particularly in Europe, Australia and Japan. In addition, new-built F-16-series were contracted for Slovakia and Bulgaria. Greece is modernizing 85 of its existing F-16s to a higher capability level and it began talks on possible F-35 purchases. US Arms exports to Europe accounted for 13% of US arms exports, which is an increase of 45 per cent. US arms exports to Africa increased by 10%. However, its exports to the Americas decreased by 20% as the region’s political will is to source materiel stocks from lower cost suppliers.

Other Premiership Players…

There were three countries outside Europe and North America among the top 10 arms exporters in 2015–19: China, Israel and South Korea.

Fine China

China is the world’s fifth-largest arms exporter contributing 5.5% to global arms exports. A decade earlier, it saw an export increase of 133 per cent. In 2015–19 Asia and Oceania accounted for 74 % of Chinese arms exports, Africa for 16 % and the Middle East for 6.7 %. The number of countries to which China delivers arms has grown significantly to 53 nations. Thirty-five per cent of their arms exports went to Pakistan as the main recipient – still – of Chinese defence exports since 1991.

Israel Is Real

As the eighth-largest arms supplier for 2015–19, Israel’s arms exports accounted for 3.0 % of the global total, but grew by 77%, the volume of Israeli arms exports in 2015–19 was the highest ever, even though its global rank was previously at number five.

Southern Comfort

Interestingly, often understated South Korea became the 10th largest arms exporter in 2015–19 with a 2.1 % share of the global arms export total. Its arms exports increased by 143%, reaching the highest level of increases among exporters in the top 10 for this period. However, its imports remained substantially higher than its exports. The number of countries to which South Korea delivered arms rose from 7 in 2010–14 to 17 in 2015–19. Asia and Oceania account for 50 % of South Korean arms exports, Europe for 24 % and the Middle East for 17 % – mostly because of South Korea’s KAI T-50 and FA-50 jet-trainers and light strike-jets. In this most recent period, the distribution of South Korean arms exports was spread far more widely than before; the largest recipient (the UK) accounted for only 17 % of its exports.

Go West!

The Combined arms exports from European Union members / Western European countries account for 26% of the total global arms trade, which is 9% higher than before. France, Germany, the UK, Spain and Italy remain the top five arms exporters; together they comprise 23% of the 26% global arms exports. Overall, French, German and Spanish arms exports increased, while British and Italian arms exports decreased – it is unknown what affect Brexit had, if any, on the UK’s drop in sales.

France

French arms exports reached their highest level for any period since 1990, with 7.9% of total global arms exports, which is a remarkable 72 % increase. According to SIPRI, the French arms industry benefited from demand for arms in Egypt, Qatar and India – mainly consisting of Dassault Rafále fighter-jets. Deliveries of the combat aircraft to these three countries accounted for nearly 5% of French arms exports and is the first time these three countries were among the main recipients of French arms since the 1980s.

Germany

Germany’s arms exports rose by 17%, accounting for 5.8% of the global total. Of Germany’s arms exports, 36% went to Asia and Oceania, 26 % stayed within Europe, 24 % sold to the Middle East, 11 % went to the Americas and 8.3 % went to Africa. Overall, 39% of Germany’s arms export value were of submarine sales: four to South Korea, three each to Egypt and Greece, two each to Colombia and Italy, and one to Israel.

The UK

The UK was the world’s sixth-largest arms exporter. Even though exports fell by 15%, they still accounted for 3.7% of total arms exports worldwide. British arms exports decreased primarily as a result of decreases in its arms exports to Saudi Arabia – where the USA is the biggest winner, India – where France is the clear European winner, and the USA – whereby Trump administration protectionist barriers may have some influence on the decline in UK defence imports.

Russian Salad

Russian arms exports accounted for 21% of total arms exports, while major arms exports by Russia decreased by 18 per cent.

As evidenced by SIPRI Researcher Alexandra Kuimova, Russia lost traction in India – the main long-term recipient of Russian major arms – which led to a sharp reduction in arms exports. Russian arms exports to India fell by 47 per cent. Although there was a substantial increase in exports to Egypt and Iraq, the loss in Indian exports was not offset by these exports. Egypt and Iraq were the main recipients of Russian arms exports to the Middle East, accounting for 49% and 29% of Russian arms exports to the region respectively: Iraq sales were up by 212% and Egypt sale were up by 191 per cent. Although Russian forces support the Syrian Government in its civil war, direct Russian arms deliveries fell by 87 per cent. It is not clear if this is due in whole or part of Russia’s presence and direct involvement in Syria’s civil war.

Importing Wildfire Fuel

While SIPRI is a reliable resource for spotting trends and finding statistics on arms imports-exports, it excels in putting these exports into context, i.e. armed conflicts.

Kashmir

On the word of SIPRI Senior Researcher Siemon T Wezeman, the nuclear-armed states of India and Pakistan attacked each other in 2019 using an array of imported major arms, as in previous years. He notes in the SIPRI report that many of the world’s largest arms exporters supply both of these two combatant states – often exporting arms to both sides – for decades. India is the second-largest arms importer in the world, while its nemesis-neighbour Pakistan ranks 11th place for arms imports.

Middle East arms imports increased by 61% and account for 35% of total global arms imports. Saudi Arabia is the world’s largest arms importer and supports observations that Saudi Arabia is determined to be the single-largest regional power in the Persian Gulf region. Its imports of major arms increased by 130%, which account for what might be an unprecedented 12% of overall global arms imports.

Saudi Arabia Hegemony

The USA and the UK continue to export arms to Saudi Arabia whereby a total of 73 % of Saudi Arabia’s arms imports came from the USA and 13 % from the UK. This is despite significant political concerns over Saudi Arabia’s overwhelming involvement in the Yemeni civil war, which international outcries highlight the widespread tragic humanitarian impact of its role.

UAE Meddling

The UAE is the eighth-largest arms importer in the world and is actively involved in the Libya and Yemen conflicts dating back to 2015. Two-thirds of its arms imports came from the US during this period. When the United Nations Security Council condemned foreign military involvement in Libya in 2019, the UAE had major arms import deals ongoing with Australia, Brazil, Canada, China, France, Russia, South Africa, Spain, Sweden, Turkey, the UK and the USA, making each of these nations “complicit” even though China, France, Russia, the UK and the USA are all members of the UN Security Council that condemned foreign military involvement in Libya.

Caucasia

Armed clashes between Armenia and Azerbaijan mean they are importing arms to increase military capabilities, including Russian missiles capable of attacking targets inside each other’s territory. Russia accounts for 94% of Armenia’s arms imports over the past five years, including a small number of Su-30 fighters. Sixty per cent of Azerbaijan’s arms imports came from Israel and – ironically – 31% from Russia. Armenia’s arms imports increased by 415%. Despite a decrease of 40%, Azerbaijan’s arms imports were still 3.3 times higher than those of Armenia.

Crimea

Ukraine’s arms imports remain low and constant despite the on-going armed conflict with Russian-backed separatists in the east of the country. Having a healthy defence industry of its own could be the reason its imports are low. The Ukraine’s largest arms imports included 50 second-hand armoured vehicles from the Czech Republic and 210 anti-tank missiles from the USA.

Turkey’s Reach

Turkey’s arms imports were 48% lower, even though its military continues to fight Kurdish rebels and chose sides in the Libyan and Syrian civil wars. Turkey’s own defence-industrial complex continues to grow rapidly and sustainably, resulting in reduced foreign dependency and cancellation of a large US arms deal. Subsequently, the USA stopped a planned sale of 100 F-35 combat aircraft to Turkey in 2019 because Turkey bought the S-400 air defence systems from Russia that year. Other European states restricted arms sales to Turkey in 2019 because of its attacks on Kurdish ethnic groups in Syria.

Libya’s “Liberation”

Turkey, the UAE, Jordan, Egypt and other countries are actively supplying and participating in the civil war between the internationally recognised Libyan Government of National Accord (GNA) and the Libyan National Army (LNA) that continues since 2014. Both sides receive weapons from abroad in violation of the UN’s 2011 Libyan arms embargo; no country sanctioned so far for involvement. Exact details about foreign arms deliveries remain unclear. Similar to Turkey’s involvement there, UAE’s interference in Libya is part of its assertive foreign policy that includes its military intervention in Yemen.

From Africa with Love…

Despite stereotypes of this continent of more than 50 independent states being one of failed states sunk waist-deep the quagmire of civil wars and corruption that volley unskilled, desperate migrants at the arm-maker countries who fuel African conflicts, SIPRI’s numbers present a different reality. Arms imports to Africa decreased by 16% overall – notably down by 49% in sub-Saharan Africa. This could be due in part to the increasingly stronger post-apartheid South African defence industry, shifting its defence-industrial model from being an import market to an export market under its progressive President Cyril Ramaphosa. Nevertheless, Russia remains the single largest foreign arms provider to Africa, accounting for 49% of arms bought by the region. The US and China are neck-and-neck with sales to Africa being 14% and 13% respectively.

North Africa

Including Egypt and Libya, sales to this region account for 74% of all African arms imports. Sales to Algeria alone accounted for 79 % of North African arms imports. As almost a corollary, Algeria’s arms imports were up by 71%, making it the sixth-largest arms importer in the world. This increase occurred in the context of Algeria’s long-standing tensions with Morocco, rising internal political tensions and concerns about spill-over from conflicts in neighbouring Mali and Libya. Russia remained the largest arms supplier to Algeria, accounting for 67 % of Algerian arms imports – followed by China and Germany that make up 13% and 11% of arms imports respectively.

Sub-Saharan Africa

“Southern” sales accounted for 26% of African arms imports in 2015–19. Russia accounted for 36% of arms imports by states in the sub-region, followed by China for 19 % and France for 7.6 % as the next two largest exporters. However, when added together and examined, armament imports to this region are 49% lower; and, are at the lowest level since the 1995–99 period.

Noteworthy

Angola, Nigeria, Sudan, Senegal and Zambia are the five largest arms importers in sub-Saharan Africa. Sales to these countries comes to being 63 % of all arms imports to the region.

Most notably is Angola, whose arms imports register as being 27% of the regions imports. While only the 42nd largest arms importer globally, and its economy is still in a gripping recession, its arms imports increased by 2120 per cent! Putting it into perspective, this world-record expenditure increase is mostly due to one sale instead of a massive military arms build-up: Russia’s delivery of 12 former Indian Su-30K overhauled combat aircraft.

Market Health

Overall, the defence market is “up”, in the sense that increases in imports or exports are at far larger rates than the decreases. The shift in leading global exporters has shifted little as one looks closer to the top of the list; however, the shift in importers show much fluidity and change due more to major purchases, such as an air defence system or fighter aircraft. In conflict zones, the spend varies across a broad range from munitions to attack helicopters. One thing is clear, there is no stagnation in the defence market.

Georg Mader & Stephen Elliott