Air mobility and airlift capabilities represent critical assets, as they guarantee deployment and sustainability of forces, both globally as well as within the European theatre.

Both assets cover a wide range of tasks, such as strategic long-range outsized cargo transport, intra-theatre logistics, special operations or medical evacuation and provide access to theatres across the globe. Whether these tasks are foreseen for military or humanitarian purposes, for critical crisis response, or long-term peace stabilisation roles, they can easily ‘eat up’ a fair portion of the lifespans of whole fleets or individual aircraft types, which are often already decades old in some cases.

Russia’s invasion of Ukraine has further exacerbated the problem, creating a sense of urgency within Allied military headquarters. In addition to probably ending the use of the iconic Antonov-124 by European nations, this war has also reminded Western nations of some critical needs, not least of which is the ability to transport and deploy – either for their own militaries or as with Ukraine, to support a third party in dire need – quantities of large air platforms at short notice. With this particular domain however, organisation(s) and individual nations, are quite widely stretched. This article attempts to provide a short overview of military airlift developments and the various platforms, both currently operational and planned.

(Credit: Georg Mader)

Organisationally Oriented via a Multitude of Acronyms

The wide range of acronyms related to the heavy lift domain (ETAC, MCCE, ETAP, FMTC and SATOC) can initially look quite confusing. We begin with the multinational European Air Transport Command (EATC), headquartered at Eindhoven in the Netherlands. Since the first Franco-German idea in 1999 of identifying NATO- and EU-shortfalls in the domain of strategic transportation (some of which are still present) and its inauguration by four founding members, the Netherlands, Belgium, France and Germany, EATC has demonstrated its objective of improving the effectiveness and efficiency of its member nations’ military air transport efforts. Today, the fleet comprises over 150 assets, located at national air bases of the founding four nations, in addition to Luxembourg (2012) Spain and Italy (2014). All EATC nations are also members of MCCE, the Movement Coordination Centre Europe.

Then there is the European Tactical Airlift Programme (ETAP), developed with a view to improving the operational airlift capability of European countries, coupled with the aim of achieving greater interoperability between participating nations. The programme also aims to improve and develop common tactics, techniques and procedures in order to overcome the challenges of flying transport aircraft in a modern joint and joint operating environment. ETAP is divided into three distinct programmes: European Tactical Airlift Programme – Course (ETAP-C); European Tactical Air Transport Programme – Instructor Course (ETAP-I) and European Tactical Air Transport Training Program (ETAP-T). ETAP-C provides aircrews with a comprehensive course in airlift tactics, in order to enhance the tactical knowledge of the forces involved and expand the area of expertise, also in hostile scenarios. The latter also seeks to expose trainees to SAM- and fighter-threats.

From 5–16 June 2023, this year’s edition of ETAP-C’s Element Lead exercise was held in Orléans. Six transport crews from France, Belgium, Spain and Germany took part for the precious Element Leader qualification, which documents the ability to prepare, lead and debrief a mission involving two or three aircraft. In order to achieve the qualification, each aircraft flew eight missions in two- or three-plane formations, sometimes as leader, sometimes as wingman.

Currently taking place in Beja, Portugal, ETAP-T is a periodic two-week training exercise, where each type of mission is experienced. According to the characteristics and requirements of each participant, the aim is to generate greater interoperability between the various participating countries, thereby creating a foundation for successful joint and combined operations.

ETAP-I is for European airlift instructor pilots with greater experience and knowledge of the different types of existing transport aircraft, and is designed to train and assist crews during flight preparation and support them during mission execution.

The Role of the EDA

The European Defence Agency (EDA) has a role to play in this field. Following a request from their project coordinators, since January 2023 the EDA has supported three Permanent Structured Cooperation (PESCO) projects focused on the harmonisation of the requirements of two totally new platforms designed to shape future European airlift capabilities in the realm of mid-sized and out-sized cargo. While the current conditions for European nations to commit to a new unified effort may be positive, key considerations to be taken into account relate to development funds versus potential sales figures.

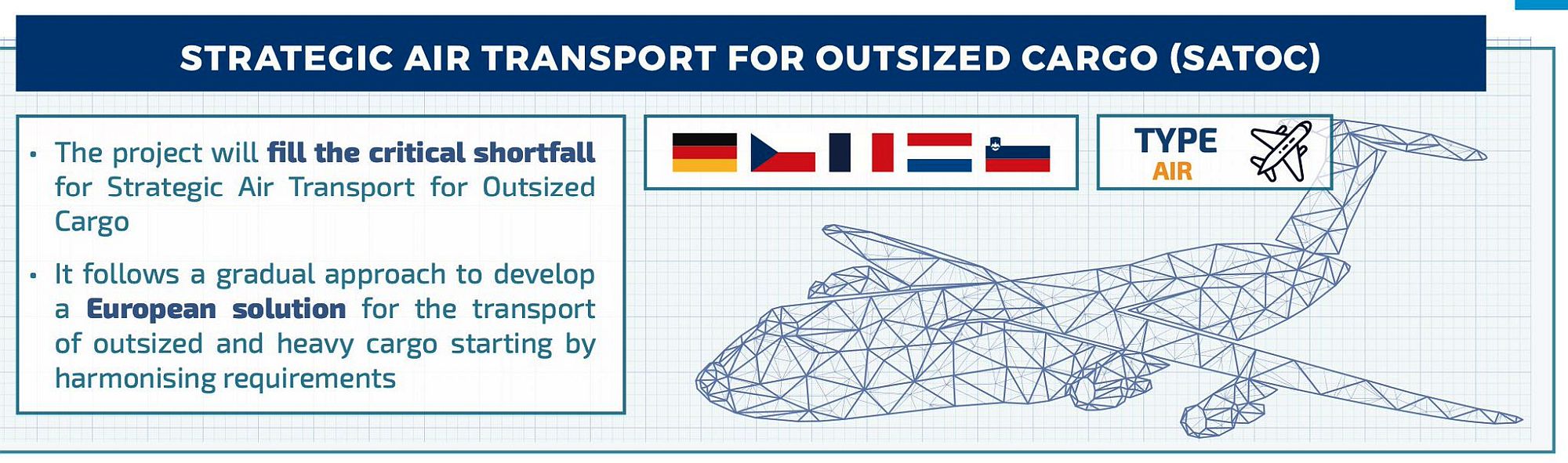

When it comes to the supported projects, European countries are looking at the Future Medium-Size Tactical Cargo (FMTC) and the Strategic Air Transport for Outsized Cargo (SATOC). Both projects were launched in the fourth cycle of PESCO projects and are coordinated by France and Germany respectively. FMTC gathers France, together with Germany, Spain and Sweden as project members while SATOC gathers Germany, together with the Czech Republic, France and the Netherlands in this four-nation SATOC project.

FMTC seeks to enhance air mobility capabilities with a new mid-size tactical cargo aircraft that aims to complement the missions of the A400M, including on shorter, unprepared landing strips. The study plan for a draft joint document proposes an analysis of the operational needs for EU tactical transport in the period 2030–2050, with the identification of opportunities for the development of FMTC in Europe. The tender, which asks for an evaluation of one or two aircraft, was signed in June 2022 and remained open until 24 November 2022. The chosen platform might well be a European derivative of Embraer’s C-390M, which is an almost perfect fit and partly consists of key sub-assemblies already produced in Portugal and the Czech Republic.

(Credit: EDA)

SATOC on the other hand aims to fill the critical shortfall for the crucial larger, strategic transport of outsized and heavy cargo. The programme involves a 3-step approach, firstly identifying a sufficient number of project members, secondly harmonising requirements, and finally identifying and agreeing on a common European solution for the transport of outsized cargo.

Moscow’s assault on Ukraine has also underscored the importance of outsized and heavy cargo transport, coupled with the fact that the destruction of several Antonov aircraft – including to the world’s largest cargo aircraft, the An-225 Mriya – has further reduced access by armed forces in Europe to strategic airlift possibilities. That leaves the three C-17A aircraft of the Strategic Airlift Capability (SAC) based at Pápa Airbase in

Hungary as the segment’s only alternative. In 2016, SAC, with its 12 participants (11 NATO, plus Sweden) moved to new facilities there, including the largest purpose-built C-17 hangar on the European continent, while a new C-17 simulator building is scheduled for construction in 2025.

This current two-fold harmonisation phase carried out by EDA is a positive development. However, as ever when it comes to European ‘jointness’, it has to be supported by a clear expression of interest for a fixed number of aircraft, so as to provide manufacturers (such as Airbus) some degree of visibility regarding the project’s viability.

Ageing Fleets

Currently, EU Member States, the US Armed Forces, and also larger operators such as India, operate a wide range of tactical cargo aircraft, including the C-130H/J, C-390, C-295 and C-27J. Apart from the 180 units of the A400M, a modern strategic-tactical cross-over platform, and Embraer’s C-390, a portion of these platforms will be approaching the end of their life cycle in the coming decade. This also is the case for rest-of-the-world fleets of Russian (or indeed Soviet-era) Il-76s, with the notable exception of a huge build-up to 100+ Chinese C-17 ‘sibling’ Soloviev aircraft, powered by Xi’an Y-20A Kunpeng and Y-20B with domestic WS-20 engines. On 9 April 2022, six Y-20 aircraft landed at Belgrade’s Nikola Tesla International Airport, delivering a shipment of FK-3 SAM-systems and on 28 June 2022, six Y-20 aircraft arrived in Afghanistan to deliver 105 tonnes of humanitarian aid in response to the June 2022 earthquake. In early 2023, one Y-20A was visiting as far away as Innsbruck in Austria’s Alps, to support a Chinese mountain troop unit participating in a mountaineering challenge.

(Credit: USAF)

Coming from US manufacturers, there are three mainstays in operation, of which the strategic C-17 has been out of production for eight years now, and which continues to serve the armed forces of the UK, India, Australia, UAE and Qatar. A total of 52 C-5M life-extended Super-Galaxy aircraft have been re-delivered since 2018 and are set to transport the heaviest and largest US assets until 2040. A genuine replacement is not in sight, apart from the recent USD 235 M contract awarded in August 2023 to JetZero to produce a flyable full-size demonstrator of the radical tailless flying-wing blended-wing body (BWB) XBW-1 by the first quarter of 2027. However, the goal – so far at least – is to only demonstrate the capabilities of BWB technology, giving the DoD and commercial industry partners more options for their future air platforms. According to Air Force Secretary Frank Kendall, the USAF and NASA would also contribute to producing the test aircraft, as would JetZero’s partner Scaled Composites, owned by Northrop Grumman.

India’s Byzantine Projects

New Delhi is known to many aviation observers for its often large-scale and ambitious projects, which have been known to take a considerable amount of time to materialise. This is certainly the case regarding India’s airlift capability, where the 2020 border stand-off with China has obviously changed the nature of airlift and support for the Indian Army in high-altitude areas.

New Delhi is looking to procure a light tank weighing up to 25 tonnes for deployment in the mountains, especially in Eastern Ladakh. This has resulted in a fresh look at procuring a medium transport aircraft (MTA) and resulted in a comprehensive study to identify the current and future payload-carrying requirements. A Request for Information (RFI) was issued to global manufacturers for aircraft in December 2022, with an unusually broad load-carrying capacity between 18 to 30 tonnes. Three companies responded with a ‘Rough Order of Magnitude [ROM] cost of aircraft and associated equipment’ for a batch of 40, 60, or even 80 aircraft until an extended deadline of 31 March 2023. The three included Airbus, with the A-400M with a maximum carrying capacity of 37 tonnes and with user Malaysia already in the region; Lockheed Martin with its C-130J (20 tonnes); and Embraer with the C-390 (26 tonnes). So far, and unsurprisingly, at present nothing has been decided with the MTA programme.

(Credit: Georg Mader)

On the other hand, in September 2021, the Indian Defence Ministry signed a contract with Airbus and Space S.A., Spain, for the procurement of 56 smaller C-295MW transport aircraft to replace the decades-old Avro 748 and part of the An-32 aircraft fleet, executed in partnership with Tata Advanced Systems Limited (TASL), and with a final assembly line to be set up in Vadodara, Gujarat. The first C-295 aircraft was inducted into the Indian Air Force (IAF) on 25 September 2023. The IAF’s hodgepodge transport fleet currently consists of over 100 An-32s, Avro 748s, IL-76 heavy transports (45–50 tonnes of payload) and IL-78 tankers, as well as 12 C-130J Super Hercules and 11 C-17 Globemaster strategic airlifters (70 tonnes).

The Indefatigable Hercules

The most numerous airframe type – and not only in the US inventory – remains Lockheed Martin’s evergreen C-130 series; with the C-130J and stretched 30-model still in production at Marietta – not only for US forces – but currently also for a new customer, Germany. As the world’s most widely operated tactical-transport aircraft, the 525 Super-Hercules delivered thus far (in 18 versions) have accumulated more than 2.5 million flight hours by 25 different operators in 21 countries. Lockheed Martin’s Director of Air Mobility and Maritime Missions, Richard Johnston spoke to the author and emphasised that “the best replacement of the venerable Hercules is another, new built one”.

For some users, including Australia and Indonesia, this seems straightforward and logical. However, in the case of Austria and its (ex-RAF) C-130K replacement for example, on 20 September, it was decided to procure four jet-powered Embraer C-390s instead. In this particular case, the requirements demanded the capability to transport the locally produced Pandur EVO IFV with mounted remote controlled weapon station (RCWS) or to airlift an S-70 Black Hawk helicopter. Vienna has decided to operate a ’supply and humanitarian military cargo airline.’ Interestingly, the Austrian plan is to attempt to jump on a currently negotiated form of G2G agreement with the Netherlands, where five of the Brazilian ‘new kids on the block’ have already been selected. In addition to Portugal (with five ordered, one delivered) and Hungary (two in production), the Czech Republic and Sweden are expected to follow.

(Credit: Georg Mader)

Embraer claims that its C-390 Millennium was developed together with the Brazilian Air Force to explicitly address the shortcomings of the C-130; however the Força Aérea Brasileira (FAB) will now receive 19 instead of the originally planned 28. Subsequently, there are enough slots for new customers who are ‘in a hurry’, including the Austrians who are against spending another EUR 30+ M on heavy maintenance, repair and overhaul costs. One of the three 1967 airframes was overhauled at OGMA in Alverca, Portugal last year, but on the other two – though satisfied with the quality – Vienna wanted to avoid this scenario, in light of the swift arrival of the C-390s.

(Credit: Georg Mader)

Regarding Austria and Sweden, both countries were briefly looking for replacements of their decades-old C-130s on the used aircraft market, when they were examining Italian C-130Js from the early 2000s temporarily stored at Pisa. However, upon learning that their avionics-standard was 6.1 (new builds are 8.1 standard) both countries stepped back. Bahrain, however, received the first batch of ex-RAF C-130Js, which were retired early in 2023 since they are 20+ years old. Even older airframes have entered service elsewhere, with the Polish Air Force in 2021 taking on five C-130Hs built in 1985 and stored in the Arizona desert since 2017, via a grant from the Pentagon’s Excess Defense Articles programme for USD 14.3 M. This covers the cost of aircraft regeneration and retrofits, which includes a replacement of the centre wingbox. The five aircraft should all enter operational service at the 33rd Transport Air Base at Powidz by 2024, and still be 15 years younger than the previously operated ‘stone-age’ E-model Hercules acquired in 2012.

Georg Mader

![Europe’s airlift rejuvenation: is it enough? An Airbus A400M in French service, pictured on 25 June 2024. As things stand there will ultimately be 170 A400Ms in service with European air forces. [Armée de l'Air et de l'Espace]](https://euro-sd.com/wp-content/uploads/2025/06/French-A400M-Armee-de-lAir-et-de-lEspace-Kopie-218x150.jpg)