On 9 August 2022, the Biden administration signed the CHIPS and Science Act into law. The act was intended to boost semiconductor manufacturing in the US, decreasing its reliance on foreign suppliers. Since then, the global competition for semiconductor production and the supply of rare earth metals has only heated up.

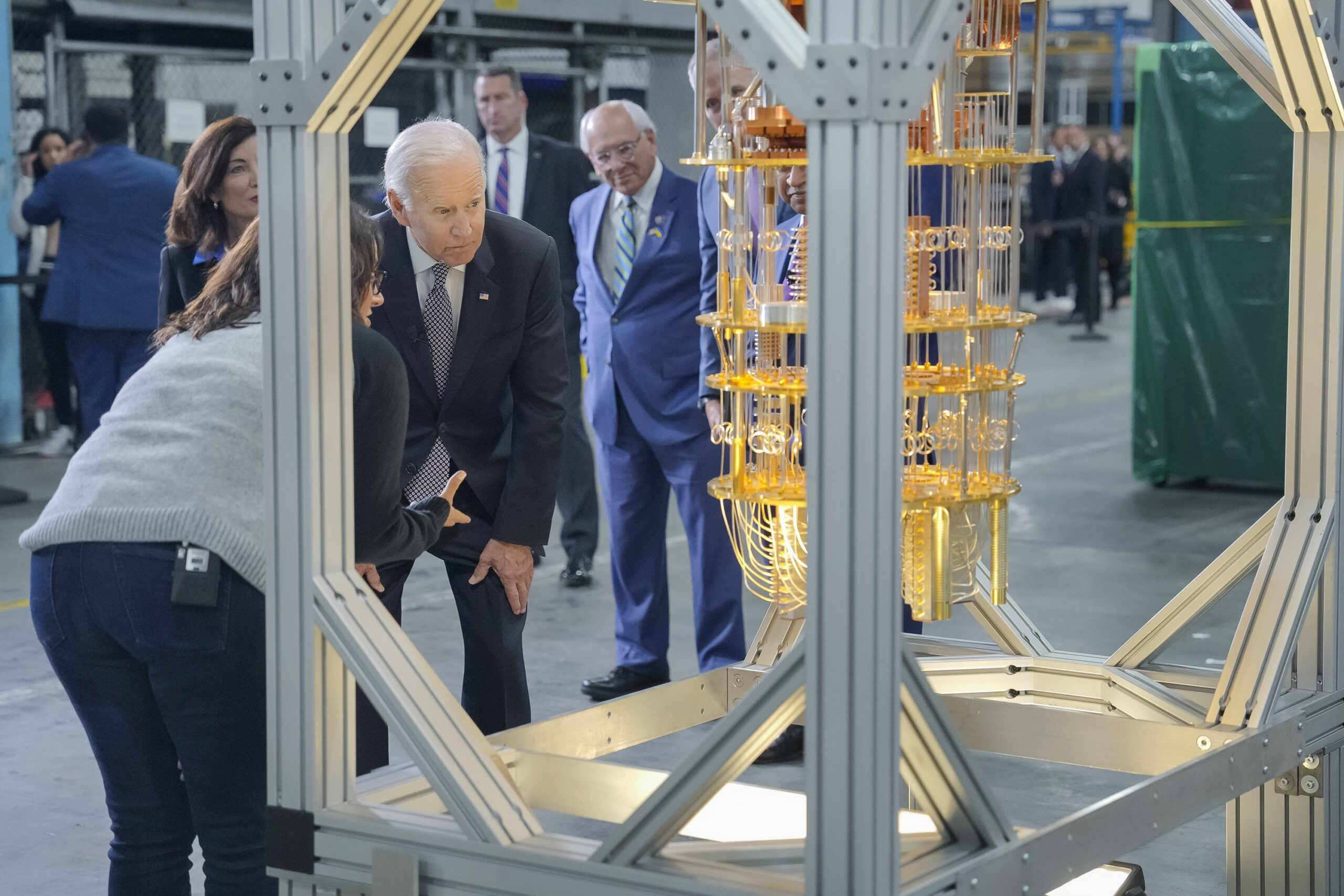

Credit: White House Press Office

During President Xi Jin Ping’s recent state visit to the United States on 15 November 2023, the leader of the Chinese Communist Party took barely a minute after taking the floor to announce his concern about global supply chains. It was no coincidence that just over a week earlier he had announced the tightening of controls on exports of rare earths, which are effectively monopolised by his country. This announcement became a reality one month later, in December 2023, when the Beijing government banned the export of technology to extract and separate these metals.

The Chinese reaction to the US CHIPS Act denying the Asian giant access to certain microchips – and the technology to manufacture them is a continuation of the controls enacted over the past five months on gallium and germanium, which have led to a de facto export ban and, more recently, to an announced control of graphite exports. The trend of this trade and technology war seems clearly marked by chips versus rare earths, or rather, chips versus critical metals, in a tit-for-tat exchange.

De-globalisation is here to stay

The alarm over de-globalisation is gradually awakening Western countries. The fractious global management of COVID-19, the lack of unanimous international condemnation of the war in Ukraine since early 2022 and now the conflict in Gaza, together with an evolving trade war with China, are shaking liberal democracies out of their soporific slumber of security and dreams of unlimited growth.

US hegemony must now contend with technological, economic, and diplomatic threats, in addition to its usual military threat portfolio. The global South is moving ever closer to the BRICS bloc, as demonstrated by more than 20 new official applications and five new members (Saudi Arabia, Iran, Ethiopia, Egypt, and the UAE), dwarfing NATO’s enlargement of two new members (Sweden and Finland). The petrodollar’s domination is under threat as several OPEC+ countries such as Russia, Venezuela, Iran, and Brazil increasingly conduct trade with alternative currencies. Even traditional US allies such as Saudi Arabia are now selling their oil to China in CNY. World trade is gradually turning ‘red’ as the total volume of Chinese exports continues to rise. China is enabling this trade via alternative ‘made in China’ economic structures. For the first time in recent history, most Chinese cross-border payments are in CNY. China has already developed its own alternative to the SWIFT system, the Cross-Border Interbank Payment System (CIPS) and has similarly taken the lead in developing a Central Bank Digital Currency (CBDC) framework in conjunction with the Bank for International Settlements (BIS), while still pushing their own ‘digital Renmibi’ (also referred to as ‘e-CNY’) currency.

These are times of realpolitik. In this emerging new Cold War, China has already taken several technological leads: in hypersonic glide vehicles, methane-fuelled rocket engines, Thorium-based molten salt breeder reactors, and cellular network technology. It has also made significant progress in other key technological areas, such as electromagnetic projectile weapons (railguns and Gauss guns), and micro-satellite constellations. Even in fields less directly relating to the defence and aerospace fields, such as machine learning (ML), artificial intelligence (AI), and voice recognition technologies, China has gained notable momentum. The Chinese iFlytek app already has 700 million users, roughly twice as many as Apple’s Siri. In general, these are Western technologies that have been copied and improved. China may not have invented the wheel, but it’s certainly working to perfect it.

The primacy of material factors

The US, Europe, and Japan have just begun efforts to halt China’s advance, focusing most recently on microchips and the requisite high-end equipment to manufacture them. Disruptive technologies such as AI, which could tip the balance of technological power, depend on some of these chips. Yet all semiconductors are just an abstract entelechy without a physical basis to realise them. If chips are the brains of electronics, then rare earth metals and other critical elements such as lithium and cobalt can be said to form the neurons. A fundamental asymmetry exists at between these two responses – microchip production equipment can be developed, but raw materials and the supply chains needed to extract and process them, at demanded scale and at costs the market can bear, cannot simply be wished into existence.

Credit: White House Press Office

China’s industrial foundations are based on its land; it manufactures its products with the minerals it extracts and with the metals it refines. By contrast, the Western neoliberal economic consensus of the past few decades has shown no qualms about outsourcing the critical mining and refining portions of supply chains, and with them the bothersome labour costs and pollution they generate. It is therefore no accident that critical elements such as cobalt, lithium, manganese, tungsten, antimony, bismuth, graphite, fluorspar, vanadium and germanium are now under effective Chinese monopoly, with either the amount of ore mined, or the elements processed accounting for more than 50% of the world total.

Since August 2023, China has banned the export of Gallium and Germanium, and announced controls on exports of rare earths beginning in November 2023. These materials are essential for high-performance semiconductor production, modern weapons systems, fibre optics, and various ‘green’ technologies such as solar panels, wind turbines, and high-performance batteries. These restrictions should not be read as hasty retaliatory reactions, but rather as well-analysed efforts with a strategic purpose. Under this model, China’s efforts are aimed at crippling the supply of elements critical to the aforementioned technical fields, in order to establish its own market dominance.

The Asian giant has cited national security reasons that allow it to restrict its exports without breaching World Trade Organization (WTO) regulations. In this case, the control mechanism is based on the obligation of exporting companies to obtain a specific licence. This supply restriction represents a massive blow, given that China is currently responsible for suppling of 94% of Gallium, and 83% of Germanium available on the market. As such, the Chinese Ministry of Commerce has essentially turned off the global tap of these elements, and threatens to do the same with rare earth metals, while retaining its monopoly.

Learning from the past

During the peace dividend years, the West has forgotten lessons learned in the Second World War, when securing supplies of war materials was essential. Today, anaemic Western arsenals, understocked further though material donations to Ukraine and insufficient resupply and production cadence, serve as a painful reminder of these lessons. Yet Ukraine was not the West’s first reminder of the importance of these critical war materials – two decades ago, demand for Germanium, used by the US military, skyrocketed due to the Iraq War. The demand for this material, used in various high-end optical applications including thermal imagers, night vision goggles and missile seekers, rose from 5,000 tonnes in 2003 to 30,000 tonnes in 2007, and had more than tripled in price over this period.

Credit: US Army/Courtney Bacon

It has taken China roughly two decades to create the supply chains for many of these minerals, and it could take the West another two decades to get them back, especially since China does not appear inclined to give up its control. Going further, it remains to be seen whether the West would be willing to bear the ecological, health, and social costs for processing these coveted metals, as China has. Beyond the strategic leverage it enjoys, China’s dominance means that is has a major influence on the prices of these commodities on the market.

China’s rare earths strategy of monopolising the refining process and buying the raw material cheaply can be likened to that which the seven major Anglo/American companies, known the ‘Seven Sisters’, used to obtain and maintain their oil monopoly between 1940 and 1970. Between them, Exxon, BP, Chevron, Shell, Mobil, Texaco, and Gulf Oil held, an approximate 85% monopoly on the oil market, comparable to that enjoyed by China today in rare earths. These companies bought up as many oil wells as possible outside their territories and then moved the extracted crude oil to their national refineries. In a similar manner, China now concentrates critical metal refinement domestically, a technical art perfected over the years to the point of mastery. Yet despite being rich in mineral resources itself, it also seeks to obtain ownership of third countries’ resources while preserving its own. In part, this is being pursued through its Belt and Road Initiative, recently renamed as the ‘Global Development Initiative’.

The war for metals has just begun

In this slow awakening to de-globalisation, Western attempts to regain control over the periodic table has been sluggish. The timid measures taken by Europe and the US so far have failed to correspond to the reality of the new political-industrial conflict. Although both have defined a list of critical and strategic materials, there is currently no list of critical defence metals. Meanwhile, countries’ stockpiles of war materials continue to dwindle, despite renewed efforts to increase production. Defence industry leaders such as Gregory J. Hayes, CEO of Raytheon, stated in June 2023 that “We can de-risk, but not decouple” with respect to manufacturers’ dependence on China.

The US Inflation Reduction Act (2022) and the European Raw Materials Act favour the development of mining projects as well as the acquisition of metals extracted and refined on their own soil. However, they do not protect these entrepreneurs from the price fluctuations and market manipulation that China’s subsidised monopoly enables. Liberal democracies are quickly reaching the limits of their capability to react in the face of a new model of autocracy that embraces global capitalism while exploiting liberal institutions. For instance, although China is a key member of the WTO, it does not hesitate to intervene in its markets on national security grounds, as seen with the ban on exports of metals which feed the West’s technological ambitions. Nor does it hesitate to use its 97 major state-owned enterprises to project power beyond its borders.

Credit: TMY350, via Wikimedia Commons

The reality is that most Western-aligned countries cannot support a fully integrated domestic supply chain for rare earths, so cooperation is critical for any strategy to succeed. Yet multinational cooperation adds a major layer of complexity and more points for failure. Developing effective strategies also requires adapting long-term strategic thinking, as China employs. However, the short-term election cycles inherent in most Western democracies does not allow for planning far beyond the four to six years a leader is typically in office. Right now, it is incredibly difficult for the West to effectively compete against China’s dominance while operating under the rules and norms of democracy and liberal capitalism. Pulling supply chains out of the web of globalisation may effectively mean playing by the same rules as China.

The institutions created after the Second World War were designed to promote a model of globalisation that is now crumbling, and the West cannot continue to labour under the illusion that it can successfully combat illiberal actors under these same neoliberal institutions. Developing a successful strategy would likely require the US and EU to return to a socio-economic model where the state manages and protects critical industries and resources, and where the security needed to protect liberal values trumps economic benefits.

The war for metals has just begun, and the recently-initiated subsidy battle to convince European or American companies to remain in their territories instead of leaving for East Asia shows us one of the fronts in this new Cold War. It is a front where control of supply chains will be the lynchpin for assuring access to technologies that can tip the balance of power and push the global geopolitical map back towards the values the West wants to uphold and proliferate. Any progress in this slow war is unlikely to come quickly or cheaply.

Juan M. Chomón Pérez and Craig Hymel