Studies proceed in earnest to develop a next-generation NATO rotorcraft

Peter Felstead

In July 2024 the NATO Support and Procurement Agency issued study contracts ultimately intended to kickstart the development of a next-generation medium, multi-role rotorcraft capability for the alliance: an ambitious project that could see a preferred solution selected by the end of 2027.

The Next-Generation Rotorcraft Capability (NGRC) effort is a NATO Support and Procurement Agency (NSPA)-led High Visibility Project in which the participating nations – Canada, France, Germany, Greece, Italy, the Netherlands and the United Kingdom – are combining their efforts to work on the design, development and delivery of a future medium, multi-role rotorcraft capability.

The multinational NGRC initiative was initially launched by France, Germany, Greece, Italy and the UK though a letter of intent signed in November 2020. In June 2022, when those nations launched the concept stage of the project through the signature of a memorandum of understanding (MoU), the Netherlands joined as the sixth nation participating in the NGRC effort, while Canada subsequently joined in March 2024. The United States and Spain are currently acting as observers on the NGRC effort.

In July 2024 the NATO Support and Procurement Agency (NSPA) awarded contracts to Airbus, Leonardo, and Lockheed Martin’s Sikorsky business for a 13-month study into the future concepts for the NGRC, also known as Concept Study Five. The three companies’ responses to this – which could theoretically each comprise up to two concepts – are to be delivered in October 2025, enabling the NSPA to prepare a subsequent report to the participating nations.

After October 2025, the participating nations will then identify their preferred solutions from those concepts presented before then writing the requirements for the NGRC programme in earnest. Meanwhile, the NSPA has been working on two additional studies that are meant to inform what the NGRC solution’s powerplant and open-system architecture (OSA) might look like, with Lockheed Martin contracted for the OSA study.

Speaking to Defence iQ ahead of the company’s February 2025 International Military Helicopter conference, Cyril Heckel, programme manager for the NGRC concept stage at the NSPA, said, “We plan to identify, potentially, an NGRC preferred solution by the end of 2027, and we have also in mind for nations that, ideally, we would like to have the first asset delivered by 2038.” Heckel additionally noted that the NSPA is targeting a unit fly-away cost for the NGRC solution of EUR 35 million, with affordability being a key aspect of NGRC considerations.

Heckel told ESD on 30 January 2025 that, with the programme currently at the concept stage, “we don’t have yet requirements but only attributes or high-level expectations. We explore what could be possible concepts. To explore these options, the nations and NSPA defined a concept of operations (CONOPS) containing 11 missions.”

NGRC attributes

A NATO factsheet on NGRC describes the rationale for the effort as follows: “A significant amount of the medium multi-role [helicopter] assets currently in service [with] Allies will reach the end of their life cycle in the 2035-40 period and beyond, with the subsequent need for replacements. These existing inventories are all based on designs dating back to the previous century. The aim of the NGRC initiative is to respond to this upcoming requirement, in a timely and cost-effective manner, while concurrently leveraging a broad range of recent advances in technology, production methods and operational concepts.”

The helicopter types currently in NATO nation inventories that are expected to be replaced by the NGRC effort include the Airbus (formerly Aerospatiale) Super Puma, Leonardo (formerly AgustaWestland) AW101, NH Industries NH90 and Bell CH-146 Griffon. The Sikorsky UH-60 Black Hawk has also been mentioned in this list, although the latest variant, the UH-60M, continues to be procured in significant numbers and the Black Hawk will not be fully retired for decades to come.

The UK will certainly have renewed interest in its participation in the NGRC effort, given that its much-delayed New Medium Helicopter programme, which was largely focused on replacing the Royal Air Force’s ageing fleet of Puma HC2 helicopters, has been left with a sole bidder (Leonardo Helicopters UK, offering the AW149) and could well have fallen into abeyance.

In September 2020 the NSPA detailed a number of the attributes that the NGRC solution should feature. These included: a range in excess of 1,650 km (900 NM), a maximum take-off weight of 10 to 17 tonnes, a capacity for up to 16 troops in full combat gear or mission equipment, an endurance of more than five hours or up to eight hours with additional fuel tanks, and a combined internal and external payload greater than 4 tonnes, with at least 2.5 tonnes carried internally.

Additionally, the NSPA stated that the NGRC should be capable of being used as an “optionally unmanned/remotely piloted vehicle” and that maritime and land variants should use a common airframe with a footprint no larger than the NH90 or AW101, including a folding tail and main rotors.

The intended cruise speed of the NGRC was given as “optimally 220 kt [407 km/h] or more but not less than 180 kt [333 km/h]”, which is not as fast as that envisaged for the US Army’s Future Long-Range Assault Aircraft (FLRAA). The winning solution for that programme, the Bell Textron V-280 Valor, which was selected in December 2022, has a cruise speed of 519 km/h (280 kt) and a maximum speed in excess of 556 km/h (300 kt).

Airbus

For its NGRC Concept Study Five effort Airbus has teamed with RTX’s Collins Aerospace and Raytheon businesses along with European missile and systems house MBDA.

There was early speculation in defence media that Airbus’ Racer high-speed helicopter demonstrator, which combines a traditional main rotor with lateral propellers and can cruise at up to 400 km/h, could form the basis of Airbus’ NGRC proposals. However, an Airbus Helicopters spokesperson told ESD on 29 January 2025, “We won’t develop a military version of Racer, but knowledge gained through the Racer project could be re-used for a military platform.”

European armed forces have expressed a need for a long-range aircraft with speeds that would exceed the capabilities of a conventional helicopter. The technologies developed by Airbus can match these requirements.

The Airbus spokesperson added, “European armed forces have expressed a need for a long-range aircraft with speeds that would exceed the capabilities of a conventional helicopter. The technologies developed by Airbus can match these requirements.”

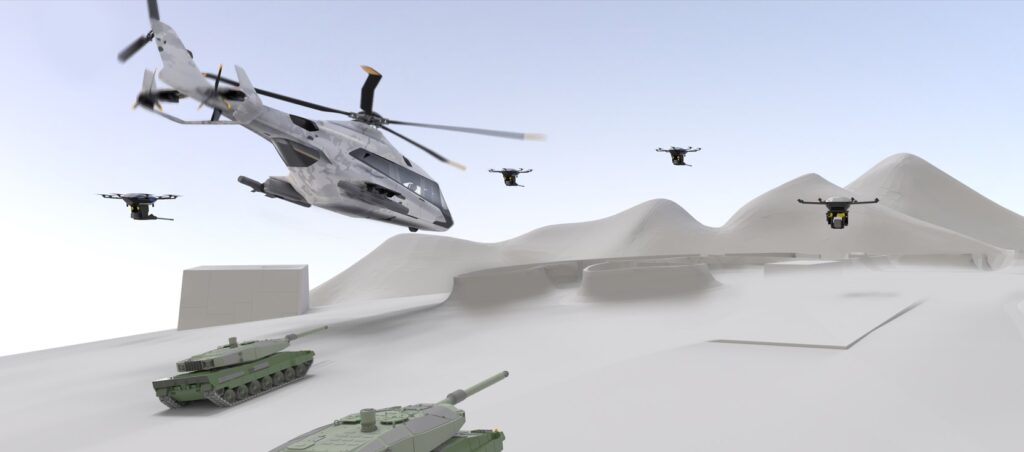

He additionally noted, “One of our priorities is to integrate our platforms into a multi-domain combat cloud where the helicopter will be a force multiplier: a mothership capable of deploying combat capabilities fast and at a long range. That is why we are working actively on crewed-uncrewed teaming. We have already developed and tested teaming capabilities with the H145M [a military version of the H145 light utility helicopter] and more recently with the European project MUSHER [a manned-unmanned teaming demonstration initiative launched by the European Commission in December 2021].”

The Airbus spokesperson further added, “Connectivity at large is a key element of our research on the next-generation rotorcraft. We are not only working on future platform concepts but also on a combat cloud that will integrate helicopters, unmanned aerial vehicles and other assets taking part in military operations. This is why Airbus Defense and Space is part of our NGRC team” and that “Working with RTX and MBDA, we are also making sure that our platform and systems will be fully modular and NATO integrated.”

Leonardo

On 29 February 2024 Leonardo announced that it had signed an MoU with US company Bell Textron to evaluate co-operation opportunities in the tilt-rotor technology domain. This co-operative effort began in earnest with work on NGRC Concept Study Five, in which Leonardo is taking the lead on a tilt-rotor design proposal with Bell in support.

The Leonardo/Bell team thus combines Bell’s experience with its V-280 Valor tilt-rotor, which was selected as the US Army’s FLRAA platform in December 2022, with Leonardo’s experience in developing the AW609 tilt-rotor. The Leonardo-led NGRC consortium additionally includes General Electric, Hensoldt, Leonardo DRS, MBDA Italia, NLR, Rolls-Royce and Safran.

Gian Piero Cutillo, managing director of Leonardo Helicopters, added, “We’re thrilled to evaluate new joint efforts for the next generation of rotorcraft technologies, based on our solid and shared view of the unique advantages of tilt-rotors. Leonardo has always firmly endorsed tilt-rotor technologies to meet evolving rotorcraft requirements, even more so as new needs emerge in the market.”

With regard to how its Concept Study Five work is progressing, a Leonardo spokesperson told ESD on 29 January 2025, “Activities proceed to schedule without criticalities. Interaction with NSPA is very good, allowing quick resolution of doubts and direction, if required. The team is ready to provide its contribution once the Study 5 phase is completed.”

Sikorsky

Meanwhile, Sikorsky announced in July 2024, upon its selection for the Concept Study Five work, that technology derived from its experimental X2 compound helicopter, which features coaxial rotors and a pusher propeller, would form the basis of its NGRC effort. The X2 first flew on 27 August 2008; the SB>1 Defiant compound helicopter developed from it competed, ultimately unsuccessfully, for the US Army’s FLRAA requirement.

“Years of investment and rigorous flight testing with multiple X2 technology demonstrators have proven its ability to change the future airspace,” Andy Adams, vice president of Sikorsky Future Vertical Lift, stated in July 2024. “Our X2 aircraft will bring to bear the strengths of Lockheed Martin along with input from our European Industry Group, such as digital thread, advanced manufacturing, sustainment, training, and weapon and mission system development, to provide NATO with an integrated rotorcraft system that combines speed, range, manoeuvrability, survivability and operational flexibility.”

Sikorsky’s European Industry Group includes BAE Systems, ELT Group, ESG Elektroniksystem-und Logistik, GE Aerospace, Hellenic Aerospace Industry, Kongsberg, Liebherr-Aerospace Lindenberg, MAGroup, Malloy Aeronautics, Safran, Rheinmetall and Terma.

With regard to Sikorsky’s Concept Study Five work specifically, Adams told ESD on 31 January 2025, “The concept design study has challenged us to look at the art of the possible, which we are doing to define the best next-generation solution for NATO. The NATO study is progressing very well; we have completed our first quarterly programme review and are tracking to complete our conceptual study in September of 2025.”

With more than USD 1 billion (EUR 0.96 billion) already invested in X2 rotorcraft, along with 15 years of testing and flying the X2 demonstrators, Sikorsky certainly had a firm basis for its NGRC Concept Study Five proposals.

Asked by ESD if this is perceived as an issue by Sikorsky, Adams replied, “We remain in the conceptual study phase. As the programme progresses and NATO provides more detail, we will have a better understanding of what will be required.”

Asked the same question by ESD, Heckel at the NSPA responded that, by awarding three Concept Study Five contracts, the NGRC effort will “ensure that diversity is maintained in the identification of possible concepts before exploring design activities”.

The NSPA and NGRC nations, he added, “will initiate the writing of NGRC requirements and outcomes of the studies will be considered to draft these requirements. The objective is now to initiate a new competitive process to be able to identify a NGRC preferred solution by the end of 2027.”

The dozen companies within Sikorsky’s European Industry Group suggest, at the very least, that the US company will be able to develop comprehensive plans for European participation if it progresses further in the NGRC endeavour.

Outlook

The NSPA’s efforts to kickstart the development of a next-generation rotorcraft are, of course, still in their initial stages, but the aim of ultimately producing a common aircraft type for multiple NATO nations that can successfully address all of their varying requirements is clearly no easy undertaking.

Salutary lessons can certainly be taken from the NATO Helicopter 90 (NH90) programme that began in earnest in 1992, which set out to address NATO requirements for a battlefield helicopter that would also be capable of being operated in naval environments. The NH90 programme stands as currently the largest military helicopter project in Europe and has delivered around 600 aircraft to the armed forces of 14 countries, but the programme was plagued with technical issues, delivery delays, maintenance issues and consequent low availability rates among multiple users. Two NH90 users – Australia and Norway – have withdrawn their NH90 fleets from service, while Sweden has also announced plans to withdraw NH90s.

The NGRC effort, meanwhile, will be hoping to avoid all those issues while still ultimately delivering a transformational rotorcraft capability for the 21st Century battlespace.

Peter Felstead