The global naval market for anti-ship missiles has entered a transition phase as established market leaders such as Boeing’s HARPOON and MBDA’s EXOCET compete against a growing number of increasingly capable, lethal, and inexpensive rivals offered from the US, Europe, China, and Russia. This article reviews the current and future prospects for naval ASuW missile in the global market.

These traditional offerors are joined by companies and countries such as India and Korea that have developed local ASuW missiles and bring them to the market with alternative supply chains, fewer export restrictions, and favourable trade terms.

The ASuW market is influenced by three strategic trends that are reshaping naval force structures. The first is the overall reduction in naval ships and submarines in service, a result of the continuing retirement of ships that were brought into service during the Cold War or in the decade after. Those ships are now reaching 30, 40 and in some cases 50 years of service and are in large part incapable of serving much longer. With fewer ships in service, naval planners will be pressed to decide which of those fewer ships will be equipped with new ASuW missiles.

Overview

The second trend is the increasing capability and dispersion of the new ships and submarines that are being built today. More navies are acquiring the kinds of ships, and ASuW missiles that in previous decades were concentrated among fewer navies. This trend has the two-fold effect of increasing the market opportunity for ASuW missile suppliers, and increasing the likelihood that ASuW missiles will be used in active operations.

Lastly, technology has fundamentally changed the conditions and constraints of ASuW missile design. Advances in communications and information technologies are clearly seen in the increasing number of “fire and forget” ASuW missiles that no longer depend on launch platform or other guidance support to strike targets at increasing ranges. Changes in propulsion and materials will contribute to the development of new hypersonic missiles that combine the speed of ballistic missiles and the manoeuvrability of cruise missiles. Lighter and stronger materials technologies also make ASuW missiles smaller and faster, with gains in range and an expanded number of options for smaller and non-traditional launch platforms – ships, submarines, ground vehicles and aircraft.

Amidst these strategic market and technology trends, the prospect that naval ASuW missiles will see active use in combat appears to be growing at both ends of the naval conflict spectrum. ASuW missiles have been used in local and regionalised conflicts involving terrorist groups and non-state actors, with the conflict in Yemen a notable recent example. The growth in (return of) great power competition at sea is also driving a renewed focus on offensive naval warfare at sea. The US Navy’s Offensive Missile Strategy that shapes research and development and procurement policies for ASuW missiles is one example of this phenomenon.

This article reviews the current and future prospects for naval ASuW missile in the global market. It draws on AMI International’s proprietary naval market reporting and forecasts to review today’s naval ASuW missile market, with a focus on strategic changes in naval ship inventories and the prospects for modernizing ASuW batteries on existing ships. The article will next review the status of several new missiles now in service or expected to join active fleets over the next 5 years. Lastly, the article will consider what the ASuW market looks like over the next two decades from the perspective of AMI forecasts for new ships and submarines to be built through 2040.

Current Market

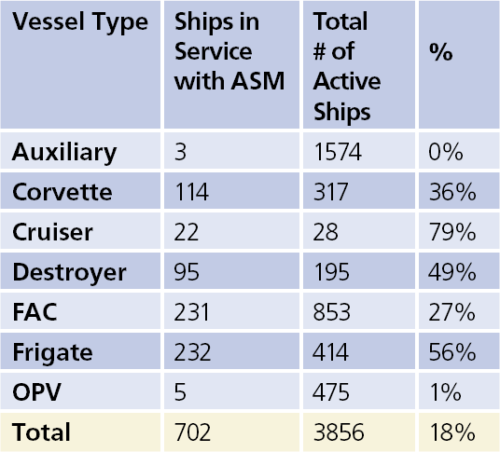

AMI’s Existing Ships Data Base (ESDB) tracks all ships assessed as currently commissioned and in service across the world’s navies and other agencies and services that operate maritime platforms. As the table below shows, today’s inventory of naval ASuW missiles is concentrated in a small part of most navies (702 out of 12,770 ships carry ASuW missiles – just over 5% of the global inventory of active surface ships). And among the ship types that do mount such missiles, less than 20% of those types are so equipped.

Destroyers, Frigates, Corvettes and FACs account for 65% of all ship types equipped with ASuW missiles, and those four ship types represent about 95% of the potential ASuW missile modernisation market. Among the four, the frigate stands out as the leader. This is not surprising as the frigate represents the largest and most capable ship for many navies.

Destroyers, Frigates, Corvettes and FACs account for 65% of all ship types equipped with ASuW missiles, and those four ship types represent about 95% of the potential ASuW missile modernisation market. Among the four, the frigate stands out as the leader. This is not surprising as the frigate represents the largest and most capable ship for many navies.

Among even the larger and most modern navies, the frigate remains the “workhorse” (in ship numbers and missiles aboard) of the ASuW mission.

Taking a closer look at what types of ASuW missiles are found in today’s navies, AMI data shows that the HARPOON and EXOCET continue to be leaders for market share. AMI shows 322 ships worldwide equipped with the HARPOON, with most concentrated on larger surface combatants. The EXOCET equips smaller ships; Fast Attack Craft and Corvettes together make up almost 75% of the 191 surface ships AMI reports as carrying the EXOCET. Combining the data from both charts, of the 702 ASuW -equipped surface ships now in active service, almost 73% of those are carrying either HARPOON or EXOCET.

While EXOCET and HARPOON hold a strong position in the current market, it is not uncontested. The Kongsberg/Raytheon Naval Strike Missile, Italian OTOMAT, Israeli GABRIEL, Swedish RBS-15, and Indian-Russian BRAHMOS taken together represent the ASuW main battery for more than 100 surface ships worldwide, together representing about 10% of market share. That percentage is expected to grow as navies look beyond the current HARPOON and EXOCET solutions. Chinese and Russian (and Iranian and North Korean) ASuW missile-equipped ships, not included in the tables above, number in the hundreds.

ASuW Missile Modernisation

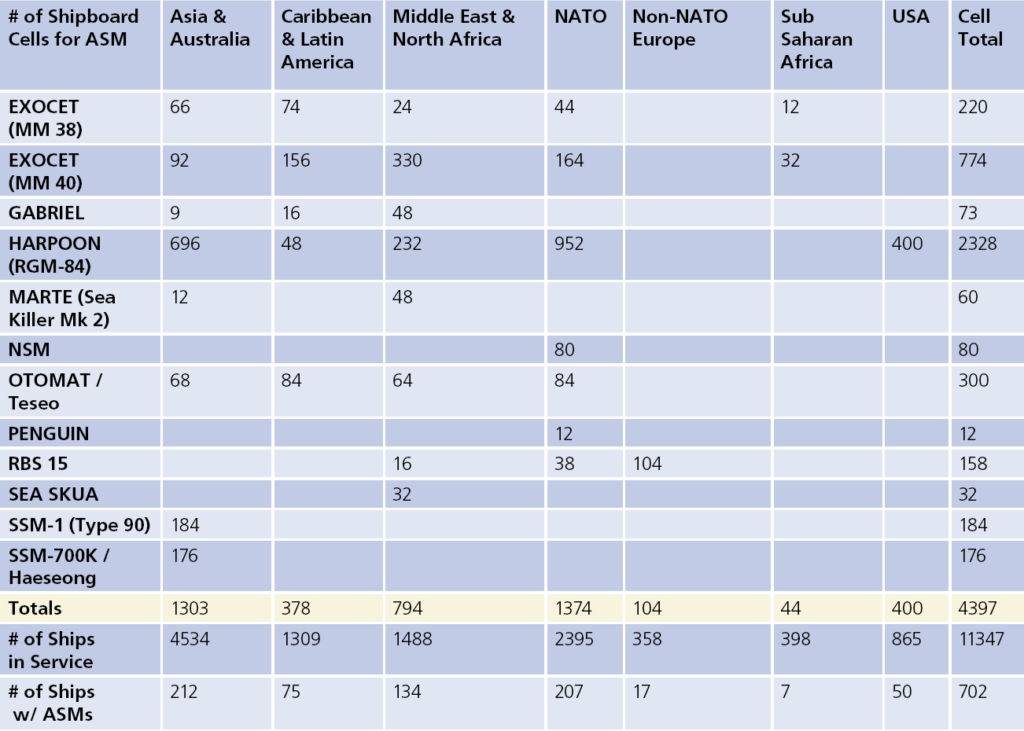

The chart below provides a finer-grained analysis of the other types of missiles in service today. When measured by the number of ASuW missile cells on existing ships (and ships can have from one to dozens of ASuW missile cells), EXOCET has about 23% of the existing surface ship ASuW missile market, and HARPOON makes up more than half of the existing market share of naval ASuW missile cells, similar in trend to the figures for surface ship market share.

From a regional perspective, today’s ASuW market is led by the Asia and Australia and NATO/Europe areas. Each region accounts for about 30% of existing ship-based ASuW missiles each. The share of ASuW missile-equipped ships also varies by region – lowest among Sub-Saharan African countries (less than 2%) and highest in the MENA region and among European fleets (about 9% each).

As noted in the introduction, a significant portion of the current base of ASuW missile capable ships is projected to be retired in the next 20 years. Worldwide through 2040, the 11,347 ships and craft now in service is expected to fall by almost 25% to 8,500. As the costs of procuring new ships with missile capabilities continues to rise, those leaving service will not be replaced on a one-for-one basis. Since navies are facing increased missile threats and geopolitical challenges in those coming two decades, they will look to preserve or expand their offensive anti-ship capability of ships and submarines remaining in service. This will make modernisation of ASuW capability among ships retained on active duty increasingly urgent.

This urgency is somewhat offset by expanding options for ASuW missile launch from other platforms – especially fixed wing aircraft and helicopter, as well as land-based mobile launchers. However, those options are not free, and will still pose a challenge in deciding where to allocate investments in new ASuW missile capability across the portfolio of launch platforms, many of which are not part of countries’ naval forces, but rather are integrated into air or ground forces.

This urgency is somewhat offset by expanding options for ASuW missile launch from other platforms – especially fixed wing aircraft and helicopter, as well as land-based mobile launchers. However, those options are not free, and will still pose a challenge in deciding where to allocate investments in new ASuW missile capability across the portfolio of launch platforms, many of which are not part of countries’ naval forces, but rather are integrated into air or ground forces.

The size and weight of ASuW missiles and associated sensors on these platforms will also remain a critical issue when looking at modernisation opportunities. This is especially true of smaller ships such as corvettes and Fast Attack Craft (FAC) with limited space to accommodate larger missiles or more missiles. This market dynamic favours modernisation solutions for missiles of the same or smaller dimensions than those they are replacing.

The size issue also helps explain why the EXOCET and GABRIEL – on the small end of the global arsenal of ASMs – continue to have the large market share on FACs. Larger ships, from destroyers to frigates, offer more capacity for missile upgrades. These types of ships can take larger missiles, but as those missiles are mostly mounted in multi-cell canister configurations, most navies are likely to prefer upgrades that do not require wholesale replacement of launchers as well as missiles.

ASuW Missile Market: Strategic Drivers

As noted above, the ASuW missile continues to evolve rapidly in many technical and tactical characteristics. The first ASuW missiles introduced in the 1960s relied of radio command guidance, requiring a continuous signal to track to the target. Now most ASuW missiles operate independently after launch, using on-board radars for active homing (together with inertia guidance systems on the missile), as well as passive infra-red and electro-optical seekers. With increasingly lethal warheads, high speed and manoeuvre, and increased range, the current and coming generations of ASuW missile pose an existential threat to most surface ship targets. And at lower costs of acquisition offered by some suppliers, they continue to represent an excellent capability return on investment to either control or deny maritime operating space to potential opponents.

Some of the strategic conditions shaping the future ASuW missile market include the renewed focus on great power rivalries, and the maritime setting in which many of these rivalries are likely to play out. Many navies are increasing focus on such contingencies as shown in planning, exercise scenarios and training. This “catch up” in ASuW capability and proficiency comes after a prolonged post-Cold War period in which many navies under-invested in ASuW capability in favour or other more pressing concerns related to supporting operations ashore or addressing maritime security and humanitarian mission requirements.

At the operational level, the continuing reduction in naval force structures also shapes requirements for both capability and numbers of new ASuW missiles to be acquired. In the past 30 years, the number of surface combatants with ASuW missiles has fallen by 30% or more. The case of the Royal Navy illustrates this. Until 2017, the Royal Navy was facing the prospect of retiring the HARPOON Block 1C by 2020 with no replacement. The UK has taken steps since to extend the service life of the missile through 2023 and is now actively reviewing replacement options under an “Interim Surface to Surface Guided Weapon (ISSGW)” programme. Still, the number of RN ships that are funded for a HARPOON replacement are small – in the case of the ISSGW program, as few as five frigates. In the US Navy, only Flight I and Flight II ARLEIGH BURKE class destroyers are HARPOON-capable: 28 out of the 76 ships in the class. And while equipping the LCS with NSM will address this shortfall somewhat, sustaining a high-intensity surface combat contingency would likely quickly stretch ASuW capabilities of virtually all navies today.

Selected ASuW Missile Programme Highlights

Boeing HARPOON Block II and Block II Plus

The HARPOON Block II missile has been in production since 2011. The Block II+ is described as a “rapid-capability enhancement” with new a GPS guidance kit and new data link interface for in-flight updates, improved target selectivity, an abort option, and enhanced resistance to electronic countermeasures. In January 2019 the US Navy ordered 79 HARPOON Block II Plus tactical missile upgrade kits.

Lockheed Martin LRASM

The Long-Range Anti-Ship Missile (LRASM) is offered as a replacement for the HARPOON and is based on the JASSM-ER cruise missile used by US Air Force. The missile is reported to have ranges up to 500 miles. The LRASM Increment 1 reach Early Operational Capability Status with the US Air Force in Fiscal Year 2019 and with the US Navy (F/A-18 aircraft) in early 2019. A ship-based variant of the LRASM to be launched from the Mk41 VLS system is under development, with initial test launches from a ship-based test platform conducted in 2018. In 2018, Lockheed Martin representatives states the company was self-funding development of a deck-mounted launcher for the LRASM to make it available on ships not equipped with the VLS. In the US, the target market for this version of the LRASM appears to be large amphibious ships.

Naval Strike Missile (NSM)

Norway’s Kongsberg Naval Strike Missile is a slower but stealthy missile equipped with passive sensors and a turbofan motor to reach targets up to 185 km away. The related Joint Strike Missile jointly developed by Raytheon and Kongsberg will equip the F-35. In October 2019, the LCS USS GABRIELLE GIFFORDS conducted a live launch of the NSM at a decommissioned target ship. The NSM has enjoyed considerable export success, with sales to the Royal Malaysian Navy (NSM to equip the RMN LCS) and Romania. The NSM will also replace the HARPOON on the German Navy’s F123, F124, and F125 class frigates.

MBDA EXOCET MM40 Block 3

The EXOCET MM40 Block 3 weapon system is the latest ship-based version, and MBDA states the missile has a range of up 200 km. Press reports indicate the French Navy will take delivery of the first MM40 Block 3C in 2021, with between 35 – 55 missiles to be acquired. In addition to the French Navy, the Block 3 equips navies in Greece, the UAE, Chile, Peru, Qatar, Oman, Indonesia and Morocco.

IAI GABRIEL V

In 2018, Finland selected IAI’s GABRIEL V missile to replace its local version of the Saab RBS15 now on Finnish surface ships, expected to be retired from service within five years. The GABRIEL V competed against the Kongsberg NSM, MBDA EXOCET, Boeing HARPOON, and Saab RBS15.

In December 2019, the Finnish Navy website disclosed the GABRIEL V will be designated locally as the “2020 system.” The GABRIEL V will be part of a mid-life upgrade of Hamina-class fast attack craft as will be installed on future POHJANMAA class corvettes. Open source reports state the GABRIEL V has a range of over 200 km, length of 5.5 metres, weight of 1250 kg, and is subsonic with an active radar seeker and advanced electronic countermeasures (anti-jam). As earlier variants of the GABRIEL are in service with a number of navies world-wide, the initial export of the GABRIEL V may signal an opportunity for additional refits in other fleets.

BrahMos

The joint Russian-Indian PJ-10 BrahMos is claimed to have a range of up to 500 km, based on a two stage propulsion plant combining solid fuel and liquid fuel to achieve supersonic speeds. An upgraded BrahMos II is under development and is scheduled for testing in 2020. The BrahMos equips Indian Navy ships (RAJPUT class destroyers, TALWAR class frigates) and is said to be under consideration by several other navies. At the May 2019 IMDEX event in Singapore, a representative of BrahMos Aerospace stated the missile was ready for export to a Southeast Asia country and awaited government to government approval of the agreement. Statements from Philippine officials in December 2019 announced the country “is prepared to acquire” the land-based version of the missile in the first half of 2020, with up to two batteries to be exported.

Hypersonic ASuW Missiles

Russia is investing significantly in this capability, with the Russian Navy working to field the TSIRKON (ZIRCON) hypersonic ASM after 2020 on modernised cruisers (KIROV class) as well as the smaller frigate classes (GORSHKOV and ADMIRAL GRIGOROVICH classes) that are being built now. If developed to operational capability, the missile could also equip newer corvettes that are fitted with KALIBR missile. The Chinese Navy also has plans to field a hypersonic ASM during this decade.

Market Outlook

What does the future hold for the surface combatant ASuW missile market? Still more new designs and missile types for one. The US award to the Raytheon-Kongsberg team offering the Naval Strike Missile for the US Navy’s LCS Over-the Horizon Weapons System (OTH-WS) highlights a strong contender to equip the US Future Frigate and ships of similar size and mission. AMI’s WNPR highlights an ASuW missile market segment characterised by sustained steady growth. Some 6000 new ASuW missiles are expected over the next 20 years, with about two-thirds of this demand expected to materialise in the next ten years. While perhaps half of this future demand represents acquisitions by closed markets such as China, Russia, Iran and North Korea, there is still a significant and sustained market opportunity for missile suppliers.

These missile market projections also fit with the latest AMI forecasts on major surface ship acquisitions over the coming two decades. 400 new cruisers, destroyers and frigates are expected to join navies worldwide in that period, with almost all ASuW missile-equipped. Another almost 350 new corvettes and fast attack craft, most carrying ASuW missiles, are forecast for the same period.

With “high end” naval conflict scenarios appearing more likely, while naval missile threats to surface ships increase in numbers and capabilities, demand will go up for the next generation of new missile launcher designs. These will use new materials and structures that go beyond current box/canister and vertical launch systems. However, core engineering in areas such as ablatives and safety systems are expected to carry over to future ship-based launchers.

And while next generation ASuW s will take an increasing market share, the HARPOON and EXOCET are not done yet. BAE’s win in the Australian frigate competition with the “GCS-A” will include HARPOON fits. The Royal Navy itself, while committed to a HARPOON replacement in the out years (2030). As noted, the RN will extend the service life of HARPOONs while evaluating replacements. The Canadian Surface Combatant ASuW missile fit will also likely be equipped with HARPOON, given that the HARPOON is now in service on the Halifax class frigate.

Summary

In summary, the coming decade promises to be an interesting one for the shipborne ASuW missiles. The 1960s and 1970s represented an intersection of technology advances (propulsion, guidance and sensors), geopolitics (the Cold War) and new operational concepts (making ships capable of engaging other ships beyond gun and torpedo range). This led to the development of the first generation of ship-based ASuW missiles like HARPOON and EXOCET, which have significantly altered the naval art in the decades since. A similar confluence of forces appears to be taking place today, and will further change naval anti-surface warfare.

Bob Nugent is a recently-selected Scholar Practitioner Fellow and

Instructor at the Busch School of Business at Catholic University of America, (Washington D.C.), as well as Ph.D candidate in Strategy and Management at Virginia Polytechnic University. He continues to work as a consultant and writer/commentator in the Aerospace and Defense industry, affiliated with AMI International. Bob is a retired naval officer.