The sheer size, geography and conditions of the Arctic region present a significant challenge for surveillance and communications. Providing enough coverage of such a vast area is extremely difficult with the ability of forces to respond to events using airborne, seaborne or land platforms considerably constrained. Current communications and satellite coverage of the Arctic is also limited, making it harder to reliably move and integrate data safely and cheaply.

Due to its remoteness and the difficulty in conducting intelligence, surveillance and reconnaissance (ISR) operations in the Arctic, a number of illegal activities occur there regularly. This includes illegal fishing, drug trafficking, and arms shipments that often become ‘dark’ targets (vessels with their automatic identification system (AIS) transponder switched off) that need detecting. Legal operations include search and rescue (SAR) services, the work of environmental and scientific research institutions, maritime shipping of all kinds, and iceberg tracking systems. These activities, which are all increasing in number, make the need for a common operating picture even more acute.

The main shortfall in ISR is twofold: first, a lack of persistent coverage, and second, that the provided image resolutions are insufficient for activity monitoring. Most monitoring from space is performed by geostationary Earth orbit (GEO) satellites, which are situated above the equator, though the curvature of the Earth means they are unable to cover the higher altitudes near the poles from about 75° onwards. Meanwhile, non-geostationary Earth orbit (NGEO) satellites that traverse over the Arctic in a highly elliptical orbit (HEO) can provide coverage over many thousands of square kilometres, but only at resolutions of around 100 m.

Although there are a growing number of organisations and agencies with assets and capabilities in the Arctic, they are not sufficiently interconnected, and therefore providing a single more complete joint operating picture of activities in the region has so far not been achieved. The small population of the Arctic and its ice-blocked terrain means there little demand for large-scale communications and surveillance services. However, greater interest in the region due to its natural resources, climate change, the opening of new maritime trade routes, and strategic considerations mean there is now a growing demand for more communications capacity.

Growing satellite capability

Due to concerns about the lack of satellite coverage and limits of surveillance and communications, a number of efforts are underway to introduce new solutions. The US Air Force (USAF) released its Arctic Strategy in 2020 and devoted USD 50 million towards testing low Earth orbit (LEO) satellites around the polar region.

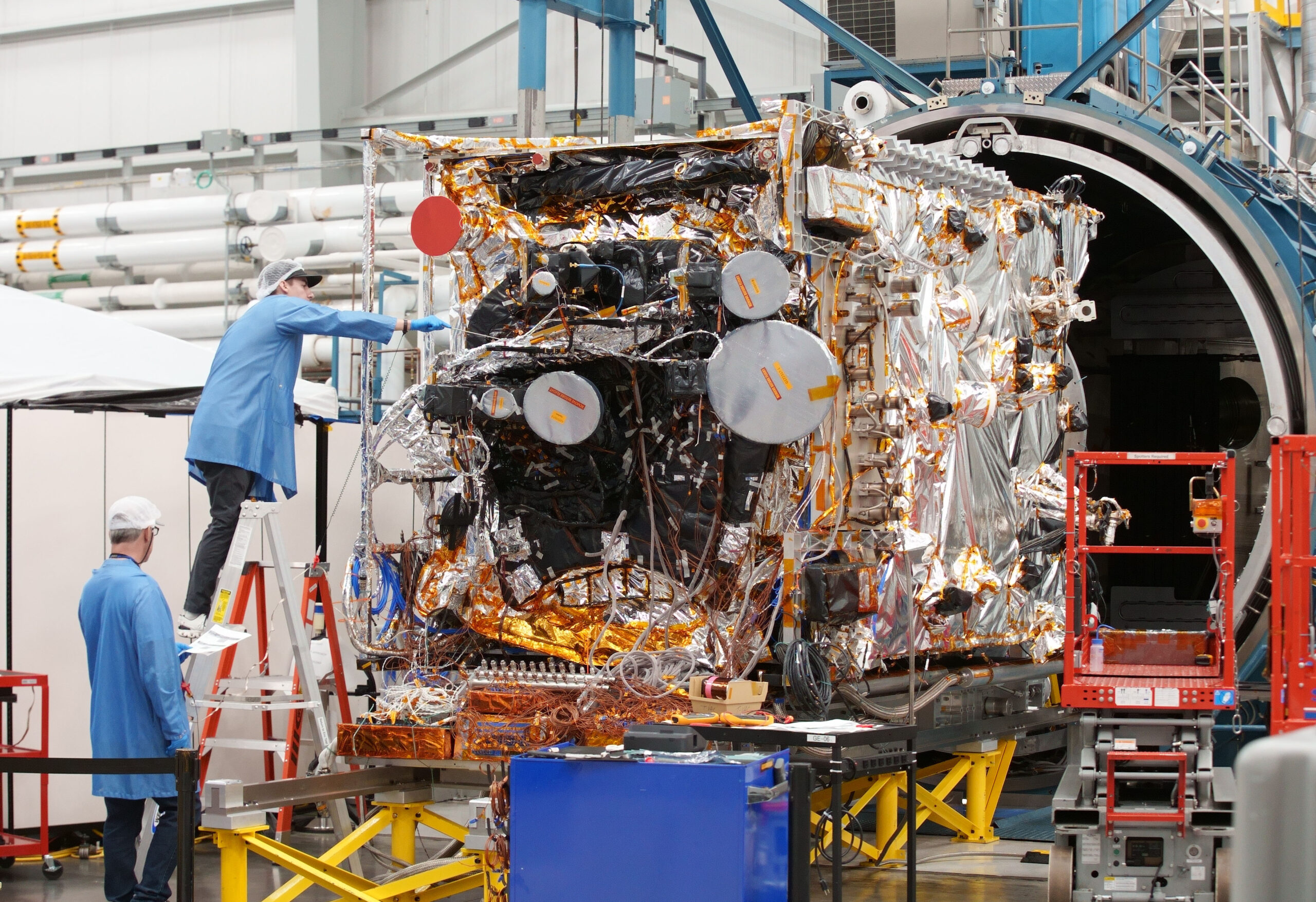

Credit: Northrop Grumman

The Arctic Satellite Broadband Mission (ABSM) is a joint venture between Inmarsat, the Norwegian Ministry of Defence (MoD) and the US Space Force (USSF). Under ABSM, Northrop Grumman has built two NGSO satellites with combined military and commercial payloads. The company announced on 7 November 2023 that with thermal vacuum testing on ASBM-1, the first of the two space vehicles was completed. ASBM-2 will complete the same process early in 2024 with a prospective launch date later in the year.

These systems will operate in HEO over the Arctic, providing X-band satellite communication (SATCOM) connectivity for the Norwegian Government, with Viasat’s Ka-band SATCOM payload to be used by Inmarsat, and the Enhanced Polar System-Recapitalisation (EPS-R) extremely high frequency (EHF) payload by the USSF. The latter will extend EPS capability into the 2030s. Considering that the US Navy is starting a buildup in the Arctic and High North, and expanding its Joint Pacific Alaskan Range Complex (JPARC) training area, more communications and surveillance capacity will be needed to support a higher operational tempo.

The US Coast Guard (USCG) is also due to procure new Polar Security Cutters (PSCs) as part of its plan to increase the number of icebreaking-capable ships The USCG also launched its own Arctic Strategic Outlook Implementation Plan in October 2023, which includes projects to introduce modified MH-60 helicopters suitable for Arctic operations and set down requirements for a new pole-to-pole SATCOM system with GEO and NGEO satellites to support communications, as well as a terrestrial communications system.

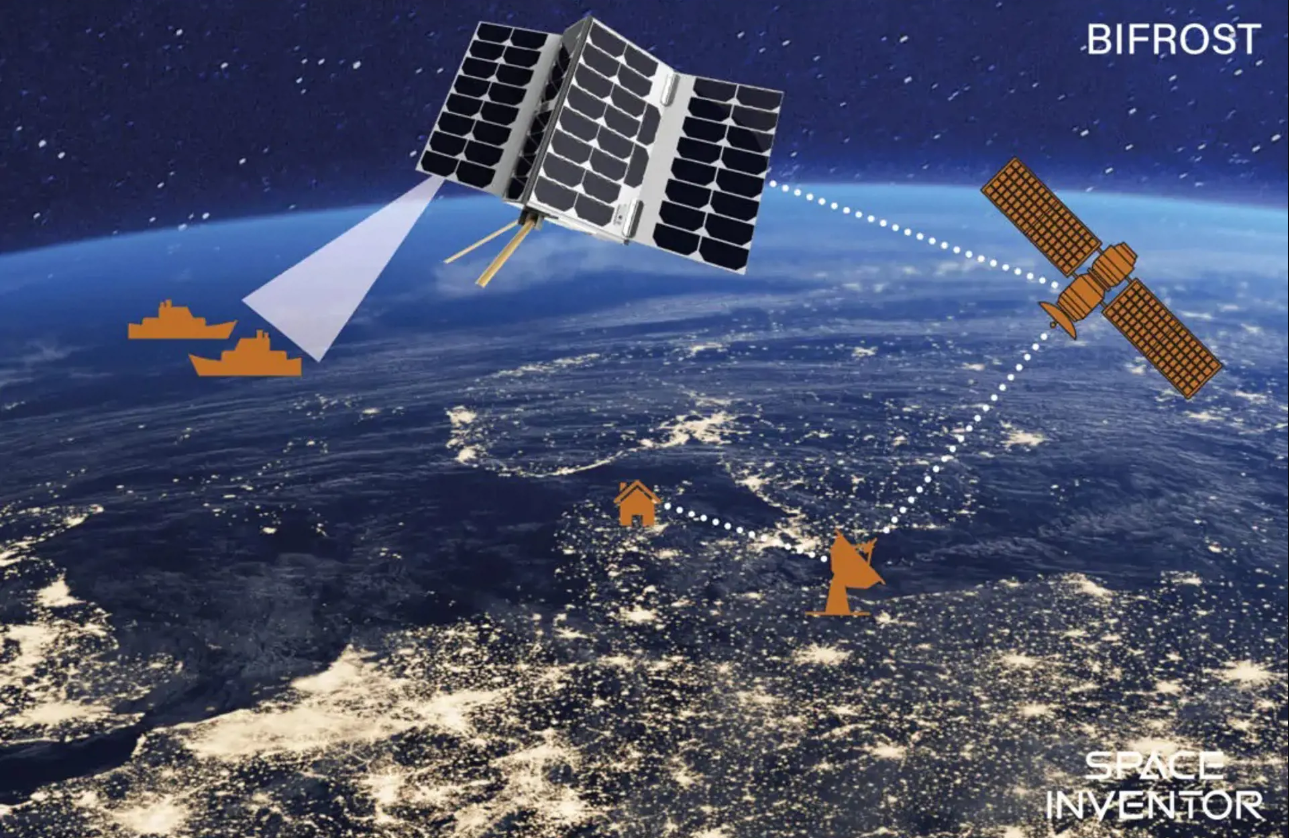

In Europe, a partnership between the Swedish and Danish defence procurement authorities signed in July 2023 will see the joint development of a new satellite called Bifrost, which will be used to support the Danish Joint Arctic Command. Denmark is also planning to install new radar on the Faroe Islands as part of an Arctic Capability Package to improve air defence, with a contract for the radar expected in 2024.

In January 2023, two Dutch–Norwegian military nanosatellites named Huygens and Birkeland were launched into polar LEO orbit on a SpaceX Falcon 9 rocket. The pair will provide testing data and detection of radar signals for both countries. Researchers at the Norwegian FFI, Dutch TNO and Royal NLR developed the nanosatellites, together with NanoAvionics under the bilateral MilSpace 2 cooperation project.

Credit: Nanoavionics

Meanwhile, Russia and China are set to develop their own HEO satellite capability following a meeting in November between President Putin and General Zhang Youxia, the Vice Chair of China’s Central Military Commission. China is expected to leverage past Russian experience and there could be cooperation on Russia’s Arktika HEO project with a constellation of up to 10 satellites expected, nine of which will be focussed on the Arctic. The first pair were launched in 2021 and 2023, but China could join the development of the four Ekspress-RV satellites as these are for military use. The first of the Ekspress-RV series is scheduled to be launched in October 2025, and all four are planned to be deployed during 2026.

Meanwhile in August 2023, a joint Sino-Russian surface action group completed a transit of the Aleutian Islands near Alaska which included 10 ships. In February 2023, Russia changed its Arctic policy to remove cooperation with other members of the Arctic Council, which had suspended Russia following their invasion of Ukraine in February 2022.

Elsewhere, private operators including OneWeb and Starlink want to meet the demand for ISR and communications services by sending more LEO satellites to conduct orbits of the polar region, while SES is establishing a medium Earth orbit satellite network called O3b mPower to cover the Arctic.

Adding uncrewed assets

However, satellites alone will not provide the kind of detailed surveillance needed about events or operations taking place in a specific area. Additional assets in the air, surface and under the water are required alongside satellites to offer a more comprehensive and joined-up ISR picture.

A new Integrated Remote Sensing for the Arctic (IRSA) service is being developed as a way of filling this capability gap. The IRSA Development Group (IDG) consortium building IRSA capabilities includes Andøya Space Center, Boeing, C-CORE, Karl Osen, MDSI, Scott Polar Research Institute, Viasat, and VTT. Together, these companies and institutions are jointly funding the development of a system that integrates specially-configured and optimised commercial platforms in the sea-air-space domains for the Arctic, providing layered coverage to defence and commercial customers.

Credit: Andøya Space

Paul Curlett, senior business development lead for Boeing Phantom Works, one of the leaders of the IDG Consortium told ESD that the IRSA was the most cost-effective way of providing surveillance of the Arctic. The IRSA is made up of long-endurance ISR platforms (both crewed and uncrewed aircraft) supported by access to several communications networks.

“The explosive growth of remote sensing satellites, and their more tactical capabilities, allow for larger areas to survey for anomalies and then cueing high resolution satellites for detailed looks at the activity,” Curlett explained. “This can only be done with the integration of space agency wide-area satellites that provide freely available data with advanced commercial systems that can distinguish threats on almost an hourly basis when done properly,” he added.

The IDG can integrate these growing constellations of publicly available data and commercial satellite missions to support a range of surveillance objectives. In this way, it can respond to urgent requirements as well as provide the stability to address long-term ISR needs. Curlett explained, “this involves tactical tasking of satellites, various ground stations for downlinking acquired data, rapid analytics to condense massive data sets into specific alerts, and dissemination through common operating picture systems… that are readily integrated into clients’ own situational awareness systems”.

The IRSA project started in February 2019 with the signing of a memorandum of understanding (MoU) between the members of the IDG Consortium, initiating an early study period. This defined the required capabilities and the gaps in existing satellite and communications coverage. The IRSA was created with a full understanding of the defence and security requirements of the Arctic countries in particular, however there has been no government funding for IRSA development.

Providing IRSA

A distributed mission network architecture has been designed with mission centres located at the C-CORE facilities in St John’s, Newfoundland in Canada, the Andøya Space Center in Norway and at Boeing. C-CORE manages satellite surveillance whilst the Andøya Space Center handles command and control (C2). Boeing Phantom Works is responsible for the creation of the joint operational picture through its Common Open Mission Management Command and Control – Global Edition (COMC2-GE) product.

The IDG also has its own deployable Mission Centre capable of exercising C2 of satellite detection, as well as ISR missions with crewed and uncrewed aerial vehicles (UAVs), in addition to surface and sub-surface assets. This is an extension of the capabilities provided by the Andøya Space Center. The IRSA’s medium-altitude long-endurance (MALE) UAV and small UAV (SUAV) capability is provided by the Integrator and ScanEagle, both supplied by Boeing’s Insitu. Meanwhile, the Centaur system from Aurora Flight Sciences provides the MALE optionally piloted vehicle (OPV) capability.

Credit: Boeing

Boeing Commercial Satellite Services and the satellite constellations of Boeing’s commercial partners are used to support the IRSA network across the land, sea and air domains, with two satellite systems providing coverage of the Arctic region. IRSA also uses OneWeb and Starlink, which are both LEO constellations operating in the Ku-band.

Other satellite missions are utilised that provide freely available data and different access protocols, while others are entirely commercial with their own operating concepts. For the future, there are other satellite systems in the development or planning stages that will offer additional coverage of the Arctic.

With an increasing number of platforms and volume surveillance data gathered, Boeing can use COMC2-GE to create a joint operational picture. “COMC2-GE has the capability to fuse data from many different data sources and satellite feeds and visually display prioritised information to decision-makers in a command centre,” Boeing Phantom Works’ Curlett said. “IDG has the technical capability to integrate sensor data from maritime and air surveillance radars if a customer had such a requirement and funding was available,” he added.

X-trials demonstrations

Over the past three years, the IDG has been developing the IRSA network. These satellite and aircraft systems have been tested most recently during the Arctic X21 and Arctic X22 exercises.

During Arctic X21, an IRSA ‘Lite’ capability was demonstrated for very remote or hostile maritime scenarios and helped develop standard operating procedures. This was followed by a full demonstration in Denmark that included use of all its space, aircraft and UAV assets, during which the IRSA detected dark targets, enabled detection and response of illegal maritime activities, and search and rescue operational planning.

Arctic X22 was held in Norway and Denmark and was focussed on using UAV sensors and long-endurance platforms with a distributed mission management centre used to coordinate assets and data from five different organisations. More than 60 satellites from 11 different constellations were employed at various stages with C-CORE conducting the integration of the space-based information.

The integration of this satellite information with data from the crewed ISR and UAV platforms was a joint effort by the IDG partners and completed through the mission control centre: Andøya supported the crewed ISR assets, Insitu managed the UAVs and MDSI was responsible for scenario planning assets and national coordination.

In both the X21 and X22 exercises, the IRSA also detected a non-reporting warship operating close to Danish waters and was able to report it to the authorities. Curlett said the demonstrations led to contracting opportunities “that are still ongoing”.

Going below

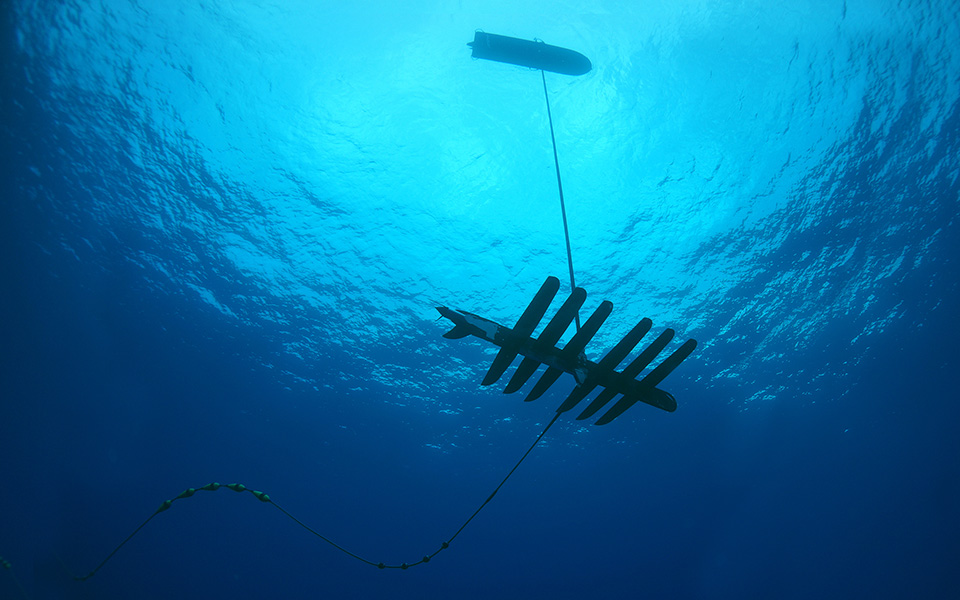

Future plans for Arctic X24 “include expansion of available assets into sea surface and sub-surface UUVs [uncrewed underwater vehicles] platforms (Wave Glider and XLUUV), based on availability, to demonstrate IRSA applicability to monitor critical asset infrastructure”, according to Curlett, and build on the remote sensing capabilities and SAR scenarios.

Credit: Boeing

For sub-surface surveillance, the IDG plans to use the Wave Glider uncrewed surface vehicle (USV) from Liquid Robotics (a Boeing subsidiary) and Boeing’s extra large uncrewed undersea vehicle (XLUUV; known as ‘Orca’ in US Navy service) that will be tested during Arctic X24. This exercise will take place from 17-20 June at Andøya Space Center and C-CORE at St John’s in Canada, and will focus on the protection of sub-sea critical infrastructure. “The planned demonstrations will provide a framework for the combined IDG capabilities to monitor sub-sea critical infrastructure to customers and for further development of IDG capability to provide broadband communication, surface and sub-surface situational awareness, as well as iceberg detection and oil spill detection using satellites, autonomous systems and remotely controlled unmanned systems beyond line of sight,” Curlett said.

In January 2023, both NATO and the EU agreed to create a taskforce to examine resilience and critical infrastructure protection. In 2023, the IDG conducted a virtual event with stakeholders from government and industry to look at the requirements for the protection of critical infrastructure that will help shape the live exercise in 2024.

Meanwhile, plans to introduce new high-altitude long-endurance (HALE) UAVs into the mix have been cancelled. Early studies conducted by IDG on Arctic SATCOM coverage found there was potential for HALE UAVs to provide a communications node north of 70° North, where a redundant communications infrastructure was absent. However, it is expected that Starlink and OneWeb, deployments over the Arctic will cover this latitude instead.

“The IRSA capability has been operationally demonstrated and is ready to be matured further based on customer requirements and is technically ready to perform today,” Curlett said, “The IDG stands ready to enter service agreements with satellite providers and stand up the organisation and the infrastructure this will require funding from future clients.”

Elsewhere, in 2023 the USN already started deploying prototype parts of the Arctic Mobile Observing System (AMOS) under an Office of Naval Research (ONR) programme. AMOS includes specially-designed buoys for Arctic conditions and UUVs that operate under the ice. The ONR stated that AMOS will enable 2-way communications (vehicle-to-vehicle, vehicle-to-node and node-to-shore), under-ice mobile vehicle navigation, and extended-duration autonomy, with endurance for 12 months and a sensing footprint goal of 100 km from the central node.

Conclusion

With new Arctic policies being introduced by the major powers and several simultaneous efforts underway to expand communications and surveillance capabilities, the polar region could start to get busy in the coming years.

Credit: Terma

The expansion of satellite capabilities will go a long way to improving ISR coverage, but further work will be needed to establish a high-bandwidth service that can support the expected increase in demand from military and commercial customers.

As the Arctic becomes more contested, the need to gather and absorb all the new data, process and exploit it will become paramount. The lack of existing infrastructure and forces stationed permanently on the ice means that advanced planning, the ability to react quickly to ISR information and communicate with deployed forces will be essential.

Tim Fish