By Stealth to the Shore

Peter Felstead

With the coastal subsurface domain remaining an area that Western special forces can exploit, a number of companies are providing platforms to facilitate such operations. Peter Felstead looks at recent developments in this sphere.

While the close-in surveillance of hostile shores can increasingly be achieved by unmanned platforms, when it comes to covertly putting personnel ashore for special operations, the subsurface domain remains an area that can be exploited by novel technology. While sustaining personnel under the water’s surface clearly has its challenges, the lack of any visual or noise signature being discernible from the shore – at least until special forces operators have actually landed – provides obvious advantages.

Reflecting this, a number of developments in swimmer delivery vehicles (SDVs) have breached the surface in recent years, which seek to deliver a tactical edge to Western maritime special forces.

New US Platforms

In the United States US Special Operations Command (USSOCOM) has introduced two new complementary SDV platforms in the form of the Shallow Water Combat Submersible (SWCS) produced by Teledyne Brown Engineering (TBE) and the Dry Combat Submersible (DCS) developed by Lockheed Martin in co-operation with Texas-based Submergence Group.

The SWCS was developed to replace USSOCOM’s Mk 8 SEAL Delivery Vehicle under a July 2011 contract and is designated the Mk 11 SEAL Delivery Vehicle in US service. The first test unit was delivered in late 2014 and in October 2019 TBE was awarded a sole-source USD 178 M contract from Naval Sea Systems Command (NAVSEA) for the follow-on production of Mk 11 SWCSs, including spare parts production and the provision of engineering and technical support services through to fiscal year 2024. The SWCS entered service in 2020, with USSOCOM’s Program Executive Office – Maritime (PEO-M) telling ESD on 16 August 2023, “A total of 10 SWCS have been funded for production. Six SWCS have been delivered and the remaining four SWCS will be delivered by FY24 [financial year 2024]”.

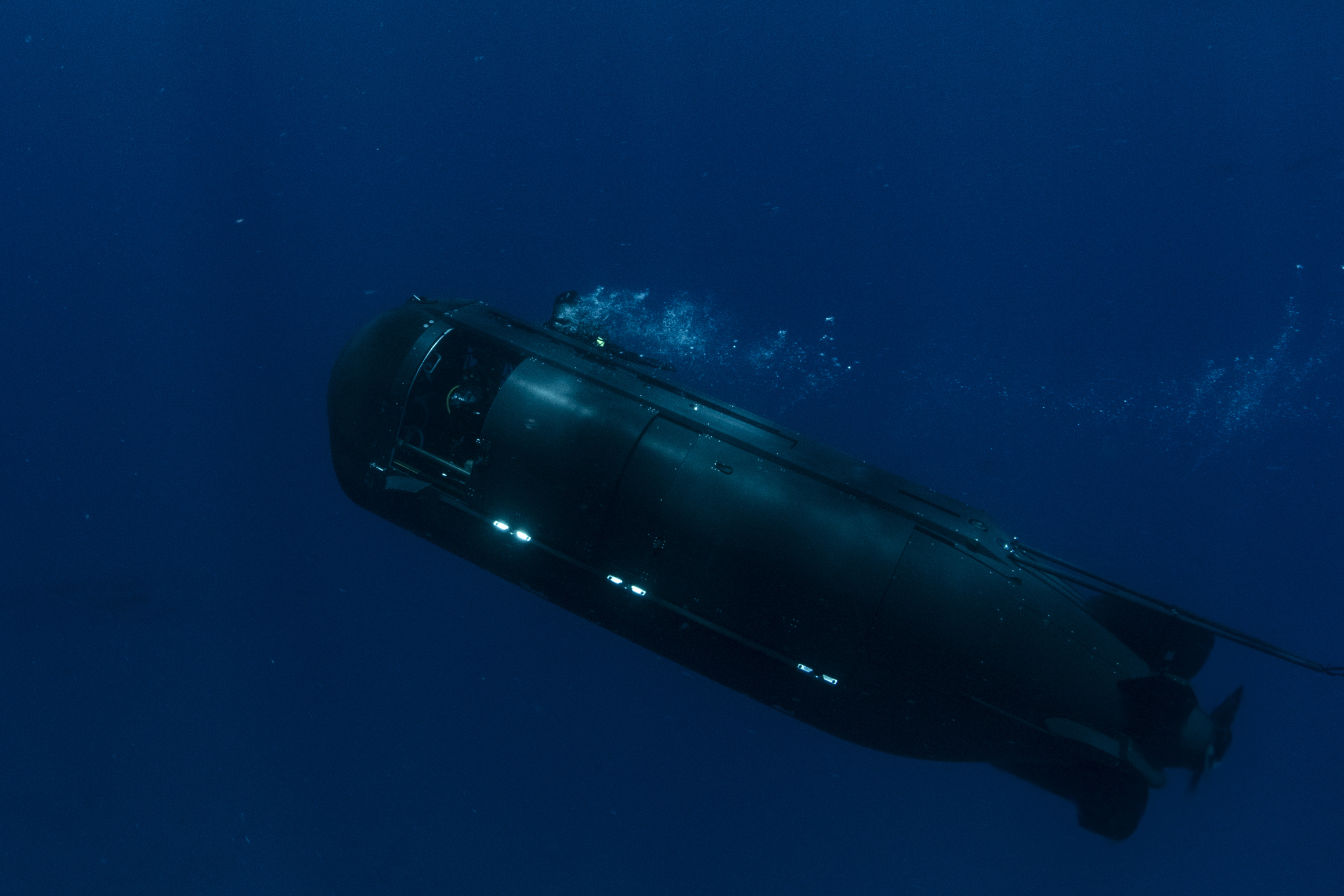

The DCS, meanwhile, was developed as a replacement for the cancelled Advanced SEAL Delivery System, with an initial operational capability (IOC) with the system reached in June 2023, according to USSOCOM, at which point two systems had been delivered with a third undergoing finishing work. The DCS allows special forces operatives to travel for extended distances below the surface of the ocean without the need for wetsuits or exposure to the elements. The vessel features a lock in/lock out system to allow special operators to exit or enter the vessel while it is entirely submerged, thus minimising any chance of being detected.

PEO-M told ESD that the DCS can be launched from a variety of platforms and that full operational capability with the craft is anticipated in FY24. The DCS is designed to carry a crew of two plus a team of up to eight fully equipped swimmers. The vessel is 12 m long, 2.5 m high and has a beam of 2.2 m. Weighing 28 tonnes, it has an operating depth of 100 m and a range of 66 NM (122.2 km) at 5 kts (9.2 km/h), when submerged and on a standard battery.

While the DCS is too large to be deployable from the dry deck shelters (DDS) of submarines, the SWCS will have this capability, although the US Navy’s current DDSs will have to be lengthened by 1.3 and their weight capacity tripled to facilitate this. The smaller size of the SWCS – with a length of 6.8 m, beam of 1.5 m and height of 1.5 m – will mean it will be able to enter areas that the DCS cannot.

USSOCOM also developed the Mk 9 SDV. This carried two SEALs along with a pair of Mk 31 or Mk 37 torpedoes. It was designed to attack surface ships rather than deploying combat swimmers, but was retired by the mid-1990s and was never operationally deployed, given that the Mk 8 SEAL Delivery Vehicle could accomplish its mission.

New UK Capabilities

Under a capability sourced through a US Foreign Military Sales request in 2018 the UK’s Special Boat Service (SBS) is known to be operating three SWCSs, which, as with US special forces, replaced Mark 8 SEAL Delivery Vehicles in SBS service. However, UK-developed SDV capabilities are now coming to the fore.

At the DSEI 2023 defence exhibition in London in September Inchinnan-based JFD, perhaps most known for its submarine rescue capabilities, is presenting its latest Shadow Seal SDV, which the company first exhibited at the SOF Week show in Tampa, Florida, in May this year. Shadow Seal, which JDF terms a tactical diving vehicle (TDV), is a four-person vessel that entered the JFD portfolio through its acquisition of Dutch company Ortega Submersibles in August 2019. Shadow Seal has a maximum surface speed of 5.5 kts (10.2 km/h), a maximum subsurface speed of 4.5 kts (8.3 km/h), a surface range of 80 NM (148.2 km) and a subsurface range of 25 NM (46.3 km). The vessel carries up to two personnel in each of two compartments, and can be piloted from either of these stations. It can thus deliver three operators or alternatively be bottomed out and shut down in shallow water to allow four divers to be deployed.

Regarding the latest developments in relation to Shadow Seal, a JFD spokesperson told ESD on 15 August 2023, “Following the [Ortega Submersibles] acquisition, the prototype model has gone under further development and rigorous trials. We are in the process of completing the build of the first production model, which is going to our partners in the US, Blue Tide Marine, for training and demonstration purposes.”

Shadow Seal complements JFD’s Carrier Seal TDV, which is an eight-person SDV that is 10.45 m long with a beam of 2.21 m and a height of 1.65 m. Carrier Seal can transit on the surface at up to 30 kts (55.6 km/h), propelled by a water-cooled 257.3 kW (345 hp) diesel engine coupled with a Rolls-Royce waterjet, before transiting to a semi-submerged mode, where a sprint speed of up to 6 kts (11.1 km/h) can still be achieved. The vessel can then operate fully submerged down to a depth of up to 50 m, propelled by two 10 kW (13.4 hp) electric thrusters, at speeds up to 4 kts (7.4 km/h). An additional fuel bag can afford Carrier Seal a maximum surface range of up to 300 NM (555.6 km), while its submerged range of 30 NM (55.6 km) can be doubled with additional battery packs. JFD was understandably reticent to talk about its sales, but the company spokesperson did note that Carrier Seal “is in operation and is an established product in our portfolio”.

Meanwhile, Portsmouth-based SubSea Craft unveiled its Victa-class diver delivery unit at the DSEI 2019 exhibition. The unique Victa design combines the characteristics of a high-speed, long-range insertion craft (LRIC) and an SDV, transitioning from surface to sub-surface operation to covertly deliver and recover divers.

The Victa can reach a surfaced planing speed of more than 40 kts (74.1 km/h), a cruise speed of 30 kts (55.6 km/h) and a submerged speed of 8 kts (14.8 km/h). The vessel has a surface range of 250 NM (463 km), can transition between surface and subsurface modes in two minutes, has a maximum dived depth of 30 m and is designed to deliver eight fully equipped operators to their objective. On the surface the Victa is propelled by a Seatek diesel engine delivering 540.6 kW (725 bhp), while submerged propulsion is provided by electric thrusters powered by Li-ion batteries that provide up to four hours of submerged operation.

SubSea Craft states that the Victa’s state-of-the-art fly-by-wire control system and human-machine interface provide “surface and sub-surface navigation whilst ensuring both optimal stability under water and outstanding manoeuvrability and sea-keeping on the surface” to reduce pilot workload and accommodate autonomous options. The first Victa prototype entered the water for the first time in September 2021, with initial testing of the vessel conducted adjacent to the company’s headquarters in Portsmouth before moving on to the waters around Gosport and then to SubSea Craft’s Trials, Testing, and Training (T3) facility at Portland in Dorset.

Asked by ESD for an update on progress with Victa, SubSea Craft CEO Scott Verney replied on 9 August 2023, “Our technology ecosystem has allowed us to advance through the development of Victa at pace; our headquarters at The Camber in Portsmouth is a designed-for-purpose building able to facilitate the manufacture of further craft; Craft 2 is already in production. A digitalised, agile methodology underpins our processes, to enable us to focus and prioritise system development.”

Verney added, “We have continued to trial the Victa-class prototype past proof of concept, initially in a controlled dock environment and latterly in Portland, where … our centre and the protected waters provide an ideal environment for our advanced testing, especially subsurface. Privately funded, we continue to evaluate and further develop the technology and capabilities in and beyond the concept of Victa.”

France: Capability Regained

The French combat divers of the Commando Hubert are among the dozens of maritime special operators around the world that operate platforms made by Stidd Systems of Greenport, New York, which supplies both its Diver Propulsion Device and Multi-Role Combatant Craft: an innovative vessel that is capable of operating on the surface or either semi- or fully submerged. These assets, however, have since late 2019 been supplemented by the Special Warfare Underwater Vehicle (SWUV) made by France’s ECA Group. The SWUV, which was unveiled at the Euronaval exhibition in Paris in 2014, is 8.5 m long and capable of carrying six operators, including a crew of two. The craft has a maximum speed of 10 kts (18.5 km/h) and can operate down to 100 m below the surface. It is understood that around a dozen SWUVs were ordered for use by the Commando Hubert.

The French Navy had, in fact, lost its ability to deliver SDVs from submarine-based DDSs with the retirement of its last Agosta-class submarines in 2001. However, with the advent of the SWUVs and the entry into service of Suffren (Barracuda)-class submarines, the first of which became operational in June 2022, this capability will be regained.

Undersea-warfare-focused journalist H I Sutton notes on his website (hisutton.com) that the Barracuda-class boats “are designed to carry a DDS behind the sail. This will be larger than previous French ones and incorporate direct access into the hull so that divers can access the chamber whilst it is drained, which is a massive operational advantage”.

Meanwhile, French undersea technology provider Alseamar has developed two SDVs – the Coryphene and Sphyrene – in addition to its Murene diver propulsion device. The Coryphene has a length of 6 m, a beam of 1 m and accommodates three divers. It has a maximum speed of 8 kts (14.8 km/h), a range of 50 NM (92.6 km), an operating depth of 25 m, an onboard sonar with a range of 350 m and a gas capacity for six hours of submerged operations. The Coryphene can also optionally be fitted with a telescopic mast with optronics system.

The Sphyrene is 8 m long, with a height of 1.4 m and a beam of 1.45 m, and can accommodate two pilots and four additional divers. It has a maximum speed of 9 kts (16.7 km/h), a range of 70 NM (129.6 km) at 8 kts (14.8 km/h), an operating depth of 25 m, an onboard sonar with a range of 350 m, a gas capacity for 10.5 hours of submerged operations and, like the Coryphene, can be optionally fitted with a telescopic mast equipped with an optronic sighting system.

Both the Coryphene and Sphyrene are stated by Alseamar to be interoperable with both submarines and warships, and are stated to feature high-end navigating and piloting systems, user-friendly human-machine interfaces, and satellite communications.

A spokesman for Alseamar confirmed to ESD on 13 August 2023 that the Coryphene is in French service, stating that its size “makes it as versatile as a jeep”, while the Sphyrene “is a preliminary project intended for export because the fashion at the moment is to have larger vehicles that can be compared to buses”.

Italy Follows its Heritage

In Italy, which has a long heritage of underwater warfare capabilities dating back to the First World War, the Navy’s Underwater and Raider Command (COMSUBIN) is understood to be operating six-person SDVs supplied by Milan-based CABI Cattaneo. From its experience in developing these, CABI Cattaneo in 2018 launched the Deep Shadow SDV, which is 9 m long, 1.8 m high and has a beam of 1.45 m. Carrying two pilots and four other operators, the Deep Shadow can be submerged down to 100 m when attached to a submarine, and has a range of 46 NM (85.2 km) 5 kts (9.3 km/h), with a maximum speed exceeding 8 kts (14.8 km/h).

In August 2023 it was announced that CABI Cattaneo had signed a memorandum of understanding with Italian shipbuilder Fincantieri regarding the integration of underwater vehicles with larger vessels designed from the outset as motherships.

A Domain for Exploitation

Such recent SDV developments attest to the companies working in this niche area seeing new opportunities to insert novel capabilities. While in some circumstances this is a case of developing capability and then seeking a market for it, rather than the more traditional procurement model of addressing stated requirements, the market is flexible in that Western special forces communities tend to be more agile in their procurement than regular forces.

“The operational wish-lists of the current era rely on new and evolving technology – networked capabilities, remote/autonomous, digitalised frameworks etc; Subsea Craft closes that gap,” SubSea Craft’s Verney told ESD. “From the outset our business model has been to be a solution provider: product first, flexible to changing requirements, not dependent on requirements to start a technology journey. Listening to the client but merging that with deep research, we are able to accelerate the delivery of the next-generation solutions for maritime manoeuvre. Victa sits at the centre of this model as a product and a test and evaluation platform.”

Alistair Wilson, strategy and sales director for JFD, told ESD that special operations communities “have suddenly rediscovered the water” and that the subsea domain “is really the last available environment from a battlespace perspective [where special forces are] free to operate”, which is allowing the SDV market to gain traction.

Rob Hales, JFD’s head of defence, noted that there is extra benefit to platforms where “you’re not dependant as you would have been historically on having a submarine to get you to the point where you can use a diving system or swim into the area of operation”. Such ‘over-the-horizon’ capabilities, he said, “can do it at a far lower cost point, and actually in a more flexible and covert way in many respects, that you can from being dependent on a submarine”.

Hales additionally envisaged a model where the insertion of fighting forces ashore “can go up the scale slightly from what would traditionally be special forces”, putting larger forces onto the beach more covertly than what would be possible with surface craft.

Wilson also envisaged a hybrid capability that would combine manned and unmanned craft, similar to the ‘loyal wingman’ concept with combat air assets, and said that JFD is looking at autonomising its craft with that in mind.

Given that SDVs have not yet been used in substantial numbers, the systems that would seek to counter them, such as shore-based sonar systems and swimmer detection systems around hostile harbours and naval bases, are not yet widely deployed. For as long as that remains the case, the market for niche underwater platforms in the littoral appears likely to be a small yet increasingly dynamic one.

Peter Felstead