Innovation, affordability, and effectiveness are key drivers that have shaped the Norwegian defence industry for more than six decades. Today the industry controls a portfolio of advanced and innovative defence equipment that has been shaped by the operational requirements of the Norwegian and allied armed forces. Norwegian defence cotractors are world-leaders in several niches, and close to 80 per cent of their sales are to customers outside Norway.

The Norwegian defence industry has existed for more than 200 years since Norway got its constitution in 1814. Today, the industry is an integral part of Norway’s overall defence capability and provides a significant contribution to safeguard the nation’s essential security interests. Specific local and regional conditions related to national security, arctic climate, challenging topography, resource constraints, extreme littoral conditions, and the vast ocean areas under Norwegian jurisdiction in the high north, have shaped the Norwegian defence industry and honed the capabilities of the companies and the skills of their employees. The Norwegian Armed Forces prefer to acquire defence equipment off-the-shelf in the international market. However, for reasons related to the conditions mentioned above, this is not always possible. In such cases, the armed forces cooperate with the Norwegian defence industry to develop bespoke solutions that fulfil the Norwegian armed forces’ requirements.

Meeting operational requirements in the most cost-effective way is always top priority. Exportability is, however, likewise a mandatory requirement when new equipment and systems are developed. Unit costs and the costs to sustain and maintain equipment solely operated by the Norwegian armed forces, by far exceeds what is affordable. Furthermore, the industry must sustain and develop technology and knowledge in between our major national development and upgrade programs. Consequently, export of defence equipment constitutes an integral part of Norway´s essential security interests, as a national defence industrial base could not exist without exports.

Within carefully selected technologies and product areas, Norwegian defence industry today possesses some of the most advanced technology and capabilities in the industry and manufactures several products and systems that are leading in the international market. Almost 80 per cent of sales are to customers outside Norway. That is one of the largest export shares of its kind in the world.

Areas of Expertise

To provide guidance on where the armed forces should spend on defence research and development and seek cooperation with Norwegian industry, the Ministry of Defence has identified a set of prioritised technologies, endorsed by Norway’s parliament.

The key technologies are:

- Command and control, information, decision support and combat systems

Systems integration - Autonomous systems and artificial intelligence

- Missile technology

- Underwater technology

- Ammunition, propulsion technologies and military explosives

- Materials technology developed or refined for military use

- Lifecycle support for military systems

To transform these technologies into products and systems, a model for cooperation between the military user community, academia and the defence industry, which has been developed and refined for decades, is applied. This “Triad” facilitates close integration and interaction between the key stakeholders, in particular the military user community, from the very early phases of concept development and experimentation to implementation and transition to operational use.

A Broad Range of Capabilities

By utilising this collaborative framework, Norwegian defence industry can develop, deliver, and export world-class products and systems in the following areas:

- Missiles (NSM/JSM)

- Ground Based Air-defence (NASAMS)

- Rocket motors (AMRAAM, Sidewinder, ESSM, IRIS-T)

- Remote weapon systems (Weapon stations and Turrets)

- Advanced ammunition for all domains (Medium and Large Calibre, Air-Burst, Base Bleed/Rocket assist/Ramjet)

- Shoulder fired weapons (M-72)

- Nano-UAVs (BLACK HORNET)

- Underwater systems (HUGIN AUV, Naval sonars)

- Command- control- and communication systems (Integrated Combat System, NORBMS, FACNAV, NORCCIS, SW-defined radio)

- Secure information systems, Crypto (XO-mail, High Grade IP-crypto, G-A-G VCS, Multilevel security information exchange)

- Soldier systems (Load bearing systems, combat clothing, ballistic protection)

International cooperation is key to the Norwegian defence industry’s international success, which made exports grow by more than 400 per cent over the last 20 years. Partnerships are actively searched for as a vehicle to secure market access and technology cooperation. Such partnerships are paramount to sustain the industry’s position in the international market today and in the future. All Norwegian defence programmes of any significance involve international industry-to-industry cooperation.

One of the most important reasons why cooperation has been successful, is that most Norwegian products and systems are platform-independent. Our industry does not deliver major platforms such as armoured vehicles, aircraft, or submarines. Rather than having to allocate resources to keep legacy platforms and systems alive, Norwegian industry can continue to invest in those niches where we have technology and products with potential.

Norwegian defence companies are small when compared to the major international contractors; hence, head-on competition is not a viable approach. A flexible approach to cooperation and preparedness to respond quickly to changes and emerging opportunities, have proven successful.

In cooperation with international partners, Norwegian defence industry today manufactures, markets, and delivers “high-end” weapon systems, such as anti-ship and land attack missiles and air defence systems, advanced ammunition, rocket motors, remote weapon systems, sophisticated communication equipment, combat management systems, personal reconnaissance systems, soldier systems and many more, to customers in more than 50 nations worldwide. The biggest and most important export market by far is the United States. NATO allies and EU member states count for approximately 90 per cent of defence exports from Norway. However, markets further away, such as Australia, South-East Asia, and The Middle East, are also important.

A Major US Programme

Norway’s participation in international collaborative armament programs is also another important contributor to the growth of the Norwegian defence industry. The country is a partner in the US-led F-35 Joint Strike Fighter programme. This has created opportunities for several Norwegian companies. Norwegian industry’s contribution to the F-35 includes advanced composite parts and subassemblies, electronics, mechanical components, and support services. A fully-fledged engine depot has been established in Norway to provide overhaul and repair services for the F135 engines. A new 5th generation long-range Joint Strike Missile (JSM), required to provide F-35 the operational capability required by the Norwegian air force, is already in production, with Norway and Japan as launch customers.

A new armour-piercing ammunition nature (APEX) for F-35, also developed by Norwegian industry, will increase the aircraft’s combat effectiveness against land targets and for close air support operations. JSM and APEX are excellent examples of how the Norwegian government and Norwegian industry invest to enhance the operational capability of F-35 to meet national requirements that buying off-the-shelf cannot attain.

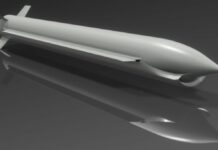

On the naval side, Norwegian industry has developed the shipborne long-range, low-observable Naval Strike Missile (NSM) with anti-ship and land attack capability for sea and ground launch applications. The missile is currently in operation with the Norwegian, Polish, Malaysian and US navies. The US Marine Corps (USMC), Germany, Australia, Romania, and Spain have all ordered NSM and will introduce the missile soon.

European Cooperation

A year ago, Norway and Germany agreed to jointly develop and build six identical submarines, four for Norway and two for Germany. Expectations are high that common submarines will provide significant cost-savings throughout the lifetime of the boats. The programme facilitates integration of Norway´s and Germany´s industrial capabilities in the field of submarines. This is governed by a strategic partnership agreement that assigns roles, responsibilities, and tasks to the industrial partners for the next 40 years.

Furthermore, the cooperation also includes a strategic partnership for development of the next generation of the NSM-missile, which will be operated by both the Norwegian and the German Navy. In this regard, a long-term strategic partnership between Norwegian and German industry in the field of anti-ship missiles has been created.

The complex oceanographic conditions along the long Norwegian coastline require bespoke solutions for underwater acoustic applications. Norwegian sonar technology, and in particular the capability to process underwater acoustic data, are state-of-the art. The technology provides the operational user the capability to navigate and maintain situational awareness under water with extreme precision. Likewise, anti-submarine warfare and mine countermeasures are also core capabilities of the naval industry. Norwegian industry offers advanced Autonomous Underwater Vehicles and is the preferred industrial partner for Norwegian navy developing the next-generation autonomous mine warfare capability.

The NATO Evolved Sea Sparrow and the European IRIS-T missiles get their propulsion from a Norwegian company. The motor for the AMRAAM-missile, which is the primary weapon for US and NATO air forces is developed and manufactured in Norway, as is the motor for the Sidewinder missile. Norwegian industry has delivered motors to the European Exocet Block 3 and recently the LMM missile.

In the field of advanced ammunition, Norwegian industry is making considerable progress. One of the primary four remaining advanced ammunition manufacturers in Europe is headquartered in Norway. New concepts like programmable ammunition, ramjet-propelled artillery grenades and advanced shoulder-launched weapons, are in the pipeline to improve combat effectiveness of war fighters, combat vehicles and artillery. NATO AWACS, NATO AGS and NATO ACCS are other examples of international programmes where Norwegian companies delivers critical software and support.

Domestic Success

Another success story is remote weapon systems. Norwegian industry is the market leader for remote weapon stations with a global market share of close to 90 per cent. More than 20,000 weapon stations have been delivered to 28 countries in cooperation with armoured vehicle manufacturers in both US and Europe.

The Norwegian NASAMS ground based air-defence system has become a benchmark for medium range air defence systems in NATO. 13 nations, including the US, currently operate the system. NASAMS has provided air defence coverage to the White House, US Congress and The Pentagon, 24 hours 365 days a year for more than 15 years, and the system will shortly also be operational with the Ukrainian armed forces.

The BLACK HORNET is the most advanced and capable nano-UAV available. The world’s smallest operational UAV is developed and manufactured in Norway. It weighs only 30 grams, still it can provide real time HD-video, night and day, using a proprietary datalink with an effective range of more than 1.5 km. The vehicle can operate in GPS-denied environments and in severe weather conditions. It provides the warfighter with situational awareness, enhanced combat effectiveness, and significantly improved safety. More than 40 nations have acquired the system, among them the US for the Army Soldier-borne Sensor program and the Ukrainian army.

Secure information systems and advanced communications for mission critical applications are other areas where the industry excels. For more than 20 years, Norwegian industry has been the sole supplier of crypto solutions for “high grade” IP-networks in NATO. Secure email and secure G-A-G voice communications are other areas where Norwegian industry is the preferred supplier to NATO.

In addition to the major companies delivering the systems and products mentioned above, the industry also comprises a significant number of high-tech SMEs, with highly specialised products. Advanced communication equipment, surveillance systems, antennas, sensors, weapon improvement solutions, command and control systems, camp solutions, medical technology, and high-end UAVs and USVs are some examples.

There is also a plethora of highly skilled subcontractors that are closely integrated in the supply chains of the major Norwegian defence contractors as well as of the leading European and US OEMs. Advanced high quality electronic assemblies and sub-assemblies, high-end equipment for data recording, processing and storage, cables and connectors, complex mechanical structures and sub-assemblies, software, and services are among what can be found.

Further Innovation

The future belongs to those who can adapt quickly. Technological development accelerates, in some areas, exponentially. Emerging and disruptive technologies create potential for developing completely new solutions to existing problems and challenges. In some areas, however, they may also imply new threats and operational challenges. Artificial intelligence, machine learning, big data, hypersonic weapons, and space technology are areas scientists predict may have disruptive effects on military operations, and hence equipment and systems within 5-10 years. Flexible, non-bureaucratic organisations with low hierarchies and short lines of communication, will continue to be a competitive advantage for Norwegian defence. The ability to respond quickly to customer requirements and needs, and to introduce new technologies without unnecessary delay, will become a prerequisite for survival.

Norway and Norwegians are early adaptors of new technology. The Norwegian Defence Industry is no exception, already working intensely to understand the potential and challenges these technologies will pose as they mature. For example: Advanced algorithms that provide counter-UAV systems with the ability to increase effectiveness by automatically analysing logs from past usage have been put into operation. 155 mm ramjet artillery ammunition is in development and has already been fired successfully. Taking into consideration the extreme timelines for development and fielding of military equipment, understanding the impact of new technology, and in particular EDTs, will be critical to be able to deliver state of the art equipment in the future.

The Norwegian defence industry is in better shape than ever. Sales, order intake, backlog and workforce are “all time high”. Plans for further growth are being implemented and considerable resources are invested in increased capacity, upgrade of production equipment and in building competence to take advantage of the technologies of the future. A mature and modern product portfolio, funded development programs, wide international market presence and a web of strategic alliances with international partners, makes the industry an attractive and reliable supplier and partner for customers worldwide. The industry is prepared to respond to present and future needs of the Norwegian and allied forces to enable them to deter, defend, and if, needed fight to safeguard our societies and our people.

About The Norwegian Defence and Security Industries Association (FSi)

The Norwegian Defence and Security Industries Association (FSi) is the only trade association in Norway dedicated to advocate the interests of the Norwegian Defence and Security Industries. The association is the primary interlocutor and partner for the Norwegian government in matters of importance to the industry. FSi´s mission is to foster framework conditions for member companies to succeed in the domestic and global defence and security markets, thereby contributing to Norway’s national defence and security goals.

FSi is also a focal point for foreign contractors seeking cooperation with Norwegian companies in relation to Norwegian defence procurements abroad and international collaborative programmes. The association has approximately 180 member companies – a diversified group ranging from the major national defence contractors to one-person businesses, all with unique capabilities built on innovation and advanced technology, serving both the military and the civil security markets. Approximately 85 per cent of the companies are SMEs.

FSi is an independent private association owned, governed and funded exclusively by the members. The association is affiliated and collocated with the primary business association in Norway, The Confederation of Norwegian Enterprise (NHO). L