Medium support helicopters

Tim Fish

The enduring importance of medium helicopters to military forces has been highlighted by the initiation of three acquisition and development programmes in Europe – the UK’s New Medium Helicopter (NMH), NATO’s Next Generation Rotorcraft Capability (NGRC) and the EU’s Next Generation Medium Helicopter (NGMH). This article examines the emerging requirements for new helicopters in this market that are designed to ensure these platforms are able to operate in an increasingly contested environment and meet the new conditions of warfare; it also explores the latest developments and trends in the medium helicopter sector market.

Medium support helicopters have multirole capabilities and are able to meet a variety of military requirements, including for transport, utility, medevac, vertical replenishment, close air support, search and rescue, firefighting and more. They are also dual use with many military designs based on commercial helicopters, which means reduced acquisition and support costs. This is unlike specialist platforms, such as attack helicopters, that have completely different designs and capabilities.

The three aforementioned programmes – the UK’s NMH, NATO’s NGRC and the EU’s NGMH – as well as the US’ Future Long-Range Assault Aircraft (FLRAA), will be part of this growth in the short and long term and will be the main programmes driving forward innovation in new architectures and capabilities. While speed is one important new factor, a spokesperson from Leonardo Helicopters, a European rotorcraft manufacturer, told ESD that navigation, protection, connectivity, autonomy, digitisation, and integration with uncrewed assets, are also important, as well as range, endurance and altitude requirements that go beyond the limits of conventional rotorcraft platforms.

Further, faster, and lethal

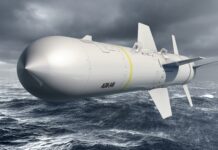

The need for increased levels of performance in terms of speed, range and altitude is because there are many more long-range precision weapons on the battlefield. This can compromise the role medium helicopters have in providing close support for ground forces. The take-off and landing zones for helicopters would usually be located relatively close to what would traditionally be considered the ‘front line’, though extended range artillery could now target them from further away.

Credit: Airbus

A spokesperson for Airbus Helicopters told ESD that helicopters “need to be able to take off from a longer distance in safe areas”, and explained: “The ability to fly further and stay longer in the air is a significant advantage. Medium and heavy helicopters offer long-range capabilities, in excess of 500 NM [926 km]. Helicopters will have to be able to operate from dispersed bases.”

Higher speeds and longer ranges would be useful for search and rescue (SAR), special forces insertion and troop transport. The ability to fly low is also crucial for helicopter survivability, along with modern autopilots and avionics that can improve flight safety, reduce crew workload and enhance the platform’s stability for observation or firing weapons.

Military operators want to add heavier weapons onto medium helicopters, including gun systems, guided rockets and missiles. Airbus has developed the modular HForce weapon system that can fit on its H125M, H145M, H225M helicopters. This system includes a fire control system, helmet-mounted monocular sight and display for gunner and pilot targeting, an optronic sight for target identification and fire control, and weapon pods with the option for machine guns, cannons, rockets, or air-to-surface, and air-to-air missiles.

“With these weapons packages, medium and heavy helicopters can be used as long-range strike platforms combining the long-range/payload capabilities of a medium/heavy helicopter and the firepower of the weapons,” the Airbus spokesperson said.

Communications is also essential for any modern military platform and medium helicopters are no exception. SATCOM is being introduced on some heavier helicopters but there is a need to protect against the jamming of communications and GPS signals to ensure that navigation, positioning and connectivity can be maintained. “In this domain, electronic warfare systems are being improved to cover a larger spectrum of threats,” the Airbus spokesperson added.

However, according to Leonardo’s spokesperson, the main concern is that “clear requirements are needed” to allow industry to fully understand which technologies can best meet them.

Autonomy and uncrewed aspects

US company Sikorsky believes that autonomy in helicopters is becoming increasingly important. It has developed its Matrix suite of technologies that improve the safety of flight, especially for helicopters that fly close to the ground, and allows aircraft to be optionally piloted.

In 2022, in cooperation with the US Defense Advanced Research Projects Agency (DARPA), Sikorsky demonstrated the control of an uncrewed Black Hawk helicopter using its Matrix technology to perform a logistics/resupply mission.

Credit: Sikorsky

Jay Macklin, Sikorsky’s business development director for Army and Future Vertical Lift told ESD: “With Matrix technology, an aircraft with no humans on board can operate safely in complex terrain and in degraded visual environments, while performing high-value missions, such as intelligence, surveillance, reconnaissance, contested logistics and medical resupply/casualty evacuation.”

The ability to operate uncrewed systems from helicopters is also a growing requirement for military operations. Airbus Helicopters has been developing its Manned-Unmanned Teaming (MUM-T) capabilities using an H145M helicopter. In the summer of 2022, the H145M participated in the Multi-Domain Flight Demo, a large-scale flight demonstration that linked up fighters, helicopters and drones as part of the Système de combat aérien du future (SCAF) programme. The company is also developing a generic European MUM-T system under the EU’s Project Musher. Demonstrations are expected later this year.

On all of its platforms, US company Boeing is exploring the leveraging of existing technologies, with a company spokesperson telling ESD, “You’re seeing increased importance of Manned-Unmanned Teaming across all rotorcraft to give the pilot more situational awareness,” before adding, “The AH-64 Apache has been operating with MUM-T capability for nearly 10 years, so we’ve done quite a bit of work already.”

Boeing also has expertise in autonomous systems with uncrewed vehicles but understands that it is not the complete solution. “We also know that nothing truly replaces the eyes and ears of a human pilot. The future of autonomy, at least in the near term for rotorcraft, is a combination of the two,” the Boeing spokesperson added.

UK helicopter renewal

The UK’s NMH programme is intended to replace the Westland-Aerospatiale SA 330E Puma HC2, Bell 212, Bell 412, and Airbus AS365 Dauphin II helicopters used by the British Army, rationalising the fleet of rotorcraft that it supports from four to one, and potentially fulfilling a fifth rotary requirement. Up to 44 new helicopters are required under NMH, with a budget of about GBP 1 billion allocated.

A pre-qualification questionnaire (PQQ) stage saw the down-selection of four companies: Airbus offering the H175M, Leonardo with the AW149, Lockheed Martin with Sikorsky’s S-70M Black Hawk and Boeing, which initially offered a services, support and training solution but has since teamed with Airbus.

“The partnership with Airbus Helicopters in the UK allows Boeing Defence UK (BDUK) to best leverage its localised training expertise and capabilities,” the Airbus spokesperson said. BDUK already supports the British CH-47 Chinook and Apache helicopters. The H175M team also includes Babcock, Spirit AeroSystems, and Pratt & Whitney Canada. Design work would take place in Belfast, with manufacturing at Broughton in Wales and support provided from Scotland and on bases across the UK.

Credit: Leonardo

Meanwhile, Leonardo says it can deliver the AW149 in less than 24 months, built at its factory in Yeovil, Somerset. A Leonardo spokesperson said that an initial production capability at the site included the manufacturing and commissioning of jigs, fixtures and tooling with 50 skilled engineers trained to build the aircraft. “We are also able to draw from a wider pool of several hundred highly skilled engineers in Yeovil that could be readily trained in AW149 specifics,” the spokesperson added.

Sikorsky is leveraging the international success of the Black Hawk with variants in service with 35 nations. It is teamed with StandardAero in Gosport where the aircraft will be assembled. Other team members include Martin-Baker, Curtiss-Wright, Chelton, Inzspire, Nova Systems, CAE and Ascent Flight Training.

A contract for NMH was expected in 2023, but this has not materialised. However, an invitation to negotiate was released in February 2024, so companies will now prepare their offers, which will be evaluated through 2025, with platform selection and contract to follow. On this timeline it is unlikely that an entry into service from 2025 can still be achieved, therefore the UK’s Pumas are likely to need a life extension upgrade to last until the late-2020s.

The true prize

However, the British project is small in comparison to the NATO NGRC programme that will deliver a new medium helicopter to many countries across the Alliance that could see orders in the thousands of units. Launched in 2020 with a letter of intent signed by five countries (France, Germany, Greece, Italy, and the UK), the programme plans to provide a new medium-lift helicopter for entry into service from 2035. Still in the concept phase, the NGRC now includes The Netherlands, with Canada also showing interest.

A three-year concept phase was launched with a Memorandum of Understanding signed in June 2022 alongside initial funding of EUR 26.7 million. It includes five separate studies that will develop requirements, concepts of operations, doctrine, disruptive technologies, trade-offs and a preliminary design review. In December 2023, the NATO Support and Procurement Agency (NSPA) awarded a third study contract to Lockheed Martin for a study into open systems architecture under the NGRC effort.

Sikorsky’s Macklin said that the company was “actively participating” in NGRC and in February 2024 was awarded a contract to develop an Open Systems Architecture concept for future rotorcraft. “We are currently preparing to bid on the NATO NGRC Integrated Platform Concept Study which will pull together results from all other studies conducted to inform NATO and assess next-generation rotorcraft capabilities against their requirements,” Macklin said.

Countries are trying to align their requirements and industrial capacity, while in the meantime, several bidders could be contracted to offer design solutions when the concept stage is completed. With increased speed a primary requirement, Airbus intends to offer a new tactical helicopter concept for the NGRC programme that includes speed as a key factor. It has already developed a prototype called Racer that the Airbus spokesperson said will “soon demonstrate the added value of a hybrid concept in flight”, adding, “We aim to achieve the best trade-off between speed, cost-efficiency and mission performance… that can be adapted for military missions.”

Credit: Airbus

The Racer has two laterally-mounted pusher props, one fitted on a double wing strut per side, in addition to the traditional main rotor and a low drag fuselage. This allows the platform to achieve high speeds of up to 400 km/h. In a similar vein, Leonardo is developing a Next Generation Civilian TiltRotor (NGCTR) aircraft that can reach around 500 km/h. These will be able to deliver something closer to the 556 km/h achieved by the V-280 Valor tiltrotor aircraft from Bell Helicopter, which won the Future Long Range Assault Aircraft (FLRAA) competition that is part of the US Army’s Future Vertical Lift (FVL) programme.

“The United States has decided to replace part of their tactical helicopter fleet with a high-speed platform. This shows that there is a need for a high-speed rotorcraft for some military operations,” the Airbus spokesperson said. Yet the need for conventional helicopters is still essential. “A mix of high-speed rotorcraft and conventional helicopters would ensure that armed forces will be able to execute both high-end operations and day-to-day military transport and logistics missions,” the Airbus spokesperson added.

With Valor

Bell Helicopter’s V-280 Valor tiltrotor aircraft was selected in December 2022 for the FLRAA part of the FVL programme to replace the US Army’s Sikorsky UH-60 Black Hawk medium support helicopter, beating the SB-1 Defiant bid from a joint Sikorsky–Boeing team. Some 2,000+ Black Hawks will be replaced when the V-280 enters service from the early 2030s.

The V-280 is designed to meet US Army requirements for a new fleet of helicopters that can operate at higher cruising and maximum speeds, and achieve a longer range than existing rotorcraft. This is to meet evolving battlefield conditions; using a Modular Open System Architecture approach will allow for the rapid integration of new technologies in the V-280 as they emerge.

A Bell spokesperson told ESD that the company was 10 months into the Weapon System Development Contract. “So far, we have completed the Delta System Requirements Review/System Functional Review. This review established the requirements and functional baseline for the FLRAA Weapon System and ensures that we are developing the capability our warfighters need,” the spokesperson said. “Bell and the FLRAA team are continuing to move forward with preliminary and detailed design activities. We are currently preparing for the Weapon System Delta Preliminary Design Review, which will lead to Milestone B,” the spokesperson added.

Credit: Bell Helicopter

In February 2022, the US and UK signed an agreement to share information on the Future Vertical Lift (FVL) programme to accelerate cooperation on rotorcraft development between the two countries, known as the ‘Future Vertical Lift Cooperative Program Feasibility Assessment’ project. The Netherlands also signed a similar agreement in July 2022. Although FVL now only includes the FLRAA component, its timelines align with the NATO NGRC, raising the potential for the V-280 to have wider utilisation across the NATO alliance.

“We are staying aligned with our Army teammates and the appropriate authorities from our government team to ensure that exportability is considered now, during design to ensure the US Government has the ability to conduct FMS in the future,” the Bell spokesperson said.

Black Hawk remains essential

Although Sikorsky lost out on the FLRAA, the company will continue to provide a huge number of helicopters to the US Army as it will still need Black Hawk for the foreseeable future. In 2022, the company signed a multi-year contract that continues production through to 2027 with Macklin saying that he was “encouraged” by Army plans to extend production beyond this for deliveries through to 2033.

“The US Army has stated the Black Hawk will be in front-line service another 40-60 years [and] operate well into the 2070s alongside the US Army’s FVL aircraft,” Macklin said. Therefore modernisation and upgrades of the aircraft will be continually rolled out to support the fleet and improve its capabilities.

Credit: Sikorsky

Sikorsky is providing upgrades that align the Black Hawk fleet with open architectures that can maintain relevance in multi-domain environments and increase the aircraft’s reach, survivability, lethality and sustainment. It is integrating a new Modular Open Systems Approach (MOSA) cockpit into the optionally piloted vehicle Black Hawk demonstrator.

European ambition

Meanwhile in May 2023, the European NGMH was launched under the EU’s Permanent Structured Cooperation (PESCO) framework that aims to bring together countries and align requirements and industrial capabilities for major defence projects. Under NGMH, France, Italy, Finland and Sweden are examining future rotorcraft needs and technologies and developing new solutions for installation in existing helicopters, such as the NH90 as upgrades, or into new aircraft.

NGMH follows on closely from the European Next Generation Rotorcraft Technologies (ENGRT) that was launched in December 2022 to develop technologies and concepts of operations for future military helicopters. It includes France, Germany, Greece, Italy, The Netherlands, Spain and Sweden. NGMH will provide solutions for helicopters through to the 2040s when it is expected that under ENGRT, a new helicopter platform will be developed, jointly led by Airbus and Leonardo Helicopters, including a host of smaller industry partners, and/or a more comprehensive NH90 Block 2 upgrade.

The first phase of ENGRT is worth EUR 40 million and will last until the 2025 timeframe. It is looking at developing concepts of operations, developing new systems, airframes and propulsion systems. A second phase worth EUR 100 million will follow that will seek to mature technologies, implement an open systems architecture, enhance platform survivability, and secure connectivity. Development of a high-speed rotorcraft will take place from 2027 with a new aircraft qualified around 2035.

Asian developments

At the ADEX Exhibition in October 2023, the Korean Air Aerospace Division unveiled a new Future Vertical Launch concept similar to the V-280. So far however, it remains a conceptual design to analyse technologies and designs in anticipation of a potential requirement from the South Korean military.

At the Paris Air Show in 2023, Turkish Aerospace Industries showcased a model of its new T925 medium utility helicopter. Developed with help from the Turkish military, it is expected that a prototype will fly later in 2024. A naval variant is also under development.

In 2021 in Japan, the Ministry of Defence announced the completion of development of the new UH-2 multirole medium helicopter for the Japan Ground Self-Defense Force. Built by Subaru (formerly Fuji Heavy Industries), the UH-2 leverages the Subaru–Bell 412EPX design following collaboration between the two companies announced at the Farnborough Air Show in 2018. Up to 150 are to be delivered, with the first examples handed over in June 2022.

The order book grows

Over 2023, it was announced that Brazil has requirements for 16 new medium helicopters, along with Croatia securing approval to buy eight more UH-60M Black Hawk helicopters under US Foreign Military Sales (FMS). The Australian Army is ditching its entire fleet of 39 NH90 helicopters and replacing them with 40 UH-60M Black Hawks. Greece has also ordered 49 Black Hawks with a Letter of Acceptance signed in 2024 and a contract award expected shortly.

Moreover, in early 2023, the Iraqi Army put in an FMS request for 16 Bell 412M and four Bell 412EPX medium-lift helicopters to replace Russian models. The Czech Republic has also taken delivery of eight Bell UH-1Y Venom helicopters. Since 2021, Bell has delivered nine Bell 412EPI helicopters to Indonesia, which are customised locally by Indonesia’s PT Dirgantara Indonesia (PTDI) before handover to the Army.

Meanwhile, Leonardo is delivering 32 AW149 helicopters to Poland and in January 2024, North Macedonia ordered four AW149 and four AW169M helicopters. In November 2023, Leonardo received an order from Slovenia for six AW139M helicopters.

Credit: Airbus

In December 2023, the German Bundeswehr ordered 82 H145M helicopters, its largest ever order. This followed a contract in November 2023 from the UK MOD for six H145 helicopters for its bases in Cyprus and Brunei. Airbus continues to deliver both variants of the NH90 helicopter to customers worldwide, with over 500 handed over so far. Airbus’ H160M has been selected by France to replace older fleets of aircraft. The military variant is currently under development and slated to be fitted with HForce. Elsewhere, Airbus’ new H175M helicopter was demonstrated in Saudi Arabia as recently as September 2023.

Closing thoughts

Procurement plans for new next generation medium helicopter platforms are not expected to come to fruition until the end of the decade. It means that the full spectrum of capabilities that the addition of new technologies can offer will not be seen in an operational platform before then.

However, existing helicopters will incrementally receive some of these capabilities both in the delivery of platforms and through modernisation and upgrade programmes. In the meantime, the market for medium helicopters remains highly competitive, with orders coming thick and fast.

Tim Fish