As submarines become quieter and operations shift towards the littorals, high-end sonar systems are needed in order to better detect and identify targets in the water column, especially in a cluttered environment. This article examines the latest technologies being used to improve sonar performance and the new products on the market that meet emerging naval requirements. It also identifies the latest sonar programmes and their importance for submarines and anti-submarine warfare operations.

The return of high-intensity peer-on-peer competition has raised the stakes in the underwater domain. The ability to control the sea lines of communication and exploit that control in the littorals has returned as a priority area for investment. Submarines perhaps represent the ultimate platform for sea control; their ability to gather information about the underwater environment in order to either hunt for submarines or to improve submarine operations is outstanding.

Naval requirements for sonar systems are evolving to improve submarine detection, underwater navigation and the tracking of underwater objects. With the addition of quietening technologies, modern submarines are becoming extremely difficult to detect; there is therefore a drive towards improving sonar systems and integrating them as part of a wider enhancement of the anti-submarine warfare (ASW) effort.

These efforts include bringing sonar systems into the combat network and integrating sonar data with other sonar and sensor system data; using the network to increase the use of multi-statics; adapting products to make them more modular and capable of integrating with drone operations; and utilising data processing enhancements such as artificial intelligence (AI), machine learning (ML) and data aggregation.

Credit: L3Harris

Multi-statics

Multi-statics is all about getting more sensors into the water to improve the ability of sonars to detect and localise targets. It means using an active sonar (often offboard) to generate a ‘ping’, with multiple passive sonar devices acting as listening posts to detect the sound bouncing off the target and allowing the target and its location to be found.

Unlike the air domain, where communications networks can easily be established linking sensors through the electro-magnetic spectrum in the air and via cables over land, this is not so easily achieved underwater or through the air-surface gap.

For multi-statics to work, it means that an active sonar source, such as from a helicopter dipping sonar will have to be networked with ships, aircraft, sonobuoys and submarines to collate the information. Multi-statics becomes more important in shallow littoral waters where active sonar is refracted and reflected creating false contacts among the clutter, thereby making it less effective – this means more sensors are needed to help identify targets.

The addition of autonomous underwater vehicles (AUVs) and uncrewed underwater vehicles (UUVs) fitted with sonars is part of the solution to have more sensors in the water and provide a more persistent surveillance of more challenging underwater environments. This can be realised with a more effective underwater communications system able to link AUVs and UUVs and crewed submarines together, and also with command centres.

Distributed acoustic sensors connected by fibre-optic cables also have the capability to continuously monitor larger underwater areas and provide real-time information.

There are several potential sonar developments that could prove to be game changers. These include the integration of sensors, such as passive and active sonar to enhance detection, and the fusion of contact data from different sources to provide a comprehensive situational awareness picture.

Advances in signal processing with algorithms that can better filter and analyse sonar data will reduce false alarms and improve accuracy of threat detection, while the use of AI and machine learning (ML) can enhance the automated processing of that data to enable faster and more effective decisions.

Sonars also need to be adaptive so they can adjust their operational parameters based on the environmental conditions and the specific characteristics of the underwater domain. For example, there is a need for enhanced sonar to operate more effectively in icy environments that can address the challenges of the Arctic and sub-Arctic regions. This can be enabled with advances in environmental sensing technologies to provide a better understanding on how sonar performance is impacted by underwater conditions.

Passive/active approaches

According to a spokesperson from Thales Underwater Systems: “The new trend for anti-submarine warfare systems is to use a combination of both passive and active sonar for a more complete and effective underwater surveillance capability, depending on environmental conditions and missions.”

Credit: Thales

The Thales spokesperson told ESD: “Nowadays, there is a growing operational need for both improved active and passive capabilities so that surface ships can fulfil their various [mission types]. For submarine sonars, the focus is more on passive sonars, however high frequency active sonar remains useful for Mine and Obstacle Avoidance Sonar (MOAS) for instance.”

Passive and active sonar technologies have different uses. The Thales spokesperson said that different principles apply to each. Advances are required in both technologies. Active sonars use acoustic transducers and power for sound output, with algorithms designed determine the distance, direction and characteristics of targets depending on the acoustic returns.

The Thales spokesperson noted that, “The development of advanced signal processing techniques to improve target discrimination and reduce the impact of background noise in active mode is essential”, adding, “The implementation of adaptive sonar technologies with the use of the most appropriate ping parameters such as frequency, pulse lengths, and types, as well as other parameters based on environmental conditions, is also a key differentiator.”

Meanwhile passive sonars use hydrophones for listening. These rely on detecting and analysing acoustic signatures from the environment. Improved signal processing algorithms are needed for improved detection and classification of those signatures. Sonar resolutions are increasing, and with them the volume of data needing to be analysed, which means that technologies to help with processing and networking are becoming increasingly important.

For a more collaborative form of ASW to be achieved with integrated sonars and interconnected sensors, the use of modern digital technologies such as AI, ML and Big Data will be vital for sonar operators to help make sense of the acoustic environment and find threats. The Thales spokesperson said that as an example, these could be used in classification and database management.

The Thales spokesperson concluded that, “For submarine sonars, the technologies enabling the management of large quantities of data are being investigated. Trustable IA and ML are also possible tools for the sonar operators, but only under operators’ supervision.” The spokesperson added, “They are important to alleviate the operators’ workload and enable them to focus on their main tasks.”

Sonar programmes

The number of programmes for new sonar systems and for upgrades to existing sonar systems is increasing for both ship- and submarine-mounted equipment.

In July 2023, the UK MOD announced a GBP 30 million (USD 38.4 million) contract with Ultra Electronics for the supply of five Type 2150 hull-mounted sonar (HMS) for the Royal Navy’s Type 26 frigates adding to the three already contracted. The 2150 is part of the company’s Sea Searcher range of sonar already being fitted to the Type 23 frigate as part of a wider programme to replace the Type 2050 HMS developed in the 1980s. Deliveries are expected to be completed by 2032.

Ultra stated that the 2150 incorporates digital control of the outboard array to minimise interference and reduce cabling. Under a USD 19 million contract from Lockheed Martin awarded in October 2022, Ultra is delivering an HMS for the Type 26 frigates being built under the Canadian Surface Combatant programme. The HMS will allow the ships to passively or actively detect submarines and extend the time between maintenance periods for the sonar.

Credit: Thales

The Type 26 frigates are specialist ASW frigates using the Sonar 2087 low-frequency active/passive variable depth towed sonar array. Sonar 2087 is the Royal Navy’s name for the CAPTAS-4/UMS 4249 product from Thales and is the service’s primary ASW sensor. The company is providing a series of enhancements to the Type 2087 sonars fitted to the Type 23 frigates under a GBP 110 million contract awarded in September 2022 for the Sonar 2087 Design Authority Capability Insertion Project (DA-CIP). Under the DA-CIP, Thales is incorporating new technologies into the system for enhanced detection and tracking, faster processing, better displays and controls that will allow it to retain operational capability in the underwater spectrum and operate well into the mid-2030s.

In the United States, during July 2021, Lockheed Martin was awarded a USD 80.2 million contract for the provision of a technical insertion-20 (TI-20) for the AN/SQQ-89A(V)15 surface ship undersea warfare combat systems and AN/SQS-53C hull-mounted sonar. The system is fitted to the US Navy’s Arleigh Burke class destroyers and Ticonderoga class cruiser; it uses both active and passive sensing to detect and track underwater objects.

The AN/SQQ-89A(V)15 upgrade includes improved automation for torpedo detection and sophisticated sonar processing and performance prediction. It also has a redesigned display to alleviate operator loads and integrates training and logistics. The AN/SQS-53C is a digital HMS, and compared to earlier variants it provides a longer detection range, relying on less power and offers more detailed contact information. Deliveries will be completed by June 2026. The AN/SQQ-89A(V)15 receives regular upgrades and in September 2022, Lockheed Martin underwent a contract modification worth USD 253.89 million for the inclusion of Technical Insertion-22 (TI-22) hardware and new TB-37A multifunction towed array components.

Meanwhile Thales announced in February 2024 that its subsidiary Advanced Acoustics Concepts (AAC) had delivered the first CAPTAS-4 Variable Depth Sonar to the US Navy in October 2023. CAPTAS-4 is to be fitted to the Constellation class frigates under a contract signed in May 2022. Four Constellation class vessels have been ordered so far, and the Navy’s present plans call for up to 20 in total. This first CAPTAS-4 is due to be fitted to the first-of-class vessel shortly, but Thales also announced that a new CAPTAS-4 production facility is being built at the AAC site at Uniontown, Pennsylvania for the final assembly, integration and acceptance testing of the next systems expected.

Submarine sonar

Unlike surface ships, submarines require a range of different sonar systems not just for detecting threats, but also for navigation and obstacle avoidance. These are mainly passive sensors because the submarine’s main asset is stealth.

Credit: Northrop Grumman

On US Navy submarines, L3Harris Chesapeake Sciences Division is providing a new TB-34X fat-line tactical towed sonar array that includes more hydrophones, improved towing mechanisms and with less internal noise generated by the system. It also produces the new TB-29A Compact Towed Array for operations in shallow water, where a slower vessel’s speed means longer towed array systems may risk coming into contact with the propeller. The TB-29A also has a reduced power and space requirement. L3Harris is also delivering the six acoustic panels that are used on the Lightweight Wide Aperture Array (LWWAA) flank array sonar fitted to the US Navy’s Virginia class submarines. These are lighter and smaller than previous panels, which means the LWWAA offers nuclear attack submarines (SSNs) more buoyancy whilst maintaining sonar sensitivity.

For the French Navy, Thales is providing a new sonar suite for the Sous-Marin Nucléaire Lanceur d’Engins de Troisieme Génération (SNLE 3G) third generation nuclear-powered ballistic missile submarines (SSBNs), and for modernising the second generation boats (SNLE 2G) – Triomphant class. The suite will include bow sonar, flank array, and towed arrays with optical technology, intercept array and echo sounders. Thales was awarded the contract from the DGA, the French defence procurement authority, in July 2023. A spokesperson said: “The new arrays will be bigger, with [higher performance] sensors will require big-data algorithms to be deployed on more powerful processors. This will be the first implementation of ALICIA [Analyse, Localisation, Identification, Classification Intégrées et Alertes] architecture.”

ALICIA is a data processing system designed to handle the significantly larger volumes of data that will be generated by the new sonar suite. It will include intuitive user interfaces to optimise operator workload and provide decision support. The company is also completing a sonar retrofit on the French Navy’s two Améthyste class SSNs that is due to be completed later in 2024.

Credit: Atlas Elektronik

ELAC Sonar is developing a new sonar system for the Italian Navy’s two new U212 Near Future Submarines under a EUR 49 million contract from prime contractor Leonardo. The Spanish Navy’s new S-80A Plus submarines will have the Lockheed Martin Submarine Integrated Combat System (SUBICS) sonar suite that includes a bow, flank, passive ranging and mine and obstacle avoidance sonar (MOAS). Sweden’s Blekinge class (A26) submarine will be fitted with new bow, flank and HF intercept sonar arrays by Atlas Elektronik, along with the SA9510S MOAS and bottom navigation systems including an EM2040 multibeam echo sounder, side-scan sonar, sub-bottom profiler and hydrographic echo sounders.

In terms of materials science, textured ceramics is one technology that promises to improve acoustic transducer performance, further enhancing sensitivity, and potentially also reducing weight and power requirements in sonar systems. Improvements in construction methods can also improve the conduction of sound to the sensor, reducing the ambient noise. Textured ceramic-based transducers are being incorporated into the product lines of a number of sonar manufacturers.

Uncrewed capabilities

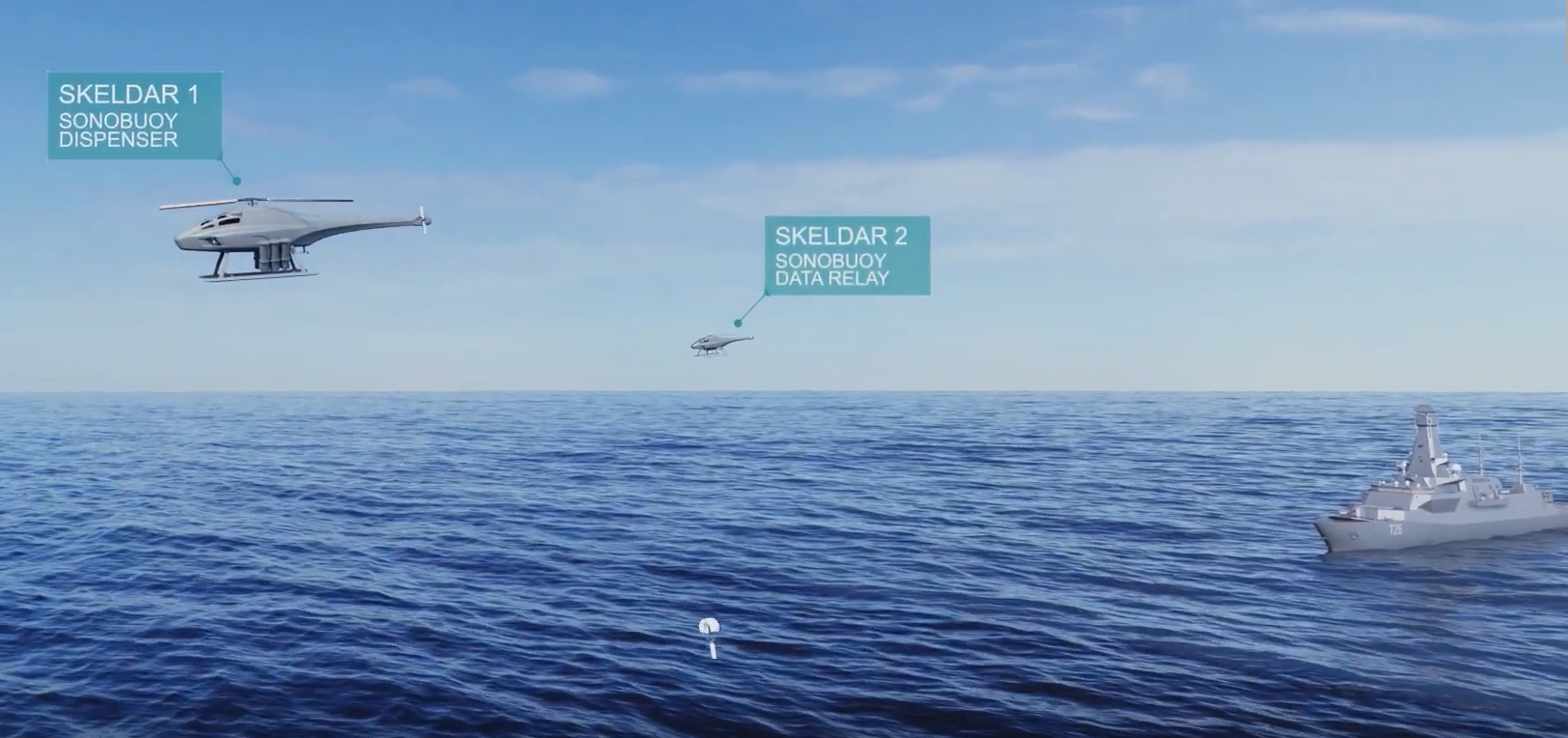

Solutions are being developed to address uncrewed ASW assets. At DSEI in September 2023, UMS Skeldar and Ultra Marine showcased a new ASW sonobuoy dispenser that could be mounted on a Skeldar V-200 rotary-wing vertical take-off and landing (VTOL) unmanned aerial vehicle (UAV). It was developed under a defence innovation contract from the Canadian Department of National Defence awarded in October 2022.

The intention is for the UAV to provide a rapid sonobuoy dispensing capability to supplement that provided by fixed-wing maritime patrol aircraft and dipping sonar mounted on a ship’s helicopters. It rapidly adds more sensors into the water that can contribute to a multi-static sensor network, for the detection of submarines. A prototype is being developed under phase 2 of the contract, with a live flight demonstration expected should the project progress to a third phase.

Credit: UMS Skeldar

Meanwhile, the UK MoD is seeking to develop, demonstrate and deliver new uncrewed deployable ASW capabilities under Project Charybdis. It is part of the wider Royal Navy ASW Spearhead programme in which the Submarine Delivery Agency is delivering phase 1 – to identify technologies ripe for application and awards contracts for concept studies.

This project includes autonomy, robotics, AI and ML that be harnessed in uncrewed platforms to enhance their capability and provide a persistent and deployable uncrewed ASW capability alongside existing assets. The service wants this new capability to be able to deploy across wide areas of ocean, detect dangerous object, classify them, localise and track them and report contacts to allied units.

With the project underway, almost 30 companies have received small contract awards to develop concepts. Phase 2 is for the demonstration of technologies, and this is due to start during FY2024–25. This second phase will build on initiatives already begun and provide evidence for new work and develop essential elements to each project, including shore infrastructure, regulatory approaches, training and support. The intention is to find solutions that could be fielded within five years.

The Thales spokesperson said that under Project Charybdis, the company “defined two ASW Surveillance concepts with a blend of UxVs [uncrewed surface/underwater vehicles] within the solutions. We are waiting for the customer to advise on the next steps for Phase 2, but the intention is to prototype capabilities from the phase 1 concepts”.

Conclusion

Sonar systems remain the key to unlocking the underwater domain. The two key improvements are firstly to enhance the performance of the sonar systems and process the data faster and more effectively, and secondly to connect larger numbers of sonar systems and into the wider military network to enable multi-static detection of targets.

Sonar developments aim to increase sensitivity to detect, classify and localise targets at longer range and apply greater processing power to manage the data loads and present information to speed up decision-making.

This technology can then also fuse sonar data with data from other, multi-static, sources via robust communications systems, that will offer a much clearer understanding of the acoustic environment across a wider area, and the ability to rapidly identify and classify targets in the water column in different environments. As sophisticated sonar capabilities such as these develop and proliferate, submarines will find it ever more difficult to remain hidden.

Tim Fish