The two sabotage events which hit the Nord Stream 1 and 2 gas pipelines in the Baltic Sea on 26 September 2022 have accelerated the plans throughout NATO and European countries for the protection of underwater infrastructure of national interest such as communications cables, oil and gas pipelines, and extraction sites in Economic Exclusive Zone (EEZ) waters, due to the increasing risk of confrontation.

In this vein, there have been a number of recent moves from NATO and the EU to address these risks. On 11 January 2023, the EU and NATO announced a joint Task Force on Resilience and Critical Infrastructure Protection. Later on 15 February 2023, NATO and the EU respectively established an Undersea Infrastructure Coordination Cell (UICC) at Alliance HQ, and on 10 March 2023, the EU Commission announced an updated European Maritime Security Strategy and consequent actions. In addition to these multilateral moves, there have also been various efforts at the national level in NATO and EU member states.

The French Seabed Warfare Strategy

Unveiled in February 2022, the French Seabed Warfare Strategy has already gained two primary ongoing procurement programmes to support deep water survey and intervention. These are the Hydrographic and Oceanographic Capacity of the Future (CHOF) and the Maritime Mine Countermeasures of the Future (SLAMF) programmes.

CHOF aims to renew the hydrographic and oceanographic capacity of the Marine Nationale with a core set of capabilities using disruptive technologies (unmanned platforms in addition to artificial intelligence). Currently in the preparation and definition phase, it includes the procurement of two 90 m next-generation hydrographic vessels and their payload is due to include unmanned vehicles and sensors in order to meet growing needs in hydrography. The two vessels are planned to be delivered in 2027 and 2028 respectively.

During the CHOF competitive preparatory phase, the French Defence procurement and technology agency (DGA) awarded a contract to iXblue (now Exail) in September 2022 for a new experimentation campaign of the DriX hydrographic unmanned surface vehicle (USV) and a launch and recovery system study.

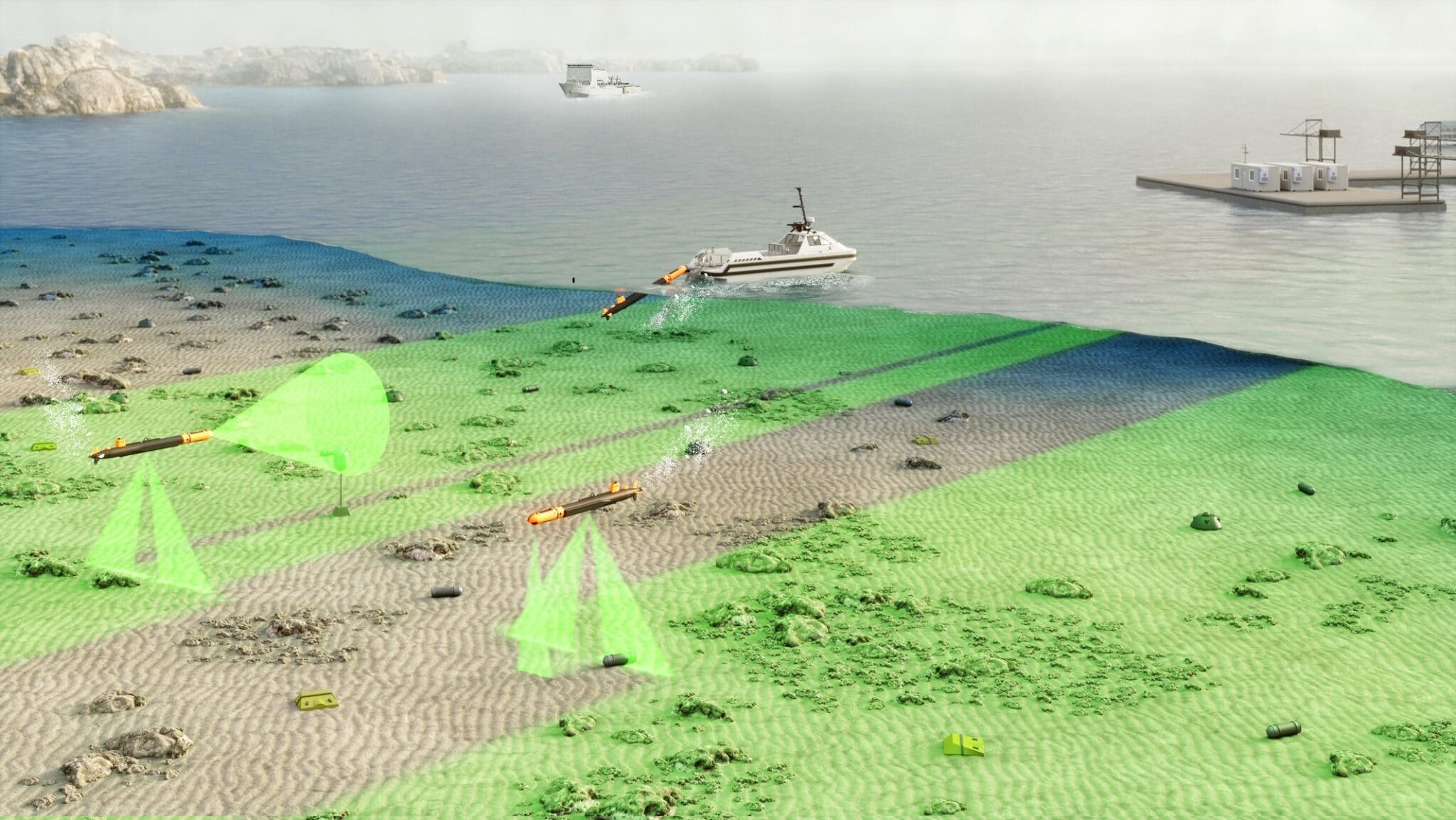

The SLAMF programme aims to incrementally renew the French Navy’s maritime MCM capabilities, and a cornerstone of this is the joint France-UK Maritime Mine Countermeasures (MMCM) programme led by Thales together with main partners Exail (then ECA Group), L3Harris and Saab. Under SLAMF/MMCM, France will receive MCM modules based on a USV platform operating Thales towed synthetic aperture sonar, Exail autonomous unmanned vehicles (AUVs) and Saab mine disposal remotely operated vehicles (ROVs). The next programme step is to be launched later in 2023, regards the procurement of new mine warfare vessel to replace the in-service Tripartite class mine countermeasure vessels (MCMVs).

Credit: ECA Group

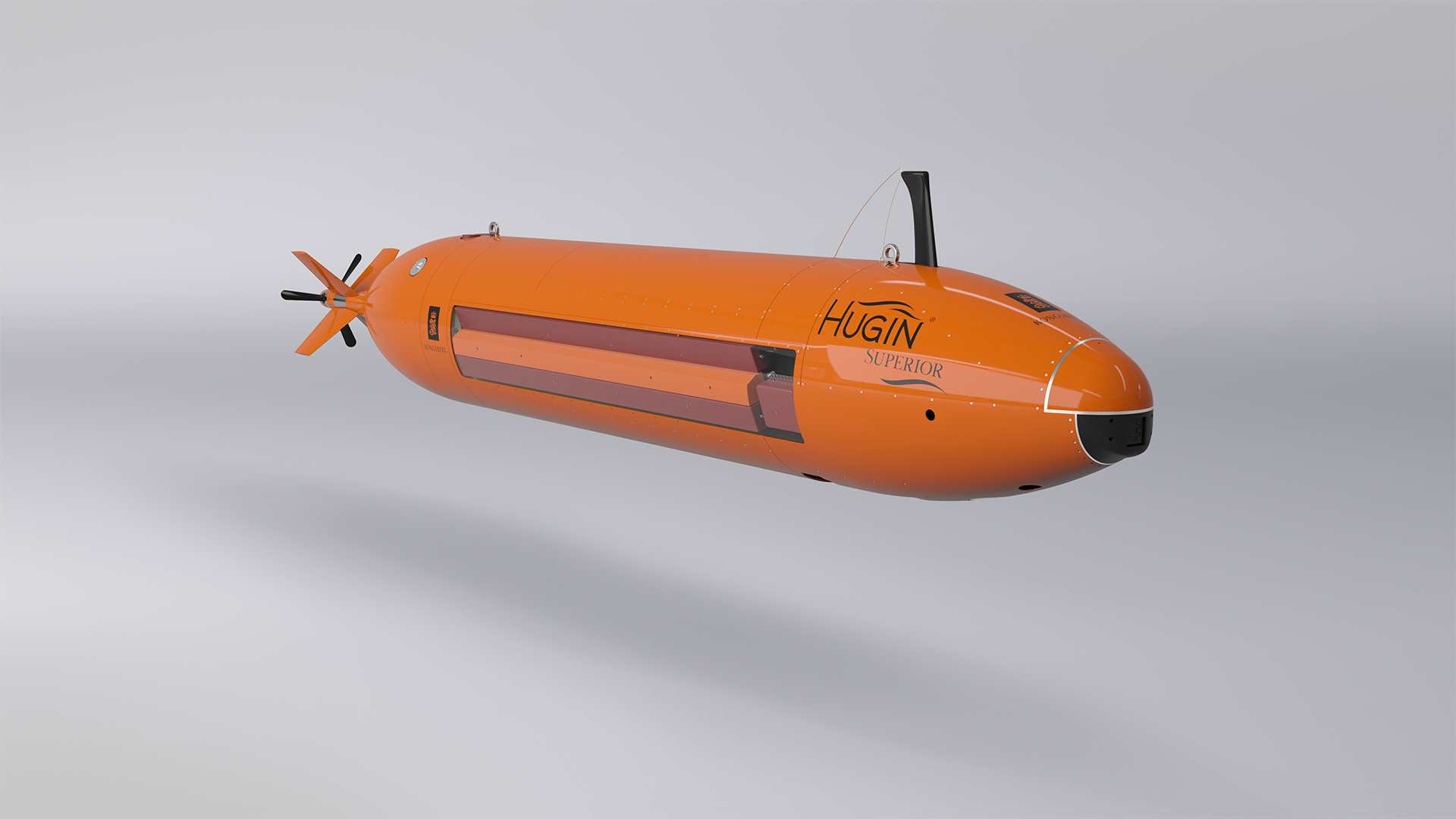

According to the new Seabed Warfare Strategy outcomes, in 2022 the DGA respectively awarded Norway’s Kongsberg Maritime and France’s Exail rental contracts to conduct experiments with HUGIN Superior and the A18D autonomous underwater vehicles (AUVs).

The Superior variant of the HUGIN family is capable of operating up to 6,000 m with good sensory, positioning and endurance capabilities. The Exail A18D is a mid-size AUV designed to perform missions at depths up to 3,000 m autonomously, with an endurance of up to 24 hours. Exail is also in the qualification phase of its Ulyx AUV for IFREMER French National Institute for Ocean Science, capable of reaching 6,000 m depths, while Alseamar company provides the well-known SeaExplorer gliders. These experiments are oriented to acquire an initial Seabed survey capability by 2025, comprising one AUV and one ROV pair capable of operating in waters up to 6,000 m in depth, along with an AUV/ROV pair for operations up to 3,000 m in depth. They are intended to be used by vessels of opportunity, in addition to French Navy platforms. A second programme phase increment includes the procurement of two additional 6,000 m AUV/ROV pairs, and two 3,000 m AUV/ROV pairs, to provide a full deployable capability by 2028. A third increment is also foreseen, consisting of an additional 6,000 m AUV and unspecified dedicated platform.

In late 2021, during the 5th edition of Naval Group’s Naval Innovation Days, the company unveiled a new Large ocean-going Unmanned Underwater Vehicle (LUUV) demonstrator, developed in partnership with Thales for the sensor suite and the start-up Delfox specialized in Artificial Intelligence (AI). The 10 tonnes displacement and 10 m long UUV has an endurance which can vary from several days in the current platform configuration to weeks with a longer hull up to 20 m. Naval Group has also developed the D19 medium AUV built on a F21 Artemis heavyweight torpedo base, equipped with modular front-end payload, which can be launched by a submarine, surface vessel or from the shore.

Credit: Naval Group

United Kingdom

The protection of the UK’s critical underwater national infrastructures was brought forward in November 2022, when the UK Defence Secretary announced the termination of the National Flagship programme for dedicated vessels and instead accelerated the procurement of two off-the-shelf platforms called Multi-Role Ocean Surveillance Ships (MROSS). The first of two commercial vessels acquired through the Defence Equipment & Support agency arrived at Cammell Laird shipyard in Birkenhead in January 2023 for modification, before their planned entry into service with the Royal Fleet Auxiliary in Q3 2023. The first vessel, RFA Proteus is a 98 m long, 6,133 tonne offshore support vessel (OSV) built in 2019 by Vard (Fincantieri). According to the UK MoD, it is being modified to conduct a range of missions in support of military operations, namely safeguarding seabed telecommunications cables and oil and gas pipelines. It will also operate as the mother ship for remote and autonomous offboard systems for underwater surveillance seabed warfare.

The OSV has a beam of 20 m, a helipad and heave-compensated crane, large working deck and a moon pool for ROVs and AUVs. Once converted, it will be crewed by 24 RFA seafarers and will accommodate 60 Royal Navy specialists who will operate drones when embarked.

The second MROSS is reported to be converted in UK later this year to support MCM and underwater surveillance in British waters. No information has been released on the equipment suite which will equip the two MROSSs, but the national civil and security industry could provide a range of equipment. Among these, Atlas Elektronik UK and Saab UK could offer their ranges of AUVs, ROVs and USVs, already sold to military and commercial operators worldwide.

Under the Mine Hunting capability (MHC) programme, the UK MoD is procuring up to six MCM Maritime Autonomous Systems (MAS) and up to four MCM Logistics Support Vessels (LSV). Replacing the Hunt and Sandown class MCMVs, the MAS and the LSVs will provide expeditionary MCM capability, while the acquired OSV will enable UK offshore operations. In addition to the Maritime MCM systems developed under the joint French-UK programme and being delivered under the first increment of MHC, the Royal Navy has recently acquired the Combined Influence Sweep (SWEEP) system provided by Atlas Elektronik UK, along with Medium Underwater Autonomous Vehicles (MAUVs). The latter comprise Atlas Elektronik UK SeaCat AUVs equipped with high resolution synthetic aperture sonar also provided by the company.

Credit: Atlas Elektronik UK

In addition to small and medium unmanned underwater vehicles (UUVs) from L3Harris and Huntington Ingalls Industries (HII) for MCM duties, the Royal Navy recently acquired two Teledyne Marine Gavia AUVs, rated for depths of 1,000 m, under Project Hecla, which is aimed at optimising the Royal Navy’s ability to collect and exploit hydrographic and oceanographic information.

Building on the experience with the Manta Extra Large UUV (XLUUV), a technology demonstrator built under a UK MoD Defence and Security Accelerator (DASA) programme, in early December 2022, the UK MSubs company was awarded a contract to build the first XLUUV for the Royal Navy under Project Cetus. The 17 tonne unmanned platform will be 12 m long and 2.2 m in diameter, and capable of “[diving] deeper than any vessel in the current submarine fleet” and having an endurance of up to 1,609 km (1,000 miles) in a single mission. The unarmed battery-powered AUV will operate independently or side-by-side with traditional manned submarines, and is capable of fitting into a shipping container for worldwide deployment.

Italy

While elaborating a Seabed Strategy, Italy is working on the ‘National Underwater Cluster’, which was finally established by the 2023 national budget law approved in December 2022. Conceived as a multi-Ministerial entity, it will bring together industries, universities, research institutions and centres under the supervision of Italian Navy and MoD to coordinate activities in the underwater domain. The Italian Navy and MoD have been frontrunners in the dual-use seabed survey and protection sphere, with of mine warfare components and hydro-oceanographic vessels. More recently, these have included the management and manning of the NATO’s Alliance and Leonardo research vessels.

Having introduced the Kongsberg Maritime HUGIN AUV into service in the early 2010s for dual-use operations, since the Nord Stream accident, Italy has intensified the survey of underwater infrastructures of national interest with its fleet of MCMVs. In July 2022, the Marina Militare also signed with Italian Sparkle global network company an agreement to improve the protection of underwater communication infrastructures through joint research and operational procedures. In June 2021, the Italian MoD Naval Armament Directorate (NAVARM) awarded to T.Mariotti shipyard the contract for the construction and equipment suite of a new special forces and diving operations – submarine rescue ship (SDO-SuRS) to be delivered in 2025. In addition to diving equipment and a new generation submarine crew rescue system capable of operating at depths of 600 m, provided by DRASS and Saipem oil and gas services company, the SDO-SuRS will be capable of launching and recovering deep water AUVs and ROVs, the latter provided by Saipem Sonsub.

Credit: T. Mariotti

In February 2023, NAVARM awarded Fincantieri the contract for a new main Hydro-Oceanographic vessel (NIOM), planned to be delivered in 2026. In addition to hydro-oceanographic equipment, the ship comes with deep-water AUVs, unmanned surface vessels (USVs) and unmanned aerial vehicles (UAVs), which can be used for rapid environmental assessment (REA) missions. In the meantime, the Italian Navy is enlarging her fleet of HUGIN 3,000 m AUVs, alongside acquiring an expeditionary capability from MCMVs and other platforms. The service also launched feasibility studies with Intermarine and Leonardo for both new high-seas and coastal MCMVs equipped with a toolbox of unmanned vehicles, alongside coastal hydrographic vessels.

L3Harris Calzoni is conducting an R&D programme for an unmanned MCM system based on an USV with reconnaissance AUV and expandable mine disposal systems (MDSs). DRASS offers the SDOA (Sonar and Drones Open Architecture) whose scope includes the seabed installation of a distributed infrastructure capable of acoustic detection, coupled with other sensors and ROV/UAV docking. Saipem can offer its family of commercial working vehicles, including the the Hydrone family of deep-waters dual role (ROV/drone) vehicles, and the FlatFish AUV. The latter is capable of reaching depths of 3,000 m, with up to 12 hours endurance. A smaller version of the FlatFish with improved endurance and navigation features is at the heart of an Italian MoD’s R&D programme to evaluate potential applications in dual-use and military operations.

Credit: Saipem

The Italian MoD has recently launched a market survey for the integration, launch and recovery of AUVs from in-service and future submarines (U212A/U212 NFS). Looking to unmanned ISR and operational underwater platforms, the Italian MoD has an unfunded requirement for a LUUV. Among the Italian companies specialised in the underwater domain are Cabi Cattaneo which provides a range of vehicles and equipment for the Italian Navy’s Special Forces and Diving component, DRASS, Leonardo, Gem Elettronica, Elettronica, Avio, Calzoni L3Harris and Fincantieri NexTech, and Wsense.

Germany

On 15 March 2023, the German MoD released the document outlining the new force posture for the Germany Navy by 2035 and beyond. The development of the organisation and the fleet is based on the geostrategic security scenario and threats which the German Armed Forces are expected to confront. Major factors include the Ukraine crisis, the enlargement of NATO to include Sweden and Finland and the developments in the North Atlantic, North Sea and Baltic Sea. In presenting future naval developments, the document points out how vulnerable vital economical underwater infrastructure has been due to the recent sabotage of gas pipelines in the Baltic Sea.

To cope with new surface, air and underwater threats and the speed of operations, Deutsche Marine (the German Navy), will have to be an integral part of national and allied Multi-Domain Operations (MDO) where the trend is clearly towards unmanned systems that can be used in a network shared by the various branches of the Armed Forces. The underwater dimension is rapidly gaining in importance according to the document. To counter a potential opponent which could have access to the area of interest well in advance of actual operations, Deutsche Marine needs modern underwater sensor technology – both stationary and mobile – alongside AI-supported evaluation capabilities in order to build up and permanently maintain a tactical underwater situation picture. Additionally, the Fleet needs funds to be able to act offensively and defensively under water.

Looking to the envisaged fleet composition, the mine countermeasures, seabed warfare and reconnaissance missions will be carried out by 12 new mine warfare vessels replacing the Type 332 class platforms, along with an undisclosed number of unmanned MCM systems, Germany’s first. In addition to the six-to-nine new U212 CD submarines to be procured, the document unveiled a requirement for up to six LUUV for intelligence, surveillance and reconnaissance operations. Moreover, among the operational support platforms, the document maintains three Type 424 class, 130 m long maritime surveillance & intelligence vessels, the construction and fitting out of which was assigned to NVL group in June 2021.

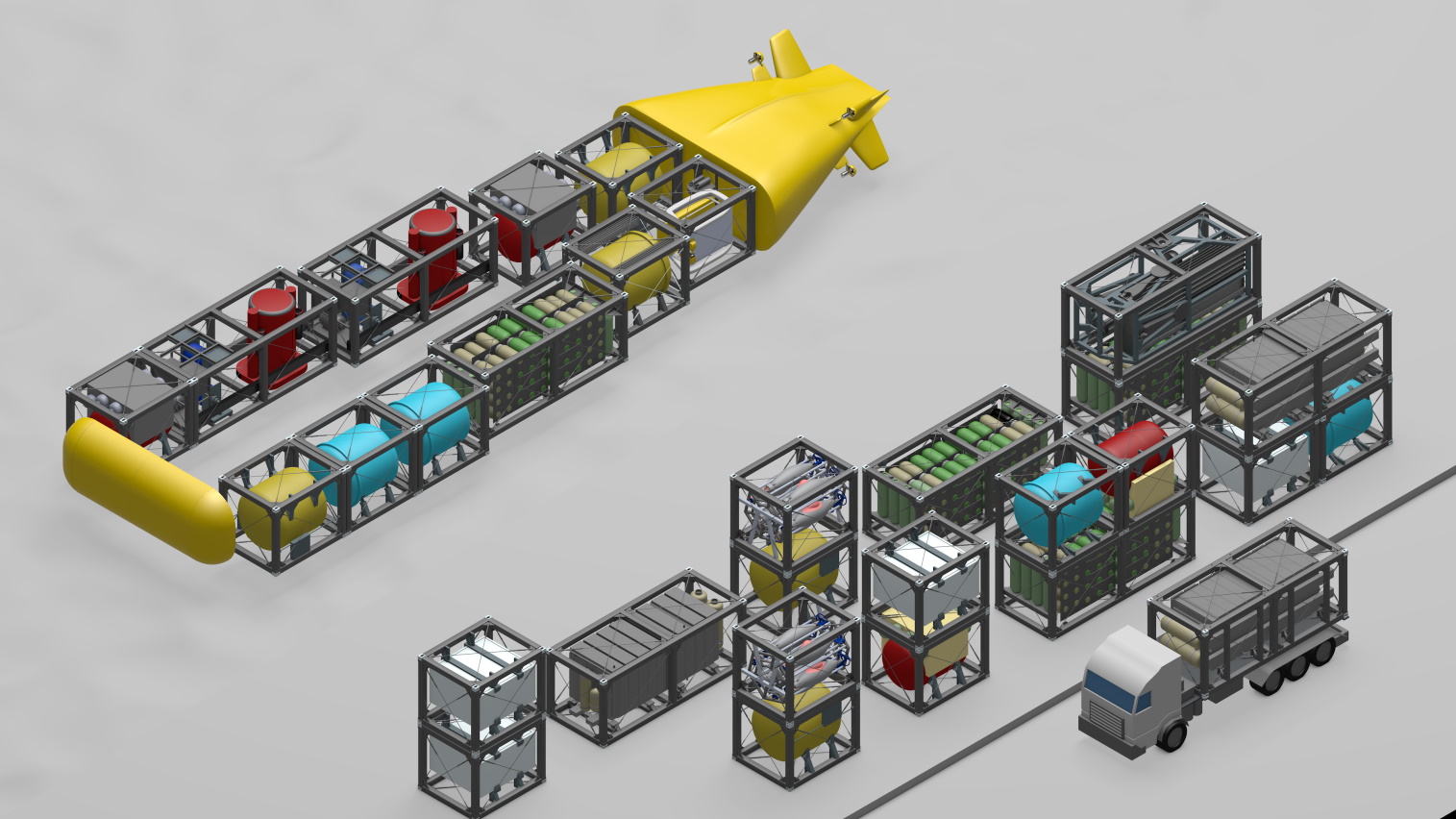

Credit: tkMS

Under the German Federal Ministry of Economic Affairs and Energy’s Maritime Research Programme supporting innovative maritime technologies, an industrial team headed by thyssenkrupp Marine Systems (tkMS) is developing a breakthrough large Modifiable Underwater Mothership (MUM) platform to satisfy various applications in the civil maritime industry, but which is expected to have military applications as well. An industrial team including Atlas Elektronik, EvoLogics, University of Rostock, TU Berlin, Fraunhofer Institute, the German Aerospace Centre, and the Institute for the Protection of Maritime Structures, is to begin building and integrate systems in a 25 m prototype in 2023. The MUM is to set a new standard for unmanned underwater operations by early 2025, according to tkMS. The system has a modular structure, including sections sized off 3 m (10 ft) or 6 m (20 ft) shipping containers and a ‘flat fish’ type design, for its wide beam, as indicated by tkMS. For propulsion and power supply, it uses emission-free fuel cell and Li-ion battery modules. The MUM will be capable of operating 24/7, 365 days a year, independent of wind and weather. It will be capable of carrying multiple smaller UUVs, ROVs and equipment for seabed operations. According to images released by tkMS, its modular design allows the MUM XLUUV to be used for military applications, such as minelaying, anti-submarine warfare (ASW), or reconnaissance.

Germany’s Atlas Elektronik has also thus far provided Deutsche Marine with ARCIMS family unmanned surface vehicles, SeaCat AUVs and SeaFox MDSs.

Sweden

The surveillance and protection of national waters against underwater operations conducted by the then Soviet Union and today Russian Federation Navy and other agencies pushed the Swedish Armed Forces to develop an integrated underwater, surface and airborne response to this threat in addition to fixed surveillance installations. The Swedish Navy maintains both sophisticated mine countermeasures vessels and submarines, and is today looking to unmanned systems to augment the size of the fleet and added new capabilities.

The next-generation A26 Air Independent Propulsion (AIP) submarines under construction by Saab Kockums will provide a quantum leap in underwater operations, as they are being developed to operate alongside and carry AUVs and ROVs, among other advanced capabilities. The Swedish Navy has been at the forefront of testing and integrating AUVs and ROVs with submarines to conduct seabed and water column survey alongside reported intelligence operations in the crowded Baltic Sea theatre of operations.

In 2019, the Swedish procurement agency acknowledged the availability of its Saab SUBROV ROVs for its submarines. The SUBROVs are handled like a heavyweight torpedo, using the same handling equipment, allowing them to be launched and retrieved from the NATO standard 533 mm torpedo tubes. With a length of 3.1 m and weight of 500 kg in air, the SUBROV has a control system with six degrees of freedom, and LiPo batteries providing an endurance of 6 hours with a maximum operational depth of 500 m. It can be used for a variety of missions, including surveillance, inspection/intervention, MCM and for the recovery of AUVs via the torpedo tubes, as acknowledged by same Swedish Navy.

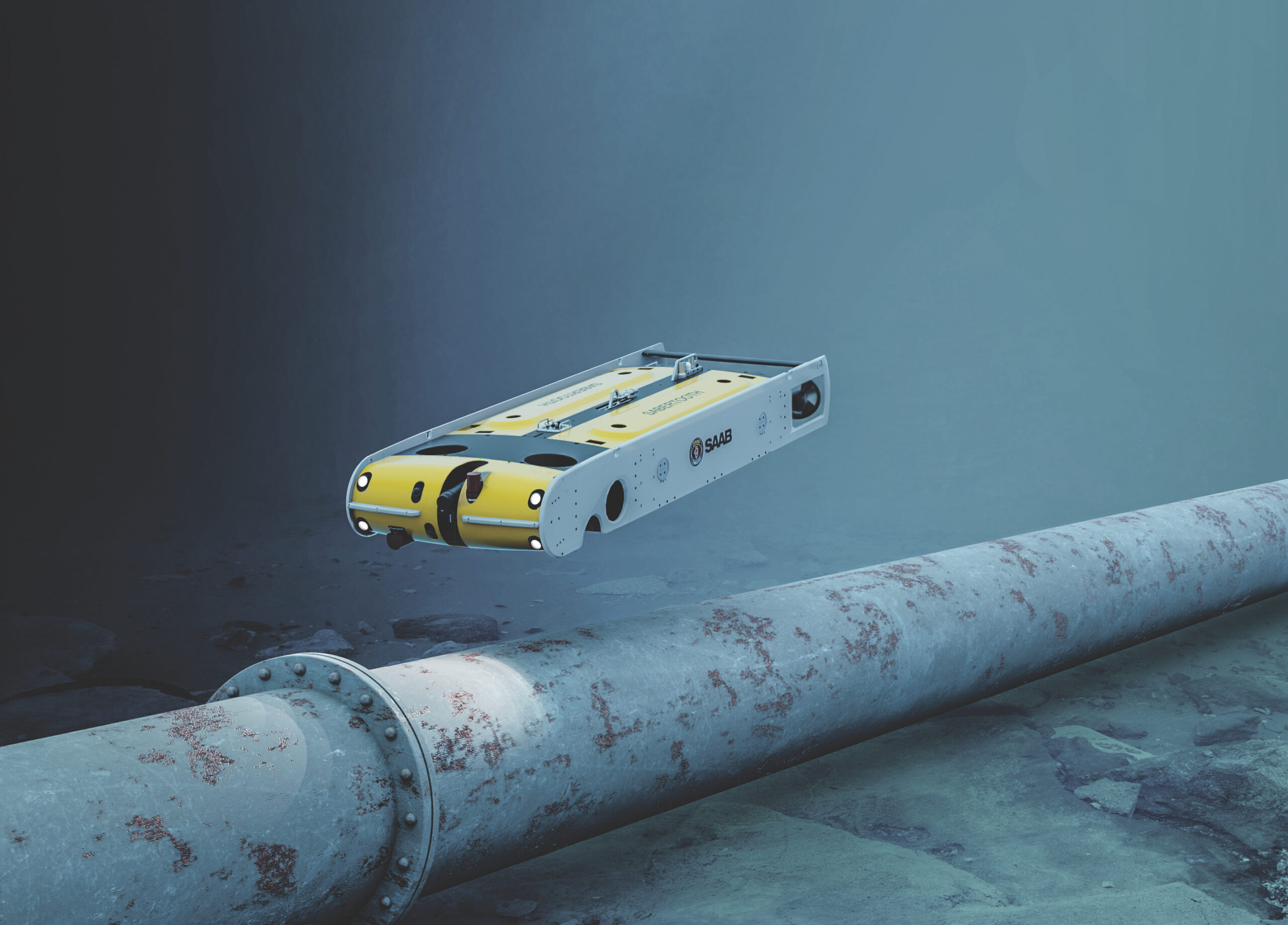

Credit: Swedish Navy

The navy is presently looking to a new generation of UUVs which could be launched by current and future A26 boats, the latter being equipped with a large Flexible Payload Lock (FPL) for special forces operations as well as the launch and recovery of larger and more capable AUVs such as the Saab Double Eagle ROV/AUV and the single or double hull Sabertooth. The latter combines Saab’s military and commercial ROV/UAV technology, driven by Saab’s Seaeye division. Capable of going to depths of 3,000 m, with long excursion range, advanced AUV functionality and six degrees of freedom, the Sabertooth can be equipped for a variety of missions and can use seabed-based docking units, where the batteries can be recharged and the AUVs can be sheltered, allowing them to operate for up to six months without maintenance, eliminating surface vessel costs. Saab is also marketing the eWROV, the latest addition to the Saab Seaeye’s underwater commercial portfolio. The ROV is completely electrical, including its manipulators, and capable to operating at depths of 3,000 m, with the option to increase this to 5,000 m.

USA

The threat posed by then Soviet and now Russian submarines in the North Atlantic down through the Greenland-Iceland-United Kingdom (GIUK) gap, to the US East Coast, the Mediterranean Sea, and the Pacific theatre, pushed the development of the SOSUS (SOund SUrveillance System) underwater fixed acoustic surveillance network during the Cold War. Today, its remaining sites together with mobile and deployable capabilities come under the Integrated Undersea Surveillance Systems (IUSS) project and Undersea Surveillance Command, with programmes being managed by Maritime Surveillance Systems (MSS) Program Office (PEO UWS PMS 485). These provide flexible and responsive wide area surveillance to the Theatre Anti-Submarine Warfare commanders worldwide.

Complementing the Fixed Surveillance System (FSS) under continuous upgrade and the Surveillance Towed Array Sensor System (SURTASS)/Compact Low Frequency Active (CLFA) suite installed on present and future Tactical-Auxiliary General Ocean Surveillance (T-AGOS) ships deployed to the Pacific theatre, the Deployable Surveillance Systems (DSS) project is becoming key to counter the expanding Russian (and Chinese) submarine operations in areas not covered by fixed arrays.

DSS comprises the following systems: Deep Water Passive (DWP), Deep Water Active (DWA) and Mobile Passive Active System (MPAS). Spiral developments to meet the evolving submarine threat will leverage ongoing Navy, Defense Advanced Research Projects Agency (DARPA), and small business research efforts including processing and sensor technology. Among the DWP systems, the US Navy is continuing to acquire and enhance the Transformational Reliable Acoustic Path System (TRAPS), which was conceived (and now separately provided) by Leidos under the DARPA’ Distributed Agile Submarine Hunting (DASH) initiative. TRAPS is a deployable fixed passive sonar node designed to achieve large-area coverage by exploiting advantages of operating from the deep seafloor. To meet similar requirements, the US Navy also has developed and is testing the SURTASS-E which offers the same passive capability packaged into a containers for deployment from vessels of opportunity.

In order to gain underwater situational awareness under iced sea surfaces, in autumn 2022 the US Navy Office of Naval Research has separately conducted trials of the Arctic Mobile Observing System (AMOS), a prototype mobile sensing system incorporating Arctic-capable unmanned underwater vehicles that can be deployed anywhere in the Arctic using a central, ice-based buoy node to provide the critical infrastructure (power, communication, navigation, and environmental intelligence).

The US Navy is also working to contribute to the overall underwater situational awareness picture, integrating the UUVs into the fixed and mobile networking infrastructure and with submarines. Looking to autonomous operations in support of anti-submarine warfare developments, the 80-tonne Orca XLUUV with a modular payload bay, currently being developed by Boeing is a candidate, although the programme is three years late and more costly than initially planned. In the smaller UUV segments, the current Razorback Littoral Battlespace Sensors-Autonomous Unmanned Vehicles (LBS-AUV) based on the HII Remus 600 medium UUV capable of persistent, autonomous, ocean sensing and data collection in support of Navy Intelligence Preparation of the Operational Environment (IPOE), is currently operated via submarine Dry Dock Shelter (DDS), but it will soon be launched and retrieved by torpedo tubes with dedicated equipment. In the meantime, the US Navy has awarded Leidos a contract for developing a more capable medium UUV (MUUV) to be used from torpedo tubes and expeditionary mine countermeasures operations as the current LBS-AUV/exMCM.

Norway

The Royal Norwegian Navy and MoD have contributed to the development of the in-service Kongsberg Maritime HUGIN AUV, whose family of systems is today either on order or in service with 12 customers around the world including US, France, Finland, Poland, Italy, Germany, India, Indonesia, Peru and Norway. Being used for a range of missions including search and rescue, REA, MCM, military survey and seabed warfare, today the HUGIN comes in three main variants – baseline (rated for 3,000 m, 4,500 m, and 6,000 m), HUGIN Superior and HUGIN Endurance. The latter has recently gained an undisclosed naval customer and which delivery will be conducted later this year. The HUGIN Endurance is the largest member of the family with a 1.2 m diameter and 10 m length, yet remaining transportable with a 12 m (40 ft) shipping container, capable of up to 15 days missions and rated for operating at depths of 6,000 m, with a range of sensors focused on mission capabilities and situational awareness.

Luca Peruzzi